This quarter’s 13Fs was non-eventful. As we’ve noted ad-nauseum, we went “full harvest” in recent months and cleaved off the chaff. Things get wacky at the tops and unless its related to gold, new CUSIPs just aren’t interesting. The only small nugget that caught our eye was the ongoing bull campaign by Tepper (Appaloosa) and Burry (Scion) in China names/ETFs, who both hold big chunks of their book in all things China. We wrote about China back in December 2023 but figured its worth flagging again as it has pulled back from its May highs and with BABAs price action this week on meh numbers. While everyone is leaning OrangeMan-bad-for-China, the contrarians in us see this as a possible stealth Trump trade if he is able to surprise with a trade deal (h/t/ Marko Papic).

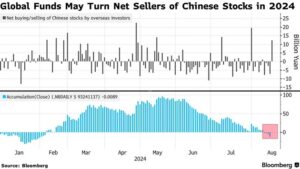

Given fund flows turned net sellers in 2024, any hint at a deal with Trump will likely re-rate the entire theme as fund scramble to get re-positioned. Worth noting that China cut off the daily fund flow data stream this week, so we can only guess to what the flows will look like under Trump….

While it’s a few weeks stale and since bounced, it’s worth noting that China (e.g. KWEB) hasn’t traded alongside US tech (QQQ) and was actually negatively correlated earlier this year. Just some food for thought as QQQ start getting whippy…

Let’s be clear, we got caught with our hand in the Russian cookie jar, so we aren’t raging China bulls at KEDM (i.e. trade, don’t invest) and can’t poke holes in the bears arguments. So while getting long China equity seems to be a sleeper Trump trade, we’d much rather play all the things China wants or is buying… which leads us back to all things gold (shocker!). Tony Greer helped me sum it up here.

China will take their foot off the pedal and make sure the paper hands get washed out a few times along the way, but they got a lotta buying to do in the coming years…

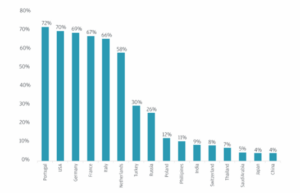

Gold as a percentage of total reserve holding across select central banks