After 2 in-depth thematic pitches in the last month (Senior Living Facilities and Private Prisons) we wanted to dive into another monitor this week: IPOs. While we don’t need to explain to anyone how IPOs work, we’ll look at what the data says on how you should ‘play’ them. Given the hot IPO slate planned for 2026, we felt this was a timely subject.

We also have a long list of actionable events for you, so feel free to skip to the Kliff Notes if you want tradeable ideas.

IPOs

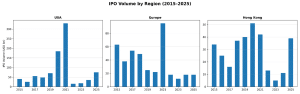

The last three years in equity markets have felt straight out of the roaring 60s. However, despite strong performance of US indices, the U.S. IPO market has been oddly lukewarm over the same period. US and European IPO volumes are well below 2021 levels, with only Hong Kong making a big rebound in 2025.

Source: Bloomberg data.

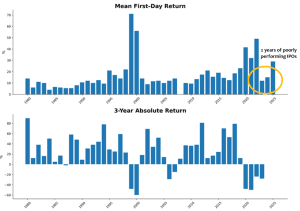

The lack of IPOs are still a consequence of the 2022 rate hike cycle. While public markets quickly adjusted to the new normal, private companies were anchored to 2020/21 valuations. IPOs with a vintage in 2022 to 2024 performed poorly on both the first trading day, as well as on longer horizons. An ever-changing geopolitical landscape didn’t help either.

Figure: IPO average returns per vintage year on the 1st trading day, as well as for a 3-year period assuming you bought on day 1

In contrast, 2026 promises to be a hot year for US IPOs. Stronger IPO returns in 2025 have re-awakened animal spirits, private valuations seem to have reset, and the IPO window seems to be reopening. We’ve got a couple of very large names getting ready to suck the excess liquidity out of the market. We’re expecting some big name IPOs to hit the market in 2026:

- SpaceX ($1.5t+ estimate)

- OpenAI ($500b – $1t estimate)

- Anthropic ($180 – $350b estimate)

- Databricks ($130-160b estimate)

- Stripe ($90-120b estimate)

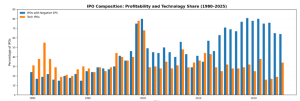

While you often hear that companies stay private longer, there has been a noticeable uptrend in the number of loss-making companies making their way to the market.

The 2026 slate of IPOs is no exception. We’ve been explicit in our views on the limited profit potential for most AI names but here we are talking about record IPO valuations. After 3-years in which stock only went up, we are running into all the usual signs of a market in which making money has been too easy.

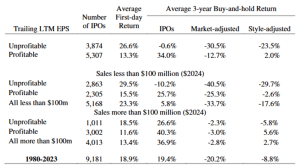

Why does this interest us? Event-Driven trading is a data dependent game. Sadly, with IPOs, the data does not favor the buy-and-hold investor. For this, we turn to a dataset published by the University of Florida, which contains 9,181 IPOs from 1980 until today.

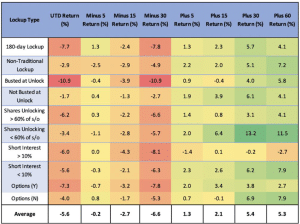

Over this dataset, the average IPO jumped 18.9% on the first trading day. But everyone buying into the IPO in the open market and holding those shares for 3 years, drastically underperformed the market: by 20.2% on a relative basis adjusted for market cap, or by 8.8% when adjusted for style. Unprofitable companies outperform profitable companies on the first day (26.6% vs 13.3%) but underperform on a 3-year basis (-0.6% vs +34.0%)

Source: Initial Public Offerings: Updated Statistics by Jay R. Ritter (https://site.warrington.ufl.edu/ritter/files/IPO-Statistics.pdf)

First day trading dynamics have little to do with valuation. If you show up with an Excel DCF model you showed up to the wrong game. IPOs are designed to pop on the first day. At first sight it looks like insiders are leaving some money on the table. If the shares instantly pop 19%, shouldn’t they have listed 19% higher? But companies go public with a limited float. Underwriters try to get the shares into ‘steady hands’: pension funds who are unlikely to turn around and sell it for a quick profit. With limited supply and high demand, IPOs tend to open in the green. This easy money awakens animal spirits. And 6 months later, at the unlock date when insiders are allowed to sell more shares, that’s where they really cash in.

To benefit on the short side, we showed in our Unlock Monitor tutorial that shorting 30 days prior to the lockup has historically resulted in a 6.6% return for your 30-day holding period.

Source: KEDM proprietary data

On the long side, the game is not as simple as to buy at the IPO and to flip your shares on the first trading day. You might subscribe to a hot IPO, but whether or not you are receiving an allocation depends in large on the commission income you’ve generated for the underwriter.

And if the IPO is a bust? All of a sudden everybody gets 100% of the shares to which they subscribed, while they were expecting to receive 25%. Everybody owns 4x as many shares as they expected and they need to immediately rebalance, driving the share price down.

So why do we track IPOs? Because the chance of mispricing is very large for a new security. Prices are set by flows, not by fundamentals. Pension funds are still waiting for their favorite banker to tell them what the shares are worth. In hot stocks, animal spirits are taking over, driving stocks to irrational levels. When there is a mispricing in the market, there is opportunity.

Our monitors track busted IPOs: IPOs that are down from the IPO price. We find this pool of unloved IPOs to be fertile hunting ground for long positions. IPOs with a vintage in 202 or 2021 stand out. Many companies opportunistically IPO’d in 2020/21 before being fully ready. They did not have the profitability, management team or systems in place to be successful, but the valuations were too attractive of an opportunity to pass by. Most of those companies trade at significantly lower valuations today, while some of those companies are finally reaching a more stable level of profitability. DraftKings (DKNG) and Remitly (RELY) fit this description.

Long term bargains do exist in the IPO monitor. Track companies that do a primary offering, meaning the company sells shares to raise capital to reinvest in the business, as opposed to a company where insiders are selling. Insiders are better informed than you, and therefore not your preferred trading partners. If there is an exception to this rule it might be this: there are a lot of PE companies that are years behind on their plans on returning capital to shareholders, and who are now rushed sellers into an IPO.

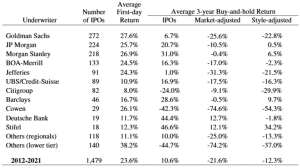

There is also a lot of difference in returns among underwriters. Remember the Wolf of Wallstreet? Stratton Oakmont isn’t quite around anymore, but there are plenty of brokers calling around trying to talk you into the next Aerotyne International. It’s surprising how many companies are brought to market, raising barely enough cash to survive 2 quarters. Some IPOs are designed to fail. Stay away from anyone with Jordan Belfort vibes.

Figure: IPO returns per underwriter. Citi and Cowen underperform due to heavy issuance in the 2021 SPAC bubble, and in the case of Cowen a tilt towards mining and biotech. ‘Others’ include some modern-day ‘Wolf of Wallstreet’ firms (you know who we’re talking about). Source: Initial Public Offerings: Updated Statistics by Jay R. Ritter

We’re looking for quirky names that nobody is paying attention to. We recently met a gym operator with a listing in Taiwan at the ICR conference: World Gym Corporation (2762.TW). The company had paid for a large room with enough space to present to an audience of 50. We were the only ones showing up. While Taiwanese gyms are not on the top of our wish list, they are exploring a US listing. The World Gym brand is known in the US and their multiple in the US would arguably be higher. We’re keeping an eye on this situation and will update our KEDM subs if this becomes actionable.

How else is any of this actionable today?

Did you notice the pickup in IPO volume in Hong Kong on the first graph? We’re outspoken in our belief that Hong Kong will continue as a major financial center of the world. It might not be the place for Western companies to list their shares, as Samsonite, Prada and l’Occitane have done in the past. But Chinese companies are certainly directing company listings to HKex. Owning Hong Kong Exchanges and Clearing Ltd (388.HK) is the easiest way to get exposure.