EMs Curling Up…

A low frequency but juicy strategy where the edge is government incompetence.

Let’s dig in…

Since mid-to-late 2024 we have been banging the table on EMs, specifically Turkey, Colombia, Brazil and China. See issues 197 and 209 for China; 210 and 200 for LatAm. YTD the latter 3 have been on a tear with China up 25%, Brazil up nearly 13%, and Colombia up 22%. While stretched in short term and sentiment pretty bulled up (China is all I see on my feed these days), it’s probably due for a nasty correction or sideways chop, but we think the EM trade is just beginning.

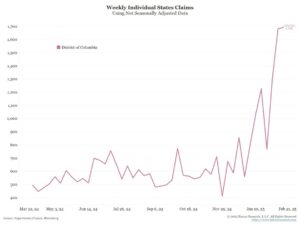

Meanwhile the US indices haven’t really budged since Nov/Dec. If you are a foreign investor in the US, you have to be thinking about your allocations, right? You have Tarriff Man throwing grenades and DOGE determined to spike unemployment by culling the purple haired libs and curtailing spending in the US (didn’t this used to be called austerity??!!), all the while EMs are perking up. Trump is determined to shake of old alliances and reshore to make us great again. Peter Thiel once wrote “For the past three centuries, the great rises and falls of the West track the high and low points of the hope for globalization [and] the rises and falls of the globalizing West have been tracked by the peaks and valleys of the stock market.” Guessing it not different this time around either…

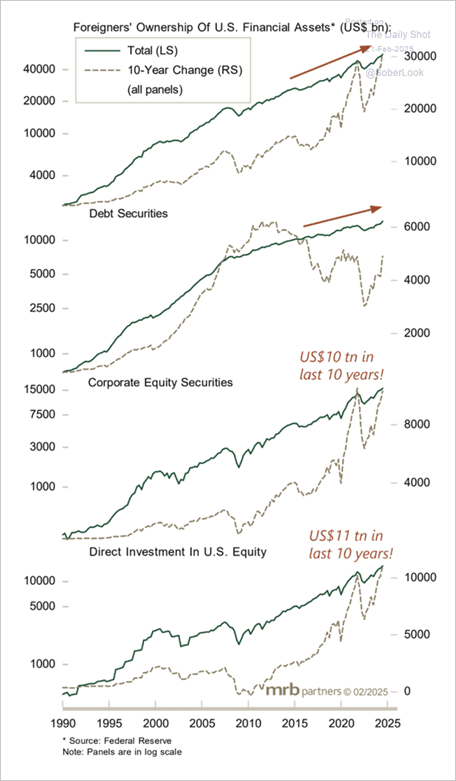

Meanwhile you have foreigners choking on US financial assets with $10 trillion of flows into corporate equity in the last 10 years (chart below). What happens when these fund flows flip? What happens if the second largest economy is suddenly investable again and takes in real flows? And smaller EMs soak up repatriated capital as their political pendulum swings back right ala Milei/Argie while the US slows?

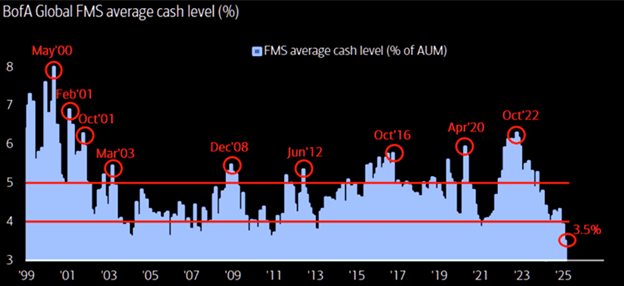

And looking at cash levels, if fund flows flip, US equity has no bid to supplement the foreign bid…

We are not doomers but feel pretty content harvesting a ton of US exposures in summer 2024 and reallocating to EMs. We’ve already seen EMs start to curl up, but US has held in so far (ex-Fridays pin action). But we think this a longer term theme that just now starting to inflect…

Start your 28-day free trial

Kuppy’s Event Driven Monitor (“KEDM”) is not a financial or investment advisor and the information contained in this publication is not intended to constitute legal, accounting, or text advice or individually-tailored investment advice and is not designed to meet your personal financial situation. The investments discussed in this publication may not be suitable for you. You are required to conduct your own due diligence, analyses, draw your own conclusions, and make your own investment decisions. Any areas concerning legal, accounting, or tax advice or individually-tailored investment advice should be referred to your lawyers, accountants, tax advisors, investment advisers, or other professionals registered or otherwise authorized to provide such advice. KEDM makes no recommendations whatsoever regarding buying, selling, or holding a specified security, a class of securities, or the securities of a class of issuers, and all commentary is for educational purposes only. The investment examples noted are intended to provide and example of the events and data KEDM flags each week and is not representative of typical returns generated by each event or any future returns.