Bitcoin Flows

A low frequency but juicy strategy where the edge is government incompetence.

Let’s dig in…

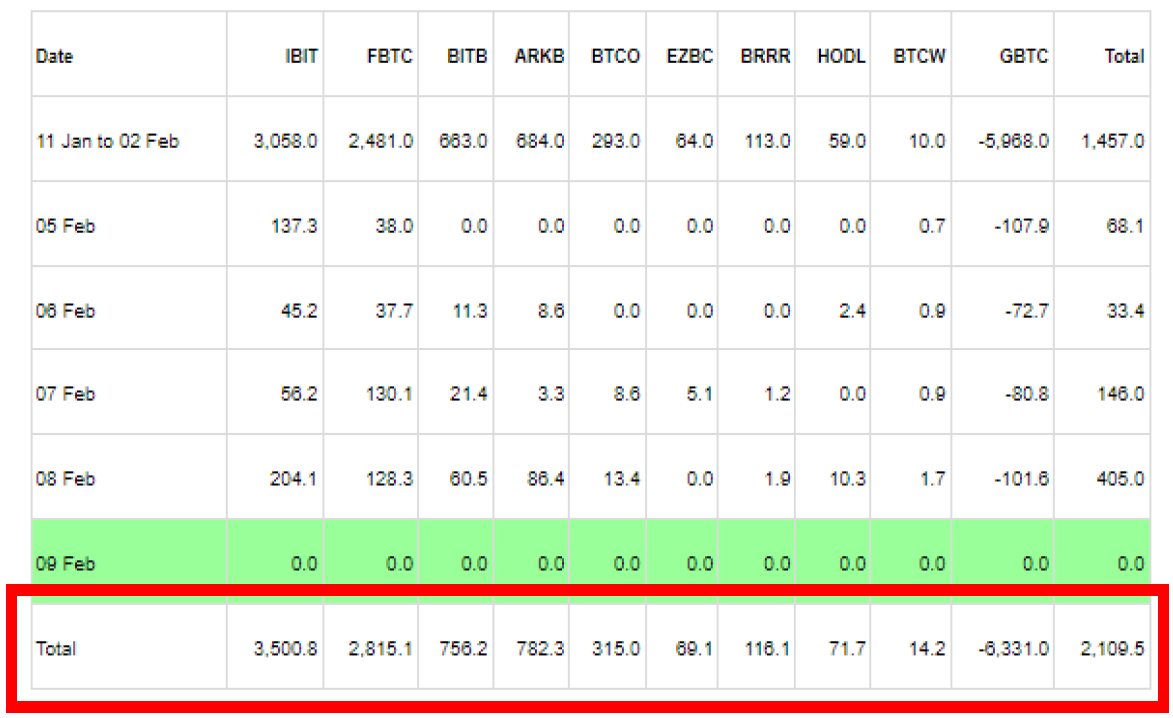

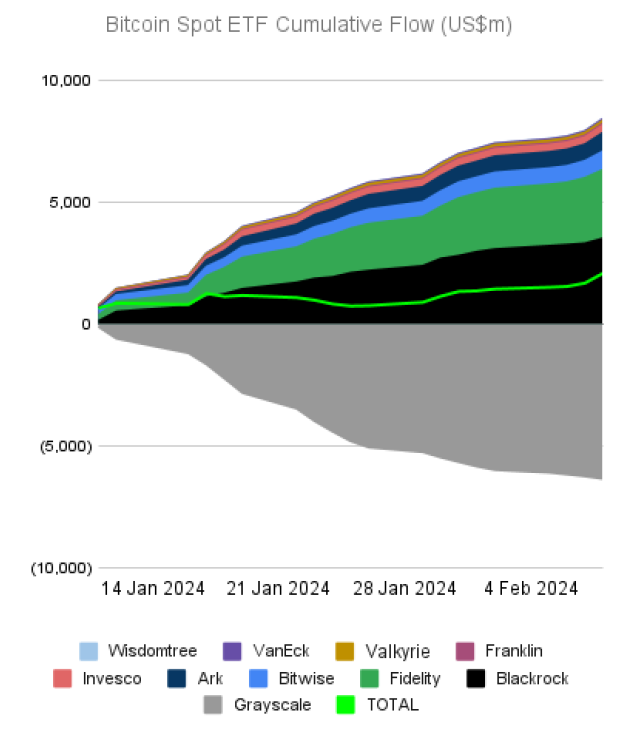

And since we are on the topic of passive flows and reflexivity, we figured we’d note the massive passive flows picking up in BTC-linked ETFs. Front-running ETF-like flows has been a recurring theme in KEDM back in 2020 with GBTC (BTC) and again in 2021 with SPUT (uranium). This time we come back to well as the SEC’s greenlighting of ETFs has created a bid in BTC (see table below with the real-time link below). With a product with no intrinsic value, these flows create a powerful cycle of reflexivity, both on the way up and on the way down…worth watching to see how far these flows can take it as BTC is perking up…

Real-time BTC Flow Table – Farside Investors

Real-time BTC Flow Table – Farside Investors

The whole point here is that the market structure has changed and is currently being driven by price insensitive flows -either through passive or corporates. One day, value will once again take center stage and we’ll be ready, but in the meantime, don’t get stuck in the dogma of “value ‘cause its trading at 4x (on its way to 1x)” but rather shift to “value with a tailwind/inflection…” Or at least to idiosyncratic Events that take advantage of these dumb money flows (that’s where KEDM comes in…).

And with that, I’ll get off my pedestal. We’ll be back next week with some theme updates. Let’s get into the Events…

Start your 28-day free trial

Kuppy’s Event Driven Monitor (“KEDM”) is not a financial or investment advisor and the information contained in this publication is not intended to constitute legal, accounting, or text advice or individually-tailored investment advice and is not designed to meet your personal financial situation. The investments discussed in this publication may not be suitable for you. You are required to conduct your own due diligence, analyses, draw your own conclusions, and make your own investment decisions. Any areas concerning legal, accounting, or tax advice or individually-tailored investment advice should be referred to your lawyers, accountants, tax advisors, investment advisers, or other professionals registered or otherwise authorized to provide such advice. KEDM makes no recommendations whatsoever regarding buying, selling, or holding a specified security, a class of securities, or the securities of a class of issuers, and all commentary is for educational purposes only. The investment examples noted are intended to provide and example of the events and data KEDM flags each week and is not representative of typical returns generated by each event or any future returns.