Bye, Bye Lula

A low frequency but juicy strategy where the edge is government incompetence.

Let’s dig in…

It seems like groundhog day at KEDM. Wasn’t that long ago (Q4 2024-Q1 2025) when NVDA was dominating the headlines, and we were leaning into SMH/SOXX as a proxy, all the while hunting EMs. Fast forward 6 months and here we are with NVDA & Co. still propping up the entire market at 14% of QQQ and the MAG again at nearly a third of the S&P. Sprinkle in alt season/treasury companies, and everyone is back to dancing.

We aren’t going to hit you with more gloom and doom on when that music stops, you know where we stand. We are still in the boat that the economy is far worse then the market is pricing. Worth watching Bill Moreland’s recent ForwardGuidance on credit being a “Potemkin village” that lifts the veil on some of the bank data on the real economy. It ain’t pretty.

But since its groundhog day and we aren’t doomers, its worth circling back on EM again. In particular LatAm which is waking up and one of our main focuses given the upcoming election cycles. Back in Issue 200 and 210 we laid out our LatAM thoughts. While it hasn’t outpaced Fartcoin (up 77% ytd!!), theres a ton of time to play catchup when EMs flip (EEM to SPY below):

Back at the beginning of February we wrote our first update on the upcoming election cycle in Latin America. Our thesis at the time was that Trump’s erratic tariff policies and his constant posting ala Twitter/X would draw U.S. attention to the catalysts ahead for the region’s markets. We pointed to the action then underway in Colombia, where Trump’s antics triggered a drop before kicking off a steep rally, as a sign of what was to come, and we have been more than vindicated in that view. Since our update on February 1st, the Colombian ETF COLO (formerly GXG) is up another 30% and CIB is up nearly 40%. Further, both Brazil (EWZ) and Chile (ECH) are up 20% making the region one of the best performing markets YTD. Even Bolivia has joined the fray with two decades of leftist rule ending when Evo Morales’ party suffered a massive defeat on August 17th.

Clearly, our thesis is beginning to play out and the elections are being priced in. The key questions now are: how do things stand on the ground? Is it all priced, or is there room for further upside?

Beginning with Chile, Boric, the current left-wing President, is out at the end of his term this fall. The three candidates to replace him are Jose Antonio Kast, Jeannette Jara, and Evelyn Matthei. They represent the right, far-left, and center-right, respectively. The odds, via Polymarket, show Kast as pulling ahead as of July to become the clear favorite, and the market’s performance confirms that.

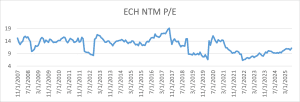

Kast has your basic, boilerplate right-wing policies: pro-business, pro-deregulation, and pro-fiscal tightening. All good things for equity markets usually and great things when compared to years of socialism. Now, we were never huge fans of Chile given it’s a smaller market that has historically traded at a premium and has a high correlation to copper, but there’s likely still upside as the index trades almost 20% below its 20-year median P/E, with added growth potential due to a pro-business environment.

Furthermore, Chile has a unique pension system where every wage-earning citizen is required to set aside a percentage of their monthly income into their pension account. Currently, the pension system is vastly underweight domestic equities, and recent reforms allow for individual contributions to be matched by their employer in a 401(k)-like structure. As markets improve, allocations will shift and increase local flows (and you know how KEDM feels about flows). Should contributions increase too, it’s just more icing on the cake.

Source: Factset, KEDM

Colombia’s upcoming election in May 2026 is similar in some respects to Chile’s. The incumbent party clearly lacks the juice to remain in power and the top prospect, according to Polymarket, is a conservative named Vicky Davila. She’s running as an independent and touts herself as a fiscal conservative – promising to lower personal, corporate, and VAT taxes to a flat 10% rate, cut the size of the government, and crack down on corruption. Her platform is in stark opposition to Petro’s government and markets are clearly in support.

The official polls are much more mixed and show a three-way tie between Davila, Sergio Fajardo (Center-Left), and Gustavo Bolivar (Left). Fajardo was the former Mayor of Medellin and Governor of Antioquia and launched previous failed presidential runs in 2018 and 2022. He’s more of a centrist than anything and while his election wouldn’t be as bullish as Davila’s, it would still be a huge improvement over Petro and see markets higher. Bolivar is the closest of the three to a true successor to Petro, so it’s worth keeping an eye on his odds as we get closer to the election. Unsurprisingly, he was the Director of the Department of Social Prosperity before he launched his campaign and is running on what is essentially a continuity platform of Petro’s initiatives of expanded social programs and progressive reforms. Clearly though, markets doesn’t like his odds.

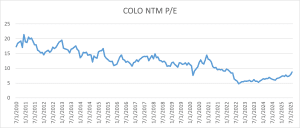

Even with the index now even in dollar terms with where it was prior to Petro’s election, there’s still plenty of upside here on valuation alone.

Source: Factset, KEDM

Finally, we’ll discuss Brazil. As readers undoubtedly know, this is our favorite setup into 2026. You have the combination of extremely high real rates, strong demographics, peaking inflation, and a poorly polling left-wing president all coming together to slingshot equities higher. Now, even though we are incredibly bullish, we fully admit that there are plenty of risks here. Lula’s government continues to prosecute the former president Jair Bolsonaro and recently placed him under house arrest. This led to Trump launching a holy war against Lula by slapping the Country with 50% tariffs (most goods ended up being exempted) and sanctioning members of Brazil’s Supreme Court under the Magnitsky Act. All of this knocked the Ibovespa Index some 6.5% in roughly three weeks and saw many US listed Brazilian stocks get crushed (we did promise there would be volatility!). Markets eventually rebounded but there’s nothing quite like the antics of EMs to put some hair on your chest.

The election outlook here is more or less the same as it was in February. Even after Trump did his damnedest to boost him in the polls, Lula is still lagging. His attempts at raising additional revenue to fund his profligate spending have been partially held up by Congress and now that the election is five months closer, markets can begin to look forward to the possibility of better times.

The incremental news has shown that the business community and elites are beginning to rally around Tarcisio de Freitas, the current Governor of Sao Paulo and likely right-wing candidate. As the Governor of the economic hub of the Country, Tarcisio is very pro-business and well-regarded by markets. This past Thursday, results from one of the more reputable polls came out showing that he’s edging out Lula and Lula himself was quoted saying that he may not even run. Both results saw the index up 132bps on the day – briefly breaking out to new highs before closing slightly below.

EWZS

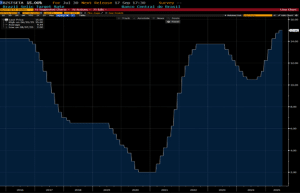

In addition to election news and Trump-driven volatility, the macro has vastly improved as the year has gone on. Inflation has seemingly peaked and the BCB held the Selic Rate steady at their last meeting and signaled the potential end of the hiking cycle. Naturally, this opens the question of when their first cut will be. The US is further adding fuel to the fire as the Fed cutting rates would strengthen the Real and allow the BCB to cut even more.

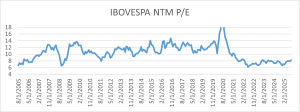

For a Country that has most of its outstanding debt on a variable rate and generally healthy balance sheets, there is an easy path to massive, market-wide margin expansion leading to increased corporate investment and growth all on a cyclically depressed valuation.

Source: Factset, KEDM

SELIC

As any previous investor in an EM will know, there are three sources of reflexivity which feed off each other to greatly amplify returns: FX, rates/valuations, and earnings growth. Bull markets begin when capital starts to trickle in, strengthening the currency. These flows get invested into local bonds and equities, improving valuations and lowering funding costs across the capital structure for both domestic corporates and the government. The central bank often responds to this influx by lowering rates at the front end to prevent further appreciation of the currency, again lowering borrowing costs. This all kicks off a pro-cyclical credit cycle as corporates and the government begin to issue capital and compete for investment. The culmination is boosted asset values which increase the availability of potential collateral which then allows further borrowing, more investment, higher valuations, and so on.

Foreign investors benefit the most from this. If they were early in the cycle, their returns get leveraged by an appreciating currency, expanding multiples, and accelerating earnings growth. These returns bring in more capital and the train continues until it eventually gets derailed. When flows reverse, it’s a rush to the door as capital flees, credit freezes, margins get squeezed, and the assets collateralizing all the newly issued credit plummet in value; all undermining the system. But for the up-cycle, it’s a beautiful, self-reinforcing moment and it looks like its still in early innings…

Turning back to KEDM before we jump into ED, worth noting that we just published the full Happy Hour recording with Roderick. If you are a thematic investor, its worth watching!

Start your 28-day free trial

Kuppy’s Event Driven Monitor (“KEDM”) is not a financial or investment advisor and the information contained in this publication is not intended to constitute legal, accounting, or text advice or individually-tailored investment advice and is not designed to meet your personal financial situation. The investments discussed in this publication may not be suitable for you. You are required to conduct your own due diligence, analyses, draw your own conclusions, and make your own investment decisions. Any areas concerning legal, accounting, or tax advice or individually-tailored investment advice should be referred to your lawyers, accountants, tax advisors, investment advisers, or other professionals registered or otherwise authorized to provide such advice. KEDM makes no recommendations whatsoever regarding buying, selling, or holding a specified security, a class of securities, or the securities of a class of issuers, and all commentary is for educational purposes only. The investment examples noted are intended to provide and example of the events and data KEDM flags each week and is not representative of typical returns generated by each event or any future returns.