Try Kuppy's Event

Driven Monitor

Peer into the weekly trading notes of a hedge fund manager. Cut through the clutter and stay up-to-date on these unique, Event-Driven opportunities with Kuppy’s Event-Driven Monitor.

What is KEDM?

Kuppy’s Event Driven Monitor (A.K.A. KEDM) keeps you up to date on corporate events and special situations to drive your investment strategy.

The issue is that there are over 7,000 stocks in the U.S. At any time, 100s of them are undergoing a corporate event. Keeping track of these catalysts to generate returns requires a team.

KEDM solves this problem for you by monitoring over 20+ screens for these “events.” Every week, Kuppy, a successful hedge fund manager, and his team of KEDM analysts review ALL of these events and distill them into their “Kliff Notes” for the coming week.

Every Saturday you will receive commentary on the events that matter most. With KEDM you will never miss another catalyst!

Start your trial and receive a sample report NOW

Try out our premium subscription today to receive exclusive commentary on current events and gain industry-leading insight to help evolve your own investment strategy. Want to see what it’s all about? Request a sample report now!

What are "special situations" and what is Event-Driven Investing?

Event-Driven investing is a hedge fund investment strategy that seeks to exploit pricing inefficiencies that may occur before or after a corporate event, such as a spin-off, bankruptcy, merger, acquisition, or CEO change.

Bottom-line, Event-Driven investing looks for catalysts. Instead of waiting around for stocks to go up, we look for timely events that help create their own returns.

Take KEDM for a spin.

Nearly 15,000 people are already subscribed. Why not join them for free with our trial? With our subscription you will gain industry-leading insight straight to your inbox with special commentary on the events that matter most.

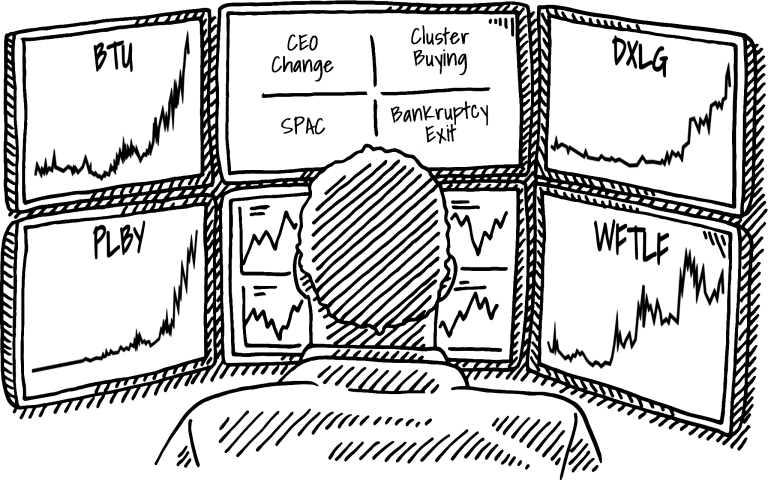

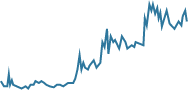

KEDM Victories

View some of our success stories below.

BTU

CEO Change

[BTU is a] Large PRB thermal coal producer with Alabama Coking coal and Australian seaborne thermal coal operations…

DXLG

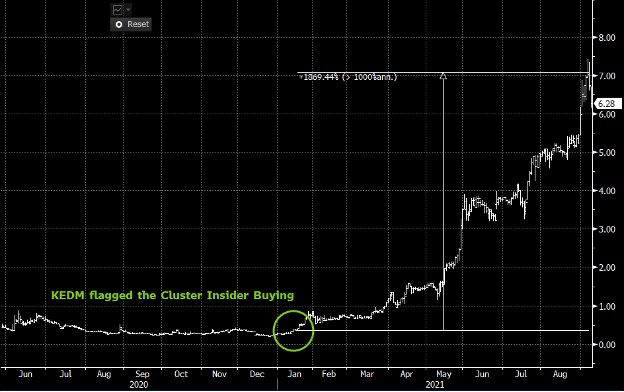

Cluster Buying

On January 23, 2021, KEDM flagged a HUGE amount of insider buying in a clothing retailer called Destination XL Group which sells…

PLBY

SPAC

A popular Event in recent years is a merger of a Special Purpose Acquisition Company, also known as a SPAC. These are shell…

WFTLF

BK Exit

Companies emerging from a successful Ch.11 restructuring can be a fertile hunting ground for equity trades…Why is that?? Generally the previous…

Try our premium subscription today!

4-week

FREE trial

No credit card needed

No spam

Just an email to sign up

Kuppy’s Event Driven Monitor (“KEDM”) is not a financial or investment advisor and the information contained in this publication is not intended to constitute legal, accounting, or text advice or individually-tailored investment advice and is not designed to meet your personal financial situation. The investments discussed in this publication may not be suitable for you. You are required to conduct your own due diligence, analyses, draw your own conclusions, and make your own investment decisions. Any areas concerning legal, accounting, or tax advice or individually-tailored investment advice should be referred to your lawyers, accountants, tax advisors, investment advisers, or other professionals registered or otherwise authorized to provide such advice. KEDM makes no recommendations whatsoever regarding buying, selling, or holding a specified security, a class of securities, or the securities of a class of issuers, and all commentary is for educational purposes only. The investment examples noted are intended to provide and example of the events and data KEDM flags each week and is not representative of typical returns generated by each event or any future returns.