Event-Driven trading: Index Additions / Deletions

A low frequency but juicy strategy where the edge is government incompetence.

Let’s dig in…

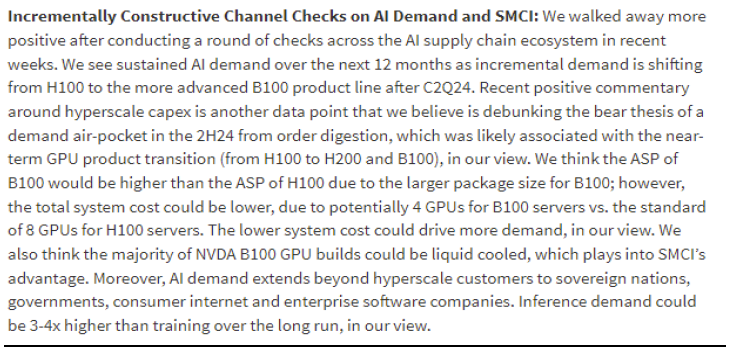

Let’s start with some Event-Driven set-ups as we style ourselves as an E-D site first, with a side-helping energy/uranium commentary. We’ve talked a bit about index additions/deletions as there have been a few interesting deletions of deep value names, but we haven’t talked much about additions because, honestly, since Tesla back in Q4/2020, they’ve all sucked. That brings us to SMCI. Yes, Super Micro Computer, Inc. sounds like a stock promote from the 1990s. We have no idea what they do. A recent analyst report from Barclays explains the bull thesis (make of it what you will)…

Fortunately, as Event-Driven traders, we don’t have to pretend we understand what this mean, unlike the poor Barclays intern who wrote that. We’re simply trading flows here and SMCI is getting added to the S&P 500.

Yeah, we’re also in shock. But we’re pretty sure we’ll be playing this in all sorts of ways.

Let’s go back to the TSLA S&P addition. On November 17th, after the close, S&P made the fateful decision that TSLA would be added prior to the open on December 21st, 2020.

Anyway, if you’d bought at almost any time between the first day of trading after the announcement (red) and sold at any point before the addition day (blue), you’d be able to call yourself a VERY successful Event-Driven trader. We know, ‘cause we played this one!!

Now, you could say that Q4/2020 was a bit strange and some crazy things were happening in all sorts of assets (like TSLA) and you’d be correct in saying that. …but do you think the AI bubble of Q1/2024 is that different?? SMCI reminds us of other hyped-up names with tight floats that went kinda crazy on index addition. We were still living in the fraternity house when YHOO got added and it went bonkers. Meanwhile, how can we forget when JDSU got added and it was something of a flop?? These aren’t bulletproof, but the hot ones with lots of option activity, tight floats and big short interests have a way of going crazy.

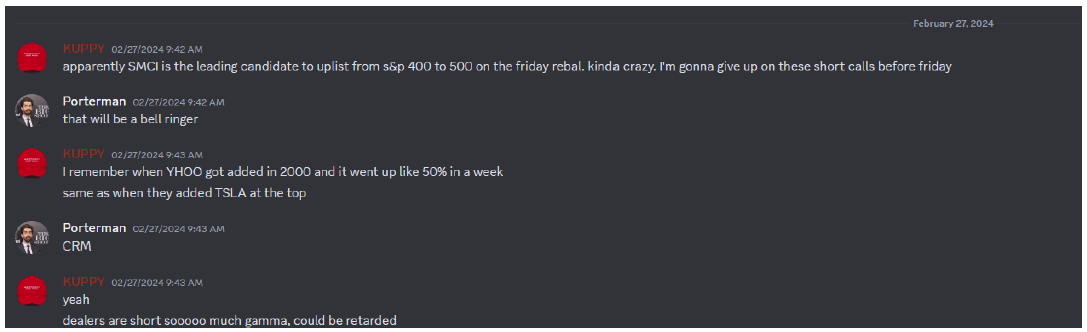

…but what about the Eiffel Tower?? Well, that got violated after-hours on Friday, but not before two weeks of Theta burn. Fortunately, one of our friends in the index arb world tipped us off (and we passed it along in Discord).

Let’s just say we think there’s going to be pin action here on the long side and with IV clocking in at around 100, and likely higher on the short-dated paper that expires on index inclusion day, there’s a LOT of ways to play this.

Start your 28-day free trial

Kuppy’s Event Driven Monitor (“KEDM”) is not a financial or investment advisor and the information contained in this publication is not intended to constitute legal, accounting, or text advice or individually-tailored investment advice and is not designed to meet your personal financial situation. The investments discussed in this publication may not be suitable for you. You are required to conduct your own due diligence, analyses, draw your own conclusions, and make your own investment decisions. Any areas concerning legal, accounting, or tax advice or individually-tailored investment advice should be referred to your lawyers, accountants, tax advisors, investment advisers, or other professionals registered or otherwise authorized to provide such advice. KEDM makes no recommendations whatsoever regarding buying, selling, or holding a specified security, a class of securities, or the securities of a class of issuers, and all commentary is for educational purposes only. The investment examples noted are intended to provide and example of the events and data KEDM flags each week and is not representative of typical returns generated by each event or any future returns.