Fund Flows Flip

A low frequency but juicy strategy where the edge is government incompetence.

Let’s dig in…

Things may be light over the next couple weeks as we are in South Florida taking meetings during the annual iConnections pilgrimage. In our typical fashion, we don’t pay the 20k entry price to roam the halls, but rather sit with a cold beer at a local bar and laugh as the sleeveless vests descend upon the streets of South Beach jostling to meet Calpers to tell them how they have a differentiated strategy to buy NVDA…

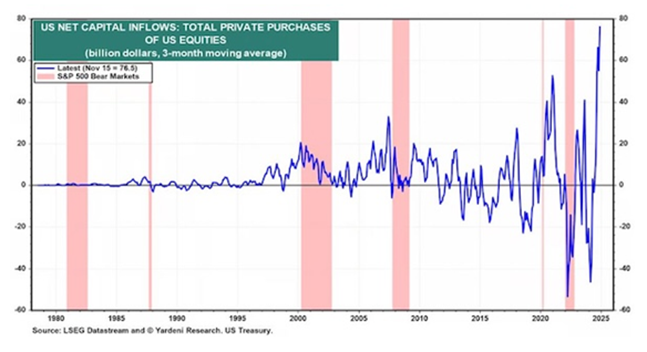

Nonetheless, our main thematics haven’t changed. Now that Trump is in, we expect a heavy dose of chaos and “sell the news” events to tick up. We already saw NVDA sell off hard on the back of Deepseek, even with the Stargate announcement and META ramping their capX. At some point, fund flows will flip and capital will drain from Mag7 and we’ll finally see mean reversion here:

The recipients of these flows will likely (hopefully) be their home countries as KEDM eyes more exposure in EM – Brazil, Turkey, and China. Speaking of the later, Trump hit Davos this week and spoke promisingly of Xi as sentiment perks up there. Meanwhile, Xi unveiled more plans to bolster their stock market as the CSRC greenlit insurers to invest 30% of new premium into A shares (upwards of $100B Yuan) and want Companies to continue to ramp buybacks and divvies. Could the Year of the Snake may finally be the year of the bull??

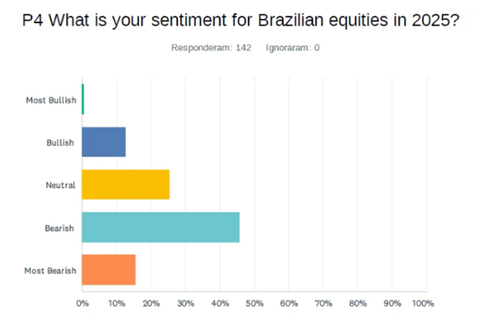

And over to Brazil, we encourage you all to read through our good friend (and previous Happy Hour guest), PauloMacro’s Brazil post this week. He is our local expert there and has been bearish for 15 years, but recently flipped bull. Even if we get the timing off by a bit, EWZ is yielding 9% for a market trading at 8x forwards. With the US elections now behind us, our eyes now move over to Brazil’s 2026 election for the catalyst. With sentiment this bad, it won’t take much…

Start your 28-day free trial

Kuppy’s Event Driven Monitor (“KEDM”) is not a financial or investment advisor and the information contained in this publication is not intended to constitute legal, accounting, or text advice or individually-tailored investment advice and is not designed to meet your personal financial situation. The investments discussed in this publication may not be suitable for you. You are required to conduct your own due diligence, analyses, draw your own conclusions, and make your own investment decisions. Any areas concerning legal, accounting, or tax advice or individually-tailored investment advice should be referred to your lawyers, accountants, tax advisors, investment advisers, or other professionals registered or otherwise authorized to provide such advice. KEDM makes no recommendations whatsoever regarding buying, selling, or holding a specified security, a class of securities, or the securities of a class of issuers, and all commentary is for educational purposes only. The investment examples noted are intended to provide and example of the events and data KEDM flags each week and is not representative of typical returns generated by each event or any future returns.