Inflation is Back

A low frequency but juicy strategy where the edge is government incompetence.

Let’s dig in…

Moving on, we don’t know exactly why it happened on Friday, but after weeks of data showing that inflation was accelerating, on Friday, the markets finally started to care…

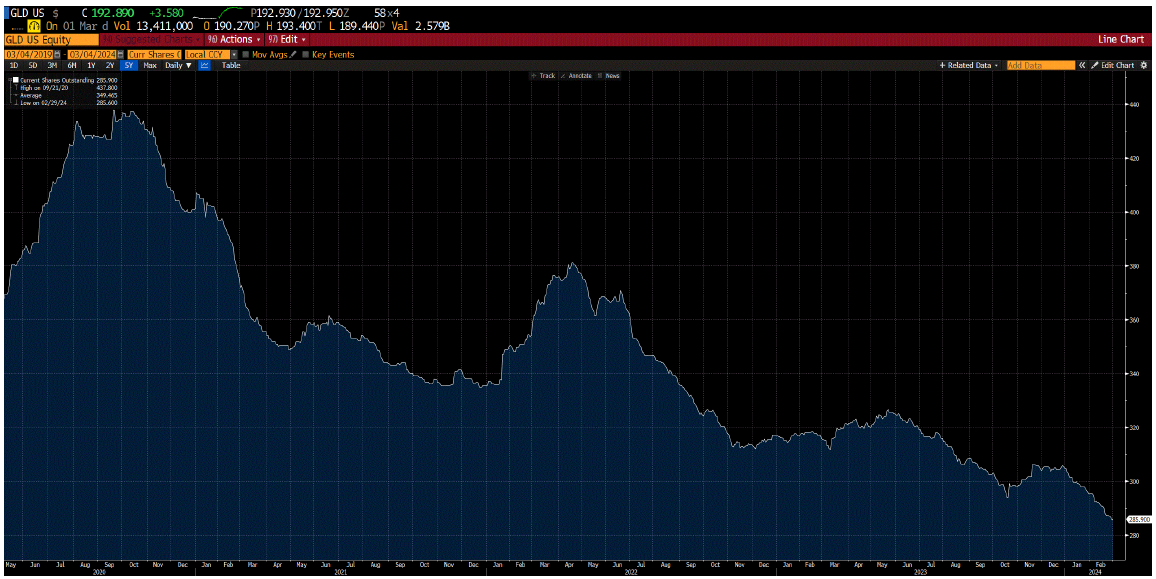

Check this chart of GLD (we’re using it instead of XAU as it doesn’t have that crazy overnight wick)…

XAU – ‘Ain’t she a beauty…??

We’re hearing that physical gold had its highest ever Comex close in USD terms on Friday.

Naturally, gold miners are once again showing you that they have exactly Z-E-R-O leverage to gold…

…however, they are the short-term Beta to gold that we all want (and need). Besides, when Jesse Stine speaks, we tend to sit up and take notice.

Let’s just say that we’re bulls on gold and we’re looking for Beta plays on it. Bitcoin has gotten all the love. We know that. Just look at all the gold draining out of GLD if you want confirmation of how under-owned gold is. It’s drained 151.9 million shares since the peak in 2020 when gold first crested 2000.

Gold has had a few false breakouts now. Maybe this is yet another one. However, we cannot think of a breakout that is this un-loved, this un-followed, this under invested. If retail comes back (GLD is retail), then we think there could be some fireworks.

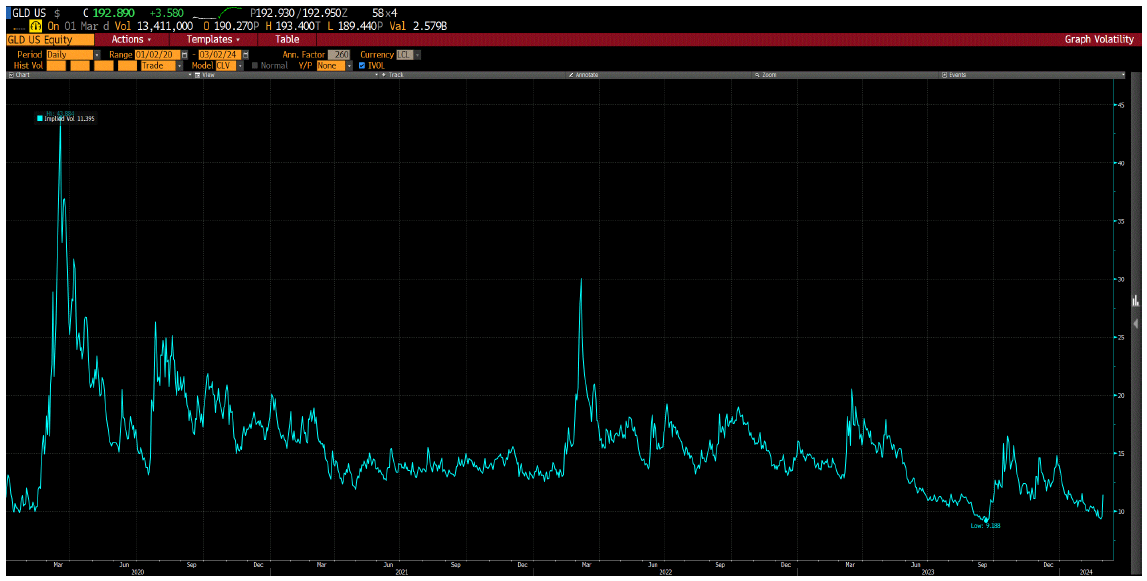

For that matter, even with an uptick on Friday, look at how cheap GLD volatility is. With the upside skew, there’s plenty of opportunities here as well.

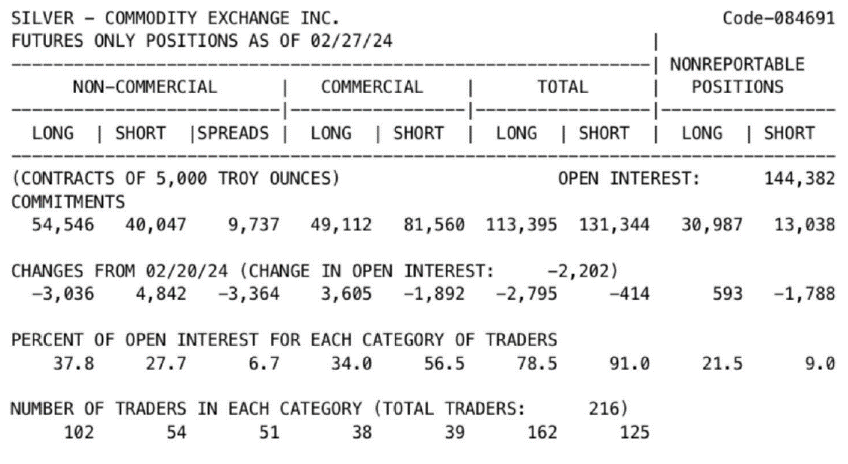

We’re not silver bulls, (please don’t @ us for it). But we know that silver tends to exhibit gold Beta and while gold is at all-time highs, silver is subdued. That said, we cannot help looking at this chart and wondering if silver gets a chance…

Especially as the COT turns bullish…

Look, we’re in search of gold Beta. We’re open to ideas. We think this is finally the real deal for gold, even if the seasonals aren’t with us. We’re throwing stuff at the wall and seeing what sticks. We’ll likely try a few angles. We’re even willing to be creative here. I mean, we could do worse, but maybe we’ll just hoard a stack of silver Trump mugshot rounds available at JM Bullion… And try to track down some Trump 2020’s (now quite collectible apparently) …

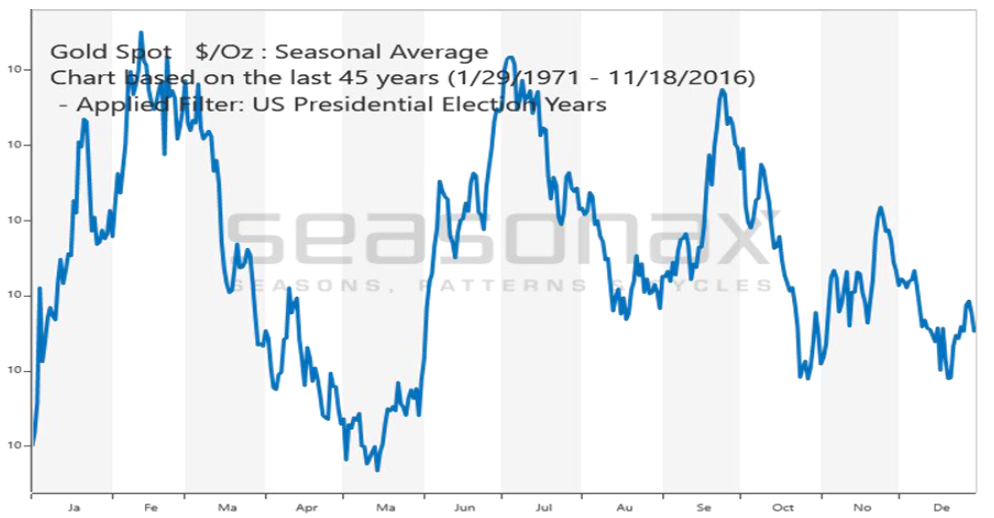

Finally, while the seasonals kind of suck right now, we’re passing along this chart as presidential year seasonals give us hope into summer…

In summary, we’re inflation bulls. We feel like we’ve been early (again). Suddenly, on Friday, we felt smart. We’re not sure what quite clicked, we just know it did. Let’s hope it continues…

Start your 28-day free trial

Kuppy’s Event Driven Monitor (“KEDM”) is not a financial or investment advisor and the information contained in this publication is not intended to constitute legal, accounting, or text advice or individually-tailored investment advice and is not designed to meet your personal financial situation. The investments discussed in this publication may not be suitable for you. You are required to conduct your own due diligence, analyses, draw your own conclusions, and make your own investment decisions. Any areas concerning legal, accounting, or tax advice or individually-tailored investment advice should be referred to your lawyers, accountants, tax advisors, investment advisers, or other professionals registered or otherwise authorized to provide such advice. KEDM makes no recommendations whatsoever regarding buying, selling, or holding a specified security, a class of securities, or the securities of a class of issuers, and all commentary is for educational purposes only. The investment examples noted are intended to provide and example of the events and data KEDM flags each week and is not representative of typical returns generated by each event or any future returns.