Happy Hour with Doug Casey on “Crisis Investing”

A low frequency but juicy strategy where the edge is government incompetence.

Let’s dig in…

Shifting topics, I had a blast catching up with Doug on Friday. Given what is happening in the gold markets we couldn’t have timed this one any better. As we typically do for Happy Hours, we jotted down some notes for those that were unable to join live. The replay will be available next week, but in the meantime, let’s rehash…

- Kuppy and Doug start out by discussing their respective locations (Puerto Rico & Argentina) and their decisions to spend most of their time outside of the continental US. Doug emphasized that his time spent in the US is becoming less and less with most of his time spent at his farm in Punta del Este, Uruguay with largely being driven by what he sees as devolving conditions in the US.

- Doug credits his interest in collecting coins with starting his interest in money. After college he read Henry Hazzlit’s “Economics in One Lesson” which he believes is the best “short” book ever written on economics which he quickly followed with Ayn Rand’s “The Virtue of Selfishness.” The third and final book which he credits with starting his interest in anarcho-capitalism and free market economics is “The Market for Liberty” by Linda and Morris Tannehill.

- Doug jokes that his libertarian/anarcho-capitalist leanings is what got him into gold and maybe not for the best as most serious investors agree it is a terrible industry. Despite this he’s done quite well in the industry.

- Over his career Doug has developed his 9 Ps of Resource Speculation (we’re able to link to 8 of the Ps).

- Of all the Ps the most important P is “People.” Incredible amounts of money can be made (and saved) by sticking with people who are the combination of “good and competent.” He emphasizes that one is useless without the other and that by avoiding bad people and idiots, and following good people who are consistent winners like Robert Friedland and the Lundin Family he has had tremendous success.

- The second P is property which is the actual geology of the prospect and

resource. He says most people get into trouble by trusting bad people and getting everything they

know about the property from shady hand waving promoters.

“Phinancing” is the third P. A property is worthless if management can’t raise the money to develop the resource. - Paper is the 4th P. Doug says it is important to know who owns the paper, at what price, and how did they get it (purchase vs compensation). If management is not invested or they received shares for free or for pennies they may not have the best incentives to deliver for investors.

- Promotion is the 5th P. Promotion and mining go hand in hand because money can be hard to raise. It’s important to figure who the promoters are and try to determine if this is a promotion to raise capital to drive the project forward or for promoters to offload paper.

- Politics is the 6th P. He says Politics are more important than ever and it’s important to understand how they may affect the way a mine operates but also what might happen should the mine become a success.

- Push is the 7th P. What is the push that will catalyze a movement in the stock price. Is it drill results, securing financing, earnings, etc.?

- Pitfalls is the 8th P. Doug asks every mining CEO, “what can go wrong?” if they don’t have an answer or the list of potential pitfalls is not long enough, he knows that he is either dealing with an idiot or a dishonest person. In either case this is a serious concern. He says in many cases it is important to ask the question twice as in his experience the second list of pitfalls is often the more realistic list.

- The 9th and final P is price. What is the price of the commodity or commodities and how is it affecting share price. Have the promoters sold a vision of higher prices that has already been embedded in the valuation of the stock? Has the price moved beyond fair value and the stock is at risk should price pull back? Or have prices risen and the market has yet to price in the higher value of the assets?

- Kuppy asks him how Millei’s popularity in Argentina might differ from what. We hear from the Western press. Doug says he is ashamed to admit it but subscribes to the major Western papers like WaPo, NYT, and WSJ and believes their characterization of Millei and of his “lack of support” in Argentina as complete and total crap. He is not Trumpian or ultra-right wing but deeply invested and interested in free-market capitalism and libertarian ideals.

- Doug tells a story of giving his Patagonian fishing guide and RE broker a copy of “The Market for Liberty” which the guide went on to devour and translate into Spanish, eventually giving his translated version to Javier Millei and starting his interest in an-cap ideals.

- Kuppy asks if the average Argentinian is willing to take the pain that comes with any type of hard economic reset like this. Doug says yes, because economic pain is all they have known for the last 20+ years and some of the crises they have gone through have been so extreme that this will be nothing in comparison. He highlights that in 2001 things got so bad that the provinces printed their own money, and the 4 Seasons in Buenos Aires could not break a $100 bill when he visited.

- Doug also says that the Western press has made too big a deal of Millei’s Omnibus bill not passing on the first round and that is being revised and will go back for further rounds of voting. Millei is not giving up and in Doug’s view this is a never-before-seen moment in history where someone with an-cap beliefs has taken over. The historical significance is not being fully appreciated.

- Osman asks about how Doug is playing the Uranium theme because he is bullish. Doug says he’s selling puts against CCJ because he views it as relatively safe downside risk but he doesn’t think the company has huge upside because they’ve hedged so much. He also participates in private placements for junior miners where he gets heavily discounted shares and warrants. Often selling the shares quickly and holding warrants. He also owns a broad-based uranium mining ETF, but he was not clear about whether it was URA or URNM

- He also asks about the situation in Panama which Doug says he isn’t following all that closely, but he does comment that although he isn’t a fan of FNV, it might be an interesting time to buy. The amount of money the Panamanians are losing by not running the mine is just too much for them to hold on forever.

- Kuppy asks Doug how he’ll know it is time to trim his precious metal positions. He says it will largely be sentiment driven and he’ll be on the lookout for “golden bears destroying the NYSE” on the cover of the Economist. He also notes that in his view the public is not broadly involved enough for the run to be near its end.

- Charles asks how Doug would play the Argentina theme. He says he has so much real estate that he doesn’t need much more exposure personally but says to keep it simple with ETFs like ARGT, and the NYSE listed land companies like IRSA (commercial/industrial RE) and CRESY (agricultural RE).

- Doug believes the RE is the best Argie play though as the prices are “real”. Because financing is so hard all the prices are cash prices. He juxtaposes this with prices in the west where debt is used to fund RE purchase and potentially inflate demand. He predicts that Buenos Aires real estate could one day be worth more than NYC real estate as rich Argentinians come back when Millei fixes the country.

- He also thinks that securing some residence outside of the US is extremely important and timely issue. He believes the Democrats will win the election (or keep power despite losing) and that capital controls will be introduced.

- Both Kuppy and Doug talk about their trips to Zimbabwe and experiences meeting the former central banker Gideon Gono. Doug comments that Gideon knew a lot about economics and the issues facing Zimbabwe, but they had to print the $100 Trillion Zimbabwean Dollar note to pay the army, because not paying an African army is how military coupes are made. That’s why the bill looked so nice because the army needed to think it was valuable. Neither Kuppy or Doug think the gold backed Zim dollar is going to work.

- Doug used to say that if a young man wanted to get rich, he should go to Africa because the playing field is tilted in your favor. He made a hobby out of going to these countries to sit down with the dictators and pitch them on free marketizing the economy and disturbing shares to the people with some share kept in trust for future generations and some shares set aside for the inevitable bribing of those who would be losing power. His plan offered these leaders three things… 1) Legitimate wealth that could be spent around the world. 2) The love of their people. 3) International fame in a good way rather than international infamy. Unfortunately, they never go through with the plan.

- Umesh asks about “crisis investing” in Cyprus after their banks failed and if there any extreme examples of extreme value in the aftermath of crisis. He goes back to Argentina and doesn’t see anything with better post crisis risk reward potential and value.

- Neal asks why gold miners have lagged so badly and whether Doug sees that turning around? Doug says there are several reasons, but he says ESG, DEI, and environmental concerns have kept people out of the market.

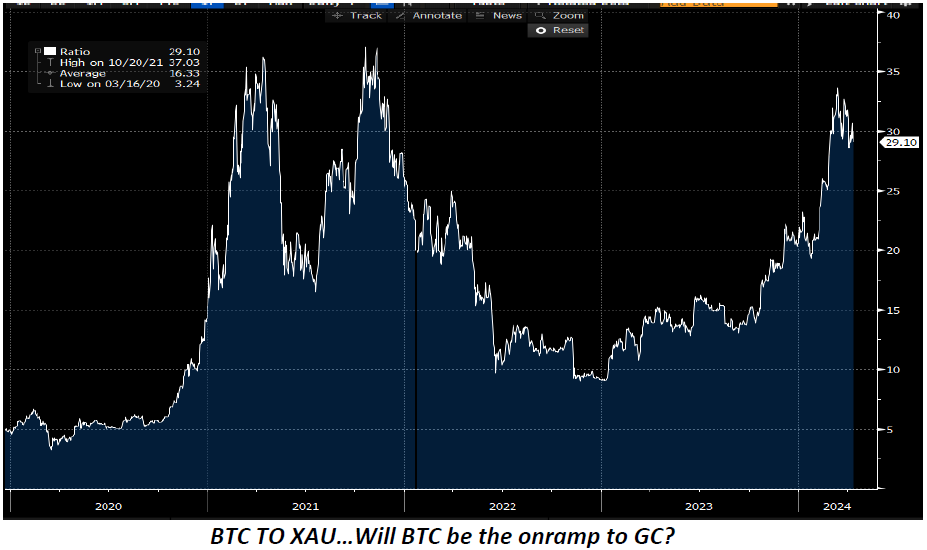

- Doug also sights general deterioration of the dollar as driving more people into gold eventually. He sees bitcoin as an onramp to gold for young people rather than something that competes with gold. He views its rise as good for gold as it shows that people understand the fundamental reasons that fiat should be avoided.

- Jonathon asks what Doug’s view of the royalty company model is. Doug says royalty companies have been good to him but as the space has become more and more popular there is less opportunity, and the deals are less advantageous for the royalty companies. He’s selling his royalty companies but believes they will still do “ok.” He sees what Michael Saylor is doing with bitcoin as the next iteration of the model.

- A write in question for Doug’s top mining tickers comes in and he lists Altius Minerals (ALS.TO) because he likes the management, and it pays a small dividend. He cautions there is no such thing as mining investing. It is always speculation.

- Doug was a late adopter to BTC but after a period he came around in 2017 and he views it as sound money. He’s still a gold bug at heart but he views it as a great asset with many real-world use cases.

- Phillip asks about Robert Friedland and Ivanhoe Mines. Doug mentions that he and Robert are friends, and he has tremendous respect for him, but the company is too big for his style, but he says if he or Frank Giustra come out with new smaller mining deals he would likely participate.

- Franklin asks what sort of portfolio allocation Doug would recommend. Doug says he wouldn’t own any bonds, but he does currently have one exception in his portfolio in West Red Lake Gold Mines because it has a12% coupon and is convertible. But overall, he says avoiding them is one of the best decisions you can make. He is heavily overweight a lot of resources like gold, uranium, coal, copper, and natural gas. He does not like the mainstream large cap stocks like Apple and Meta and believes they are in a massive bubble. He says his portfolio is probably 50% resources and 50% real estate.

- Doug says that when purchasing gold coins, it is important to buy smaller ones for travel as they are easier to get through customs and borders without being hassled.

Start your 28-day free trial

Kuppy’s Event Driven Monitor (“KEDM”) is not a financial or investment advisor and the information contained in this publication is not intended to constitute legal, accounting, or text advice or individually-tailored investment advice and is not designed to meet your personal financial situation. The investments discussed in this publication may not be suitable for you. You are required to conduct your own due diligence, analyses, draw your own conclusions, and make your own investment decisions. Any areas concerning legal, accounting, or tax advice or individually-tailored investment advice should be referred to your lawyers, accountants, tax advisors, investment advisers, or other professionals registered or otherwise authorized to provide such advice. KEDM makes no recommendations whatsoever regarding buying, selling, or holding a specified security, a class of securities, or the securities of a class of issuers, and all commentary is for educational purposes only. The investment examples noted are intended to provide and example of the events and data KEDM flags each week and is not representative of typical returns generated by each event or any future returns.