For-profit prisons

In our thematic piece, we like to discuss industries poised to see earnings inflect higher. We focus on undiscovered, niche sectors. But sometimes a positive earnings inflection in an industry is well understood and widely discussed, but still not reflected in valuations.

One of those is the current setup for for-profit prisons, or GEO Group (GEO) and CoreCivic (CXW).

It is no surprise to anyone that the Trump administration has a different attitude to immigration and to locking people up than Sleepy Joe. Regulation in this sector tends to change every presidential cycle, depending on who’s in power. The current administration is pro-locking people up.

Both GEO and CoreCivic saw their share prices double in anticipation of the 2024 presidential election, only to double again after Trump was elected and videos of ICE making very public arrests swarmed the internet.

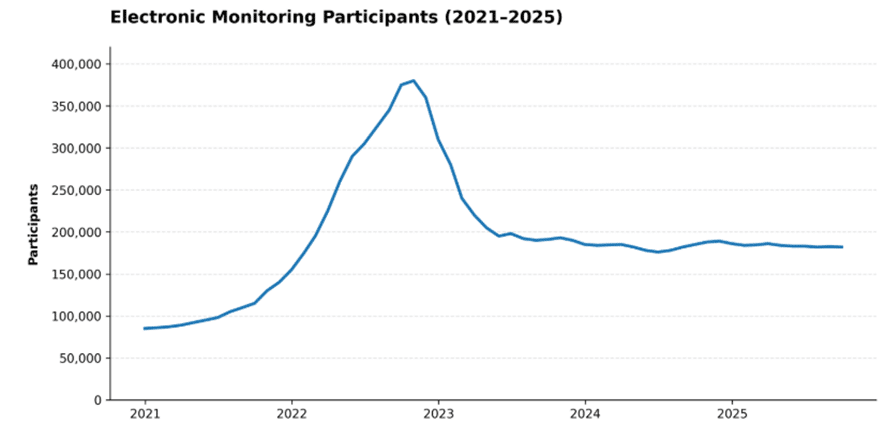

Then shares retraced, giving up most of their post-election gains. The market seems to have run out of patience, just when earnings are about to inflect higher. Both GEO and CXW reported a jump in costs and Capex in 2025, necessary to reactivate some of their facilities that had been idled under Biden. In addition, an electronic monitoring program called the Intensive Supervision Appearance Program (ISAP) failed to ramp as anticipated, due to typical government bureaucracy.

This creates the opportunity.

We understand this is a politically divisive subject. Just like we don’t make any investment recommendations, we also leave you as the ultimate judge on whether for-profit prisons fit your investment style.

A little history

Let’s start with Joe Biden, who signed an Executive Order (#14006 – reforming our incarceration system), which directed the DOJ to stop renewing contracts with privately operated criminal detention facilities. The DOJ is in charge of the Bureau of Prisons (BOP) and the U.S. Marshals Service (USMS), which are both obliged to the extent possible.

Contracts expired, and both CoreCivic and GEO had to idle some facilities. Some, but not all. Since the USMS does not own its own facilities and relies on state or private-sector facilities, some contracts remained in place because a viable alternative was lacking.

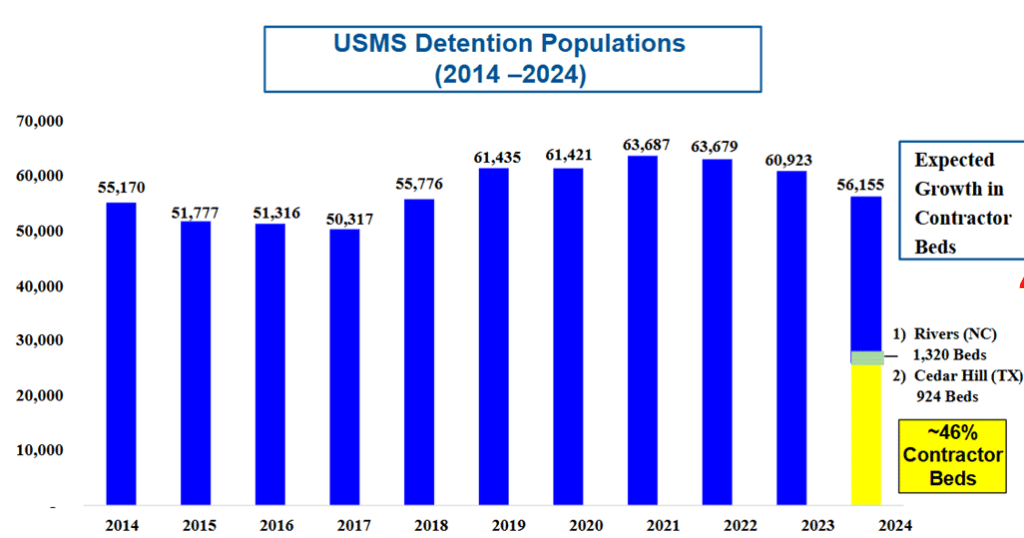

Furthermore, the USMS detention population started a slow decline under Joe Biden as enforcement around border-related crimes such as drug trafficking softened.

This directive did not apply to ICE, which falls under the Department of Homeland Security, and generally places people in administrative custody, rather than locking them up for punishment or awaiting trial.

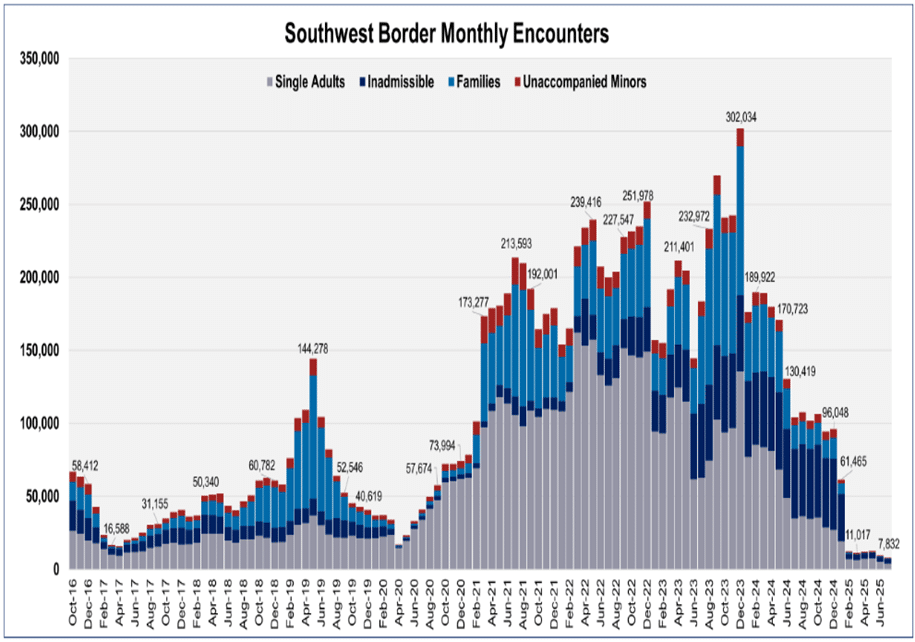

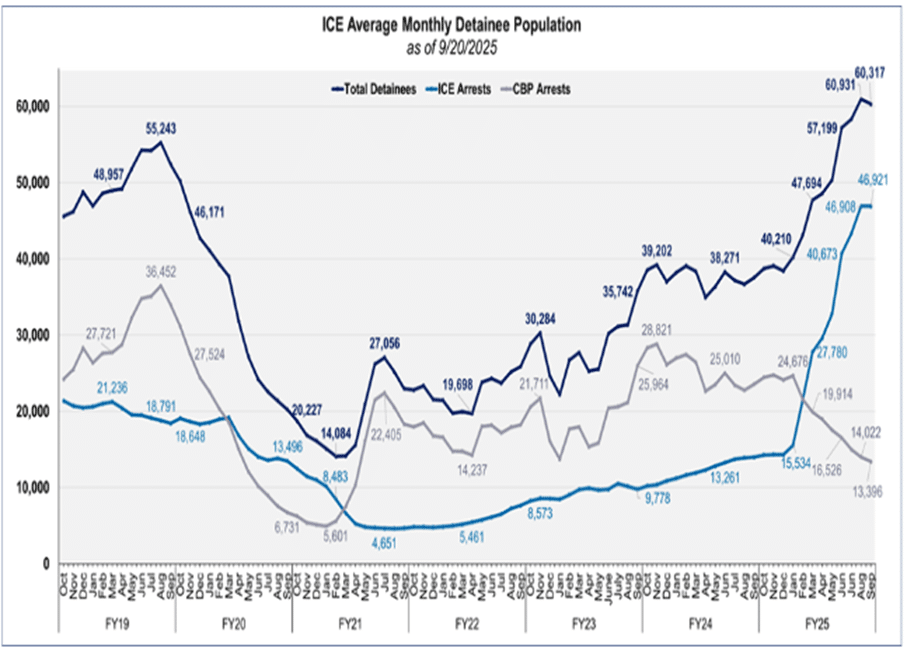

ICE-detained populations collapsed for 2 different reasons. First, there was Title 42, implemented in March 2020 in relation to the COVID-19 pandemic. This was an emergency ruling that allowed the CBP to quickly remove all apprehended single adults. This ruling ended in May 2023. Second, there was the catch-and-release policy, under which migrants who were caught entering the US were given a Notice to Appear, after which they were released into the US.

In short, Joe Biden’s presidency was a period where border encounters were up, but ICE populations were down. ICE + CBP detainees dropped from 55k at the start of his presidency, to 15k during Covid, and 38k at the end of Joe’s presidency.

Source: CoreCivic Investor Presentation

Source: CoreCivic Investor Presentation

The Opportunity

This gets us to today, where Trump’s crackdown on illegal immigrants means ICE detainees are back up to ~65k, with another 182k immigrants under an electronic monitoring program. There are 7-8 million non-detained immigrants with a Notice to Appear, and a harder-to-quantify (but roughly 10 million) ‘gotaways’. Don’t take these numbers too literally; they tend to change whenever Donald Trump talks, and nobody seems to know the exact numbers.

The “One Big Beautiful Bill” Act was signed into law in early July 2025 and increased ICE funding by $45B over 4 years, intended to expand detention from a current level of ~60,000 to ~100,000. This is undoubtedly bullish for GEO and CXW. However, in typical government fashion, everything takes a little longer than hoped. Kristi Noem, as the head of DHS, needs to personally sign off on every expense over $100k, and ICE is trying to hire another 10k employees who like to play dress-up.

ICE toyed with the idea of locking up immigrants in Guantanamo Bay, El Salvador, or ‘Alligator Alcatraz’. But everyone who’s been to Florida and ventured further than a Palm Beach golf course knows that crossing a swamp with alligators isn’t half as scary as crossing a cartel-controlled border: an idea that works well in cartoons but doesn’t hold up in the real world. And with Guantanamo being expensive and El Salvador being blocked by the Supreme Court, private prisons will see their population expand.

Then there is the electronic monitoring program. As it turns out, giving an undocumented immigrant a Notice to Appear results in ~17% of those immigrants not turning up. Compliance improves if you actively track the immigrant. GEO has been operating an electronic monitoring program on behalf of the government for the last 20 years, despite CXW’s effort to bid for the same contract.

In October of 2025, this program got extended by another 2 years, albeit at a lower price (Q4 margins will be weak!). This lower price is partially offset by a shift from a monitoring ‘app’ to an ankle monitor for which GEO can charge roughly 3x as much.

The contract specifies the need for 361k participants in 2026 and 465k in 2026, as compared to only 182k participants today. If this were to materialize, it would represent a significant step up in GEO’s profitability. But as mentioned, the US government moves at its own pace, and no real step up is yet visible.

Source: https://www.ice.gov/detain/detention-management

This all benefits the for-profit prison ecosystem. A larger prison population also means higher income from prisoner transportation. GEO even received a 2-year, $121m contract for Skip Tracing Services, which means GEO gets paid to search the internet for immigrants who failed to show up at their court hearings, then rat them out to ICE. Bounty hunting has come a long way since the founding of the US.

All in all, the next 2 years will see earnings for GEO and CXW expand. With high operating leverage and the expected drop in Capex, FCF will ramp, likely split between debt paydown and share repurchases. This gets us to a double-digit FCF yield quite easily. The only remaining question is whether we will see a change in immigration enforcement following the 2028 elections, and if we do, what this means for the multiple market will put on those earnings.