KEDM Monitor Highlights... CEO Changes!

The core principal of Event-Driven trading is that corporate events can be catalysts for change.

Of the 25+ different types of events that we track at KEDM one monitor in particular is perhaps the biggest event a company can go through without splitting up or selling itself to a new owner, a CEO change.

It’s not hard to see why a new CEO can mean a new trajectory for a business but there are a lot of other factors that make CEO Changes one of the most powerful monitors at KEDM.

Keep reading to learn more about CEO Changes…

Why do we track CEO changes at KEDM?

How Do CEO Changes Generate Alpha?

We’ve all seen the story before. There’s a business, it’s got a CEO, and it sucks. The numbers are bad, the stock is down 10% a quarter, everyone’s miserable. Something’s got to change. Maybe it’s the board checking their brokerage accounts and seeing that their ten shares are down 80%, or an activist starts sending some letters, or someone’s mean tweet gets a lot of engagement. We don’t know, but that change always ends up crystalizing one way or another into the CEO getting kicked to the curb and fresh blood getting brought in.

The new guy will take the reins, look around at the mess he’s inherited and do the usual – big bath the financials, fire a bunch of poor schmucks, and close some underperforming business lines. Then he’ll go, hat in hand, to investors and analysts and cry about how terrible the old guy was and how he, as the new guy, is so much better and how everything is going to be all right and will they please give his RSUs a twenty-five times EBITDA multiple?

Joking aside, we here at KEDM are big fans of CEO Changes as a strategy because they represent change. You take that change, couple it with a fresh slate, some lipstick, and a boat load of stock comp and you can get some sweet, sweet alpha. To be helpful we’d like to walk through a few case studies of examples that we’ve flagged recently to better help you harvest that alpha.

How Should I Start to Think About Trading CEO Changes?

From these examples you can probably tell what we like to look for here. And while the way to trade these is not always the same and requires judgement, there’s tons of alpha if you’re paying attention. Good things tend to happen when you give someone a sinking ship, a clean slate with the excel monkeys on Wall Street, and a boatload of stock comp. We’re sure that in the future there will continue to be many more opportunities such as these three and we will be here to flag them for you.

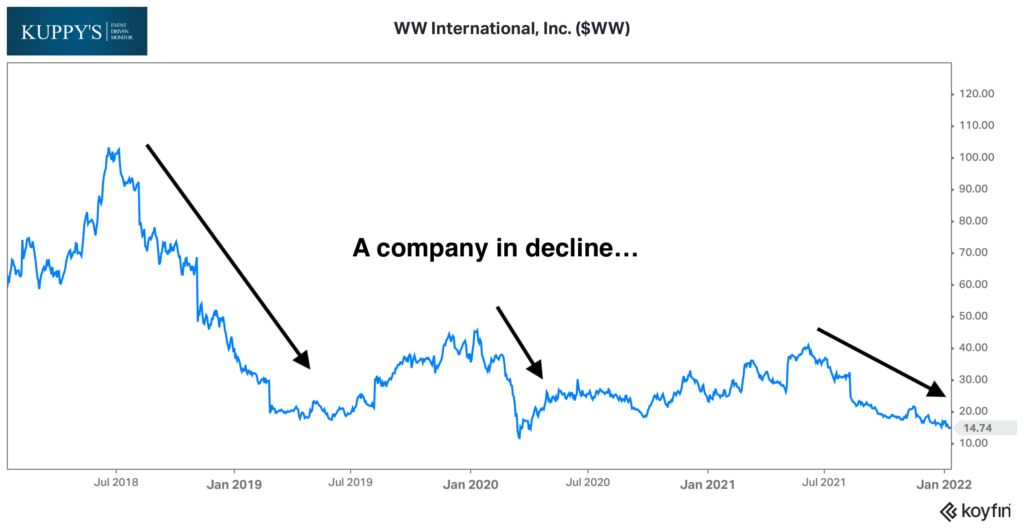

Case Study - Weight Watchers ($WW)

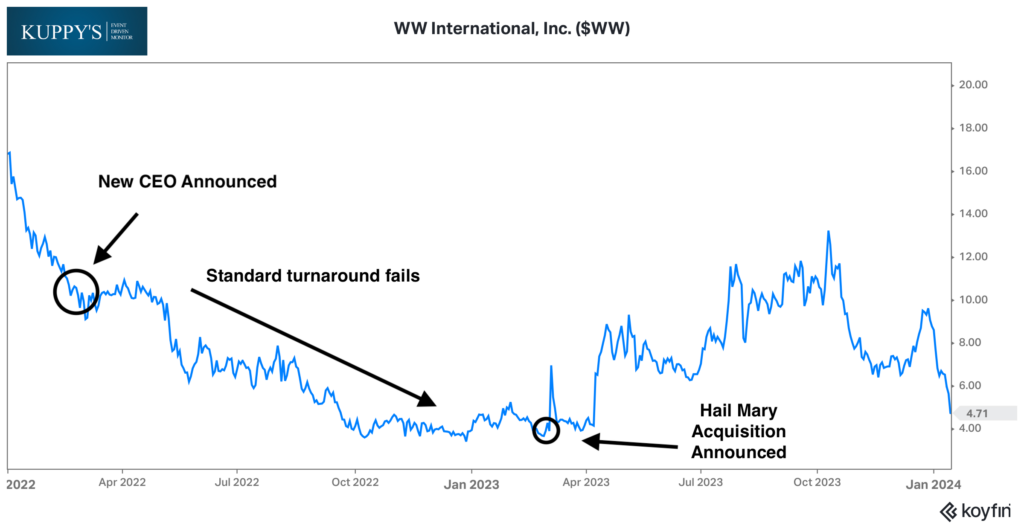

A nice winner recently has been WW, though it was certainly a rollercoaster. Everyone knows the brand and probably someone who’s been in the program, but the business has been dying since Covid. Awful year-over-year subscriber comps and declining profitability paired with a levered balance sheet led this stock to shed nearly 90% of its market cap off the high. They canned the CEO once it was down fifty and announced the new CEO in Q1 ’22, stuffing her full of RSUs and stock options struck at the grant date price, then 3x and 5x higher. But so what, she’s incredibly well incentivized? Her CV seems impressive, but she hasn’t really proven herself to be a rockstar. The business is melting, the debt is looming, and each dollar of EBITDA that leaks out the door ticks the leverage ratio higher. This has some potential, but it’s still a train wreck.

Once she comes in, she does the usual dance. They roll out a new pricing plan which flops, take a bunch of write downs and restructuring charges, axe the CFO, bring some techy types in, but no bueno. The stock is still dropping and the subs keep leaving. Now a year has passed and a solid chunk of her RSUs are about to vest and her options might as well be on the moon. You know she’s got to take a big swing, but this is a zero if she misses. The Q4 print comes and by God she goes for the fences, making a big splashy acquisition to turn the business into a telehealth fat pill company. The traders love it, their entire circle is probably on Ozempic and Wegoy and they’re kicking themselves for missing the NVO bus. The stock opens up 20% and closes up 80%. That week the Company goes on a media blitz, schilling out to the WSJ and getting as much press as they can. Everyone knows the story now but the stock trickles all the way back down over the next month, giving a window for you to do your work and get in if you believe in the plan (full disclosure: we didn’t).

Soon enough, Goldman puts a note out and slaps a bullish PT on the thing and it doubles before giving a bit back and coiling. The acquisition is closed now and they’re in the process of ramping it up – they’ve guided to taking the telehealth sub numbers up to 100k from 27k by YE. This story isn’t over, but now it’s in the “prove it” phase. Can they outgrow the debt and survive? That’s for you to decide. But we wrote this one up a couple of times throughout the process before taking it off our watchlist after the rip in Q3 2023.

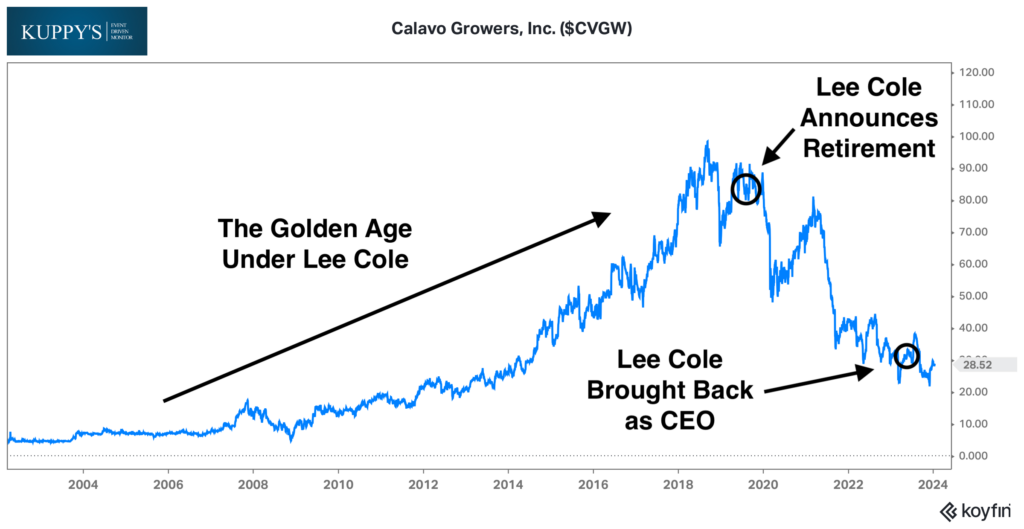

Case Study - Calavo Growers ($CVGW)

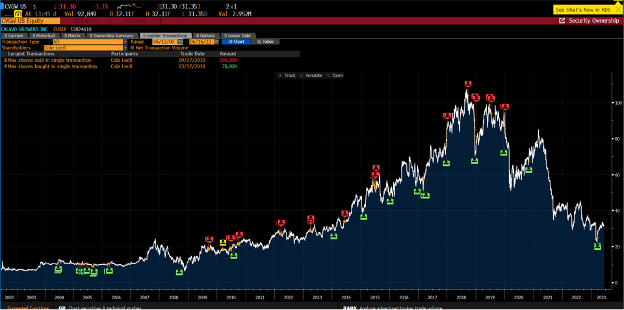

Once a sleepy co-op of California avocado farmers, this business was turned into an absolute monster when Lee Cole took the reins in the 2000s. In Q1 ‘20, Lee retired and the company began a long downward spiral, suffering through multiple different C-Suites, a drop in EBIT, and a couple short reports.

Three days after they reported their most recent Q1, the stock tanked and the Company once again canned the CEO but this time they brought back Lee, giving him a salary of $65k and 500k options (~3% of the outstanding). Later that month, Lee pinged the tape and scooped up another 100k shares in the open market (we flagged this in our cluster buying monitor as well). At 83 years old, Lee is not exactly the young Cowboy that he used to be, but he’s got a good track record of bottom ticking this business.

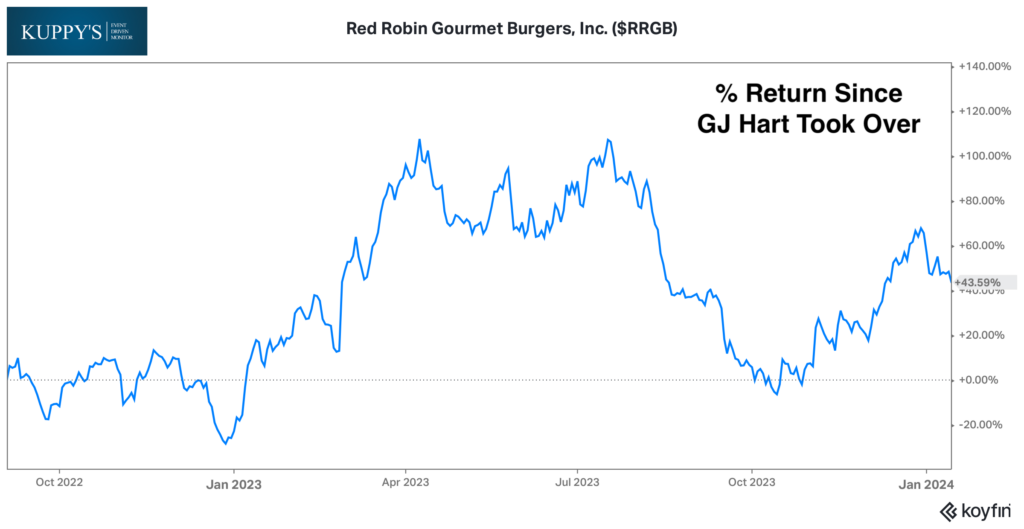

Case Study - Red Robin Gourmet Burgers ($RRGB)

The final example we’ll give you is RRGB. Taking a look at the chart tells you all you really need to know here. Declining business, bad numbers, etc. They canned the current guy and brought in the new guy in Q2 ’22. His comp package wasn’t drowning in equity but the guy’s a verified rockstar. He revamped and sold California Pizza Kitchen and doubled the store count at Torchy’s Tacos in three years.

Not long after he takes the helm in September, he unveils his “North Star Five-Point Plan to Drive Long-Term Shareholder Value” in December, along with preliminary results and the announcement of a few sale-leasebacks to de-lever, fund capex, and buyback stock. It popped and if you would’ve bought at the close that day you still would’ve had a double. Two months later, he reports his first full quarter at the helm and gives some solid guidance, sending the stock up 80% over the next six weeks.

Start your 28-day free trial

Kuppy’s Event Driven Monitor (“KEDM”) is not a financial or investment advisor and the information contained in this publication is not intended to constitute legal, accounting, or text advice or individually-tailored investment advice and is not designed to meet your personal financial situation. The investments discussed in this publication may not be suitable for you. You are required to conduct your own due diligence, analyses, draw your own conclusions, and make your own investment decisions. Any areas concerning legal, accounting, or tax advice or individually-tailored investment advice should be referred to your lawyers, accountants, tax advisors, investment advisers, or other professionals registered or otherwise authorized to provide such advice. KEDM makes no recommendations whatsoever regarding buying, selling, or holding a specified security, a class of securities, or the securities of a class of issuers, and all commentary is for educational purposes only. The investment examples noted are intended to provide and example of the events and data KEDM flags each week and is not representative of typical returns generated by each event or any future returns.