Just Don’t Yell Fire…

A low frequency but juicy strategy where the edge is government incompetence.

Let’s dig in…

We thought it would be a good idea to bring in some thoughts from our fellow KEDM’ers. First up on our list is Erik over at YWR (we subscribe and urge you too as well). You may remember Erik from our Project Zimbabwe Happy Hour back in 2023. Erik is an ex-Passport Capital (John Burbank) analyst and loves playing thematics and thinks in long term trends. He recently wrote about the coming debacle of illiquid PE and the 2nd derivatives. While most of us public market guys already nod in agreement, I think its worth hammering this home over and over again. Reflexivity works both ways and if allocators get marked down and stuck in an illiquid, they will reach for liquidity in their public market portfolio..

Over to Erik…

The more I look at Private Equity the more I think the most important driver of investment returns for the next 10 years will be avoiding the PE/VC train smash and all its 2nd derivatives.

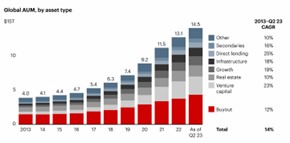

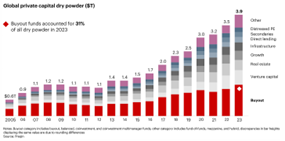

Look at the growth of this industry. As recently as 2017 it was only $5.4 trillion. Then it rockets at an 18% CAGR for the next 6 years to almost $15 trn.

Source: Bain Global Private Equity Report 2024

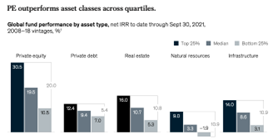

The money flowing in inflates the exit values on existing investments so returns boom. Which causes more money to flood into the asset class.

Source: McKinsey Private Markets Report 2022.

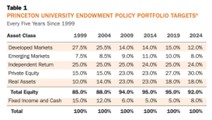

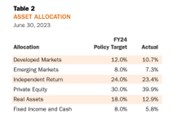

Endowments like Princeton eagerly increase their PE allocations from 15% in 1999 to 39% by 2024.

Source: Princeton Report of the Treasurer 2022-2023

Dry powder hits $3.9 trillion!

Source: Bain Global Private Equity Report 2024

But like all trends, there are cycles and I see the set-up for a big unwind which will play out for years.

- Live by Zero %. Die by Zero %

- The Rate Pin

- The Snake eats its Tail

- From $14 trillion back to $10 trillion

- This is Africa

- Beware the Second Derivatives

- Reference Documents

The Key Assumption:

Before I go further, I want to stress my key assumption in this outlook is that interest rates are more likely to rise than be cut. US 10 years go to 5.0 – 5.5%. And if so, this is how it likely plays out for Private Equity. Alternatively, if you think US 10 years go back to 3% this will all seem too negative.

Live by Zero %. Die by Zero %

As you learn about the PE/VC bull market you realise the self-reinforcing tailwind behind all of this was zero % interest rates.

Zero % rates had two intertwined effects. First, it made bonds unattractive, so institutional investors with return requirements were looking to shift into alternatives. PE&VC were especially attractive because the reported market to market was smoothed out by the fund managers, unlike public equities. Endowment funds and pension funds with long-term liabilities were especially attracted to the asset class and told themselves they were earning a liquidity premium. Maybe up until 2018 this was true.

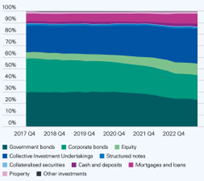

Even European life insurers which are highly regulated and supposed to be careful with how they invest their assets, got sucked into private equity funds. In 2017 their ‘Collective Investment Undertakings’ were roughly 25%, but by 2022 it was 30%. To fund more PE&VC they cut their allocation to low-risk bonds (59% to 45%).

Source: Swiss Re

US college endowments, pension funds and European life insurance companies had all increased their exposure to private equity funds.

Everyone was doing it.

Source: Alaska Permanent Fund Private Equity Report

The Rate Pin

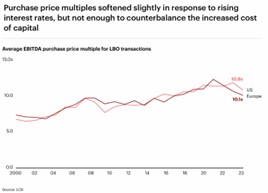

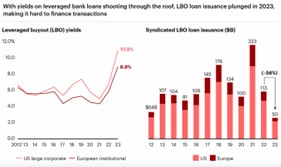

The second positive of zero % interest rates was cheap LBO financing and rising deal valuations. Buy out multiples went from 8.7x EBITDA in 2016 to 11.9x by 2021 (Source McKinsey Private Equity Report). But by 2021 Private Equity and Venture Capital had reached bubble proportions. It was a bubble looking for a pin.

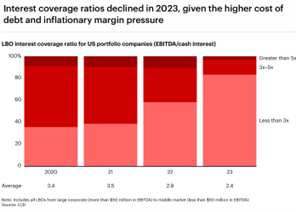

That pin was higher interest rates. In 2022 financing costs spiked from 6% to 10%. With higher interest rates all the previously positive wheels started to spin in reverse.

First, deal activity collapsed. Higher yields made it hard to finance deals. Higher financing costs means new buyers are willing to pay less.

Source: Bain Global Private Equity Report 2024

Deal valuations are starting to fall. This has further to go.

Source: Bain Global Private Equity Report 2024

But PE funds don’t want to recognise the new reality and take the valuation hits necessary to get deals done.

Maybe if they wait for 1-2 years interest rates will fall and everything will be OK. Or, maybe they can grow their portfolio company EBITDA enough to offset the lower deal multiple.

For these reasons they would rather not sell.

So exits collapse.

Source: Bain Global Private Equity Report 2024

The Snake Eats its Tail

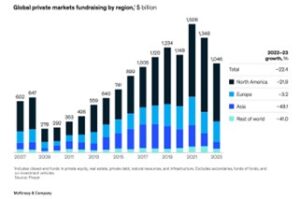

Private Equity LP’s notice they aren’t getting their money back and are also starting to have second thoughts about 40% of their portfolio in illiquid PE investments. They are cutting back their future PE commitments. Still $1 trillion in commitments in 2023, but down from $1.5 trillion and a sign of things to come.

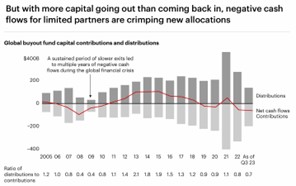

But now the dreaded DPI ratio rears its head. LP’s see they are paying more into PE funds than they are receiving back. Endowments and insurance companies have student aid to give and claims to pay so they need to see realisations in their PE funds. They tell the PE firms they want need this ratio firmly back in the positive.

Source: Bain Global Private Equity Report 2024

PE firms get the message. The pressure is on to sell these great investments.

Bain estimates there are 28,000 buy-out companies which are on average 6 years old and need to dumped on to somebody else.

Source: Bain Global Private Equity Report 2024

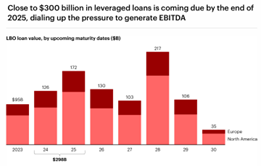

LP’s and their liquidity demands are not the only reason these investments need to be sold. In 2024 and 2025 there is $300bn of 6% LBO debt which will need to be refinanced at 9-10%.

80% of LBO companies have less than 3x Net Debt/EBITDA coverage.

Source: Bain Global Private Equity Report 2024

I’m not saying portfolio companies default as their financing cost increases 50%, but it lowers what a buyer is going to pay.

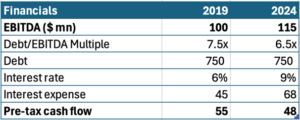

Scenario analysis of company with 15% growth and levered 7.5x EBITDA.

From 14 trn back to $10 trn.

The clearing price for these 2015-2021 investments is probably down 25% from here. Lower for venture capital.

But no way the PE funds want to sell anything -25%. They will try to wriggle out of this somehow. Their risk-free reputation is at stake.

For 2024 and 2025 exits will remain low and distributions to endowments and insurance companies will be minimal. LP’s will cut back their PE&VC allocations plus ask for adjustments to the commitments they previously made, which they realise are way too high for their liquidity profile.

For example, an endowment with a $5 billion private equity portfolio might have made commitments of $500 million/year for the next 2-3 years, assuming 10% of the portfolio is returned every year. So it’s matched.

Unfortunately, they actually own a $4bn private equity portfolio and will be receiving back $200mn/year (maybe), while they committed to invest $500mn. That’s a -$300mn mismatch every year.

Less money coming into the PE & VC sausage factory means valuations fall further.

PE&VC will dribble out their investments to public companies who will be choosy about what they pay given their already low public market valuation.

This is the train smash. I estimate that by 2027-2028 the valuation resets will be unavoidable…

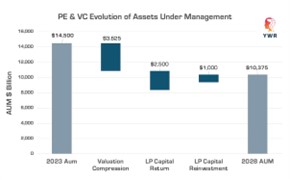

PE & VC AUM could decline 28% by 2028 to $10.3 trillion as valuations fall and they return money to investors.

This is Africa

I see the future for Private Equity, because it reminds me of Africa, another illiquid asset class.

From 2011-2014 investors loved Africa and the money piled in. There were multiple $1 billion Africa funds and African consumer stocks like Nestle Nigeria or East African Breweries traded at P/E’s of 30x. Africans were going to be middle class and drink a lot more beer. And you need beer and food everyday, so it is a low-risk investment. Right?

It all made sense. What could go wrong?

As the money flowed in investors would fight to buy shares of these companies, pushing valuations higher and higher, creating greater returns, and generating more interest in Africa funds.

Then in 2015 with the combined slowdown of China, falling commodity prices and recovery of US markets, the money flowing into Africa started to turn the other way. That was the inflection point which put the whole thing into reverse. Liquid became illiquid and valuations for everything steadily fell. For years.

The outflow pressure accelerated. With everyone trying to get out at the same time these darling beer and food stocks traded down to P/E’s of 20x, then 15x and then 12x.

The lesson for illiquid asset classes is you get out when everyone is trying to get in. Blackstone, KKR, Carlyle, and A16Z should have been dumping everything they could in 2021. And investors should have cut their future commitments to $0. Instead, they did the opposite and raised record amounts of new money. Which is always what happens.

The dirty secret of asset management is you take the money when you can and earn the fees even if the investors are coming in at exactly the wrong time. Everyone goes in at the top.

Now they’ve missed their window.

The lesson from going into Africa at the exact wrong time is you will get out but it’s going to take years. Mentally, you might as well mark it all down 30-40%. Maybe $10 trillion in PE/VC AUM in 2028 is generous.

10 years from now you can revisit investing in PE after everyone is disgusted with it. Like Africa is now.

Beware the Second Derivatives

It’s harder for me to see all the other effects this could have on the market. Is it good for public equities? Do institutions increase their public equity allocations? Or, are the liquidity pressures from the PE/VC train smash so high funds sell whatever they can? And so, they sell public equities, rather than buy them?

Do institutional funds increase their allocation to bonds now if they can earn 5-6% or even 8% on corporate credit or high yield?

Do pension fund have to ask for capital increases from the state legislatures to bail them out for over investing in private equity?

Are there broader economic consequences negatives if private equity owners try to juice the EBITDA margin on 28,000 companies by cutting staff and investments?

Is this the transmission mechanism for how higher interest rates affect the economy? Maybe public companies are fine and have little debt, but the PE funded economy is in trouble?

These potential second derivatives reinforce our YWR theme that we want value stocks which also have share buybacks. This is our defence against forced selling from the institutions.

Overall, this private equity winter will probably end up a good thing for all the undervalued sectors in the public market.

And maybe after a 10-year bull market in value and EM we can dump all our stock on the endowments and go into private equity.

Start your 28-day free trial

Kuppy’s Event Driven Monitor (“KEDM”) is not a financial or investment advisor and the information contained in this publication is not intended to constitute legal, accounting, or text advice or individually-tailored investment advice and is not designed to meet your personal financial situation. The investments discussed in this publication may not be suitable for you. You are required to conduct your own due diligence, analyses, draw your own conclusions, and make your own investment decisions. Any areas concerning legal, accounting, or tax advice or individually-tailored investment advice should be referred to your lawyers, accountants, tax advisors, investment advisers, or other professionals registered or otherwise authorized to provide such advice. KEDM makes no recommendations whatsoever regarding buying, selling, or holding a specified security, a class of securities, or the securities of a class of issuers, and all commentary is for educational purposes only. The investment examples noted are intended to provide and example of the events and data KEDM flags each week and is not representative of typical returns generated by each event or any future returns.