Let’s go back to the housing market of 2021. A year into Covid we were still stuck at home flattening the curve (or at least flattening our couch cushions). Businesses closed and people lost their jobs. Whoever was fortunate enough to keep their job was told to work from home. To keep us from protesting on the street we were all given stimmies, which most degenerates gambled into the hottest SPAC. Surprisingly, it worked. We were all flush with cash and bored out of our minds.

In addition, J Pow took interest rates to 0%, thereby kick-starting the hottest housing market since the GFC. With 2.7% mortgage rates, we could suddenly afford our wives’ dream house. And even if you didn’t buy a bigger house, spending so much time at home made you aware of all the squeaky flooring, the decking that needed upgrading, the windows that were beginning to look old, or the doors that didn’t sufficiently block the noise made by your children playing around the house while you were trying to mute them during a Zoom call.

As you’ll remember, we were big housing bulls at KEDM. We were invested across the supply chain: distributors of building materials such as Builders FirstSource (BLDR), or manufacturers of windows such as Cornerstone, or siding and OSB such as Louisiana Pacific (LPX). Basically, we owned anything that could be nailed to a house and marked up.

Looking at the graph for US housing starts (single fam + multi-fam), the market saw a massive supply gap in the decade following the GFC. The market had been underbuilt by 3 million to 5 million houses, depending on who you listened to. Population growth meant a steady demand of 1.6 million new houses per year, plus whatever was necessary to fill the supply gap.

Source: Koyfin

Rapid inflation followed by the 2022 rate hike cycle spoiled the party. Yes, there were plenty of people willing to move out of their parents’ basement, but the issue was affordability. Mortgage rates peaked just over 8% in 2023. Landlords could expect to make a 3-4% net yield from renting out their house or apartment, while the Cost of Debt was a good 3-4% higher. Renting made financial sense, as long as you could convince your wife to put off the dream house for another couple of years.

Figure: top figure shows 30-year mortgage rates (white) versus US 10-year government yields (orange). The bottom figure shows the spread in bps, with a recent tightening of the mortgage spread to 196bps.

Look, Davos was supposed to be the moment where Trump pumped the US housing market, before everyone got carried away and turned it into a week to make fun of the Europeans. Housing affordability is clearly a priority going into the mid-term elections. But let’s look at what Trump can actually do.

Replacing Powell with a strawman who will quickly take the Fed Funds Rate down impacts short term rates, while mortgages are priced off of longer-term rates. The spread between government bonds and mortgages is easier to influence simply by increasing demand. While Trump does not (yet) control the Fed’s purchasing of mortgage-backed securities, he is clearly trying to get the same result by instructing Fannie and Freddie to buy $200b worth of MBS. Judging by the recent dip in spreads, it is having some effect.

Is this enough to re-awaken the housing market? We wouldn’t be so sure. Housing turns slowly like a cruise ship, not like a meme stock. It takes a while for home owners to be realistic about the price of their home because Zillow once told them it was worth more.

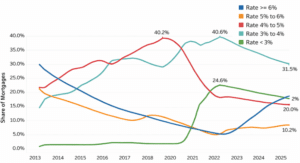

The easier call to make is that existing home sales have bottomed and are in the process of normalizing. Look, if you’re locked into a 3% mortgage and your wife wants to buy a much larger, nicer house for which you’ll have to take out a 6.5% mortgage, you’ll probably be able to tell her off for a couple of years. But that argument only works for so long. Furthermore, if we get further along into this downturn, the number of people with 3% mortgages declines. Just this January, the number of people with a >6% mortgage exceeded the people with a <3% mortgage for the first time since 2021.

Source: Realtor.com, FHFA National Mortgage Database

In a normal year, roughly 5 million people used to buy an existing home. This briefly peaked around 6 million during Covid, but it has since fallen to 4 million. This has impacted a lot of different industries. Mortgage originators saw earnings disappear overnight. Mortgage origination is a subject worthy of its own writeup some day. For now, fundamentals look good, but it’s hard to argue that Rocket (RKT) or Pennymac (PFSI) aren’t pricing in at least some recovery yet (even after PFSI blowing up this Friday).

Source: Koyfin

But there are more industries impacted. How about furniture? Sales of mattresses are below where they were in 2009 which is not bullish for domestic bliss. Similar to houses, you can only postpone the purchase of a mattress for so long. The number of companies in the furniture supply chain is enormous: Leggett & Platt (LEG), Somnigroup (SGI), Sleep Number (SNBR) just to name a few. They all come with their own problems and limitations. But maybe the macro tailwind will be strong enough to offset the fact that manufacturing furniture in the US is a low value-add business?

How about real estate brokerage? Don’t get us started on the excessive commissions they charge, but at the end of the day these are a play on existing home sales. But you can get as diverse as you like. Self-storage and U-haul trucks have had a tough 3 years. How about their supply chain: Janus Int (JBI)? The possibilities are endless.

As is always the case in finance, calling the exact bottom is hard, but housing is clearly a top priority for the Trump administration, and even without an immediate recovery, existing home sales seem to be slowly recovering back to the 5 million range.