Get long Wall Street Bets…

A low frequency but juicy strategy where the edge is government incompetence.

Let’s dig in…

We want to be long the businesses that are best poised to profit from the coming inflationary regime and we’ve been studying past inflationary cycles to see what’s worked best. One seemingly obvious theme that we’ve found across different inflationary regimes is an increased appetite for speculation.

As their purchasing power deteriorates, people consistently turn to gambling as a means of staying afloat or simply as an outlet for their deteriorating fiat, no matter the culture, class, or country. The belief that you must take on copious amounts of risk to outrun the depreciation of your cash takes hold of the collective psyche and feeds upon itself, driving the population further and further into a speculative frenzy. This mass continues to grow as new flows push prices higher and a larger percentage of the population is sucked into the mania by means of desperation and greed. We already saw what inflation can do in the US when people were locked into their homes with nothing to do but plow their stimmies into GME and Peloton bikes. Should inflation again roar its head this cycle will be repeated, and we want to be long.

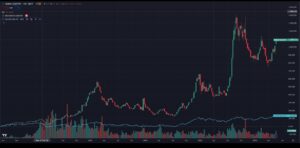

One of the ways we’ve come up with for playing this is via stockbrokers. Whether it be Weimar, Argentina, Turkey (chart below), Zimbabwe, Brazil, the US, or Asia, stockbrokers have always excelled during times of inflation. They’re a quasi-toll road on the markets, collecting small fees on trades and extending credit. Many are melded with investment banks which profit as bull markets drive equity issuances and IPOs. These businesses are structurally long increased speculation in stocks, similar to how a casino is long regular gambling. They print cash in bull markets, earning revenues as trading volumes, volatility, and margin loans all increase as risk appetite runs wild. When central banks raise interest rates in response to inflation, brokers get the added kicker of increased interest income on margin loans, client cash, and their regulatory capital – giving them leverage to the full inflationary cycle.

(Percentage return of largest Turkish broker vs the Turkish index in USD)

Look at these businesses in the US. For the most part, they grew earnings every year from 2020 on, as hits to client assets and margin loans during 2022 were offset by increased interest income as the Fed hiked. As markets have rebounded, assets and trading volumes are increasing again which, coupled with higher NIMs, have given them accelerated earnings growth. They’re the kind of businesses that benefit when assets moon during a period of higher interest rates.

In the US, this cycle has already played out and we’re late to the party. Sure, as inflation and speculative zeal comes back, we think these businesses will still thrive but we want leverage to assets that are earlier in the cycle.

This brings us to Japan.

Simply put, we cannot think of a nation more in need of inflation than Japan. For years, the country has suffered through deflation and negative interest rates as its population and economy slowly wilted. All the while, the government has run record deficits, and the BOJ has done YCC to try and blow life into their economy. With the Covid shock, the country finally got a small taste of inflation, allowing the BOJ to recently end their negative interest rate policy and signal additional rate hikes. In March, workers got the biggest pay raise in over thirty years as they rebelled against the price of ramen breaking the 1,000 yen barrier and, because of how desperate they are, the BOJ will let inflation scream rather than risk breaking the economy. They desperately need nominal growth, so they’ve dragged their feet and continually slow walked hawkishness, sacrificing the Yen rather than risk smothering their small spark of inflation in its infancy.

These pro-inflation policies extend to the concerted efforts by the government and the Tokyo Stock Exchange to pump up the Japanese stock market. Both entities have undergone a campaign to boost domestic investment into stocks, prodding the populace to raise the percentage of domestic savings they have in stocks from its low level of only 15%. To this end, the government has done things like tripling the contribution limits for tax-free retirement accounts and removing the expiration of their tax-exempt status, making these accounts permanently tax-free. The TSE has pushed companies to shed non-core subsidiaries and reduce cross holdings to simplify business structures and, in typical Japanese fashion, has began to publicly shame companies whose stocks trade under book value, forcing buybacks and capital investment. All while inflation has continued to creep back into Japanese society and both the people and businesses have begun to adjust.

These initiatives have worked. The Nikkei is at all-time highs – recently hitting 40k, the highest it’s been since the end of the last Japanese bubble in 1989. So far, the flows have mainly been from overseas investors, who represent the vast majority of the volume on the TSE. But the populace is just now starting to dip its toes back into the markets as many are having to deal with inflation for the first time in their lifetimes and others are feeling greedy by seeing their neighbors and friends becoming wealthy from being long as the Nikkei has run. Per the TSE, retail investment was up to 23% of total volumes in the equities market in 2023, up from 15% a few years ago. And this past March, the total value of household assets invested in equities increased 30% with more room to go given half of the nation’s household wealth is still kept in cash. This is slow progress, but the momentum is building.

The psyche of the Japanese people is slowly starting to change. As inflation continues to linger, more and more people will be forced to change how they invest their savings, and these increased flows will kick off the reflexive cycle that has been present in other inflationary regimes. The base the nation is working off is so low that we don’t even think that inflation needs to scream in Japan for this to work. Merely hitting the BOJ’s 2% target would be a massive improvement from the prior regime. Critically, as inflation sets in the BOJ will err on the side of dovishness and give markets room to run, the opposite of how the Fed responded in 2022. This sets up an environment where stockbrokers can benefit both from rising markets and from rising interest rates, without the fear of the latter crushing the former.

We think many stocks in the Japanese market will benefit as higher valuations come through increased retail flows and inflation leads to higher revenues and potentially expanded margins. There are certainly plenty of opportunities in cheap businesses that are trading at single digit PE multiples and below book value. But we want to be long the ones with the most operating leverage to the cycle, and those seem to be the stockbrokers. In Japan, just like in nearly all previous inflationary regimes, we believe that these will be some of the best performing businesses. The past quarter showed that the cycle has already begun as many of these businesses recorded increased earnings and revenues and trading volumes for equities, futures, and options continue to increase at a high rate.

These businesses are also leaning into the trend. The market leaders are implementing zero-commission trading and rapidly growing accounts. When the Nikkei broke 40k, the largest brokerage saw so much trading flow that their systems briefly collapsed. And while the market has been range bound and consolidating for the past few months, trading volumes continue to increase, setting the stage for additional growth should the index break out to new all-time highs.

We think the growth coming to these businesses will be significant in the coming years as the population adjusts to inflation and we’ve been doing our due diligence so we can ride the trend. The Japanese seem to be following the same inflationary path as the EU and US, albeit with a lag given the BOJ’s resistance to hawkishness. Should they repeat the cycle, we hope to be long the businesses best poised to profit.

But why now?? The NKY has been screaming for years, haven’t we missed it??

NKY – 10yr weekly

You see, brokers don’t really make much on commissions—it’s almost a loss leader as they compete for clients. They make the real money by lending to speculators on margin. After three decades, where buying the NKY on margin was a losing strategy, investors are only now starting to margin up.

Margin

Margin lending is where the profits are. It will get better…much better…once the BoJ raises rates and the brokers can earn a return on their regulatory capital, while expanding NIMs on margin lending (like most things in Japan, the financial statements are hard to decipher, but the current NIMs appear to be negligible, like 5bps negligible at one broker). It will get even better as underwriting comes back, and the banking part of the business swings to a profit, from a loss. AUM growth in wealth management will lead to increased fee income and operating leverage. It is all reflexive. These brokers should have run years ago, with other Japanese stocks, but they have been under-earning without there being any interest rates in the country. We think that’s changing, even if it’s at a glacial pace—just like the swap out of JGBs into equities. These things go slow, then fast. We think we’re at the inflection now—especially as the brokers finally have charts that are waking up. If the BOJ ever raises rates, we think these are off to the races…As we typically do, we are looking at a Japanese broker basket and will be tracking this on our Inflection Monitor….

Start your 28-day free trial

Kuppy’s Event Driven Monitor (“KEDM”) is not a financial or investment advisor and the information contained in this publication is not intended to constitute legal, accounting, or text advice or individually-tailored investment advice and is not designed to meet your personal financial situation. The investments discussed in this publication may not be suitable for you. You are required to conduct your own due diligence, analyses, draw your own conclusions, and make your own investment decisions. Any areas concerning legal, accounting, or tax advice or individually-tailored investment advice should be referred to your lawyers, accountants, tax advisors, investment advisers, or other professionals registered or otherwise authorized to provide such advice. KEDM makes no recommendations whatsoever regarding buying, selling, or holding a specified security, a class of securities, or the securities of a class of issuers, and all commentary is for educational purposes only. The investment examples noted are intended to provide and example of the events and data KEDM flags each week and is not representative of typical returns generated by each event or any future returns.