JPOW pulled the trigger on re-engaging Project Zimbabwe. We’ve been banging the table on the peasants getting carved up, hence our de-grossing, but we were a bit surprised on how trigger happy he was with equity markets clipping highs. Just goes to show how bad the FED is fuct.

I tweeted this out earlier but we had a 10-yr auction that effectively failed. So if the Fed cuts at all, they blow up the bond market and the banking sector. They realistically need to raise rates aggressively here to save things (imagine that!!). That’s the EM Dilemma. Which is why DMs do not want to become EMs. Or in other words, ‘they ARE fuct!!’…

With TLT putting in a reversal and back under 100, and USD sitting on a ledge (DXY below), inflation and commodities are about to roar.

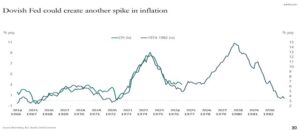

We’ve posted this chart from Torsten a few times in the past and it looks like we are right on track…(we don’t typically like analogs, but hell, it fits the narrative…)

KEDM readers are already well aware of our core themes, which just so happen to be pro-inflation with a heavy dose of commodities (shocker). But beyond that, if US/DMs are going full scale EM/Zimbabwe, there is about to be a massive flip of fund flows out of all US risk assets. So in an twist of fate, as JPOW is entangled in a EM dillema, some EMs find themselves with better fiscal and monetary prospects and will be the home for these lost funds. And you know how KEDM love fund flows…

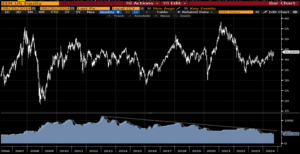

EMs have been in the dumpster bin for well over a decade but with the USD about to waterfall, EMs are piquing our interest as we await an inflection in flows. EEM is a pretty sh*t proxy for EMs but in the interest of time, let’s go with it. It has essentially chopped for better part of 2 decades and investors have all but given up (see SO in bottomhalf chart below).

And relative to SPY or QQQ, well let’s just say Mark Mobius and his white suit hasn’t been a household name lately…

Obviously EMs are a pretty broad theme with a ton of countries thrown into the mix. But we will be laser focused on it for Q4 and into 2025, kicking tires for liquidity in these markets or at least some DM-listed names torqued to EMs… ‘25 may be the year of the Magnificent EMs…Stay tuned…

Mark Mobius (and yes, he’s still going strong at 88 years young.…)