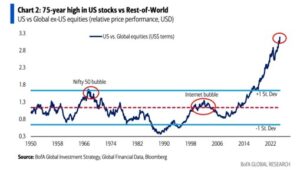

Regular KEDM readers have likely picked up on our growing bullishness for some specific EMs. We all know the chart by now but the US is stretched as NVDA and MSTR prop up the whole market. And as DMs become EMs, emerging markets should see a flip in fund flows with EMs finally “emerging.”

Since starting to note EMs in KEDM we have touched on LatAm/Brazil, China and Turkey. Our last Turkish update was rightfully neutral, but that was back on XXX, so we figured it was time for an update. Let’s jump in…

The Turkish market has been collapsing since late summer and is now seemingly at a very attractive level (we’re bummed it moved +11% last month but there is still a looong way to go). This is the chance to own one of the cheapest EM markets, trading less than 5x inflation-adjusted 2025E P/E with strong tailwinds. It’s not only on sale, but we think TR has the most upside torque to inflows in EM, Trump Presidency, and a Russia-UKR peace.

Highlevel- it’s a G20 economy, has a trillion-plus USD GDP, NATO member, second largest populated country in the area with almost 90million people (plus or minus couple million Syrians), third-largest tourist destination excluding US and China, with 56 million visitors annually. TR is the most important EM market with multiple tectonic shifts playing out, and literally no one is paying attention, yet…

Two main reasons for the brutal collapse in the market is Foreign & Domestic Funds’ rotation to Money Market Funds (MMFs) and Fixed Income assets, and the forced liquidation after margin calls caused by retail leverage in the system. Look, overnight TRY rates are at 50% today. There is nothing more natural for the foreign money, that have killed it in the it in the stock market in the last 2 years, to get parked in CDs and fetch an easy 16%-18% ARR on USD basis without lifting a finger (52% TRY- USDTRY forward rate 36%). However, the 50%+ rates are temporary, just as the depressed valuation on the market won’t last. Let’s look at the chart and discuss the reasons for the selloff and we will leave you with some underfollowed near-term catalysts.

(Turkish BIST100 index denominated in USD. Drop from $345 to $253. 1-year-Chart)

ROTATION

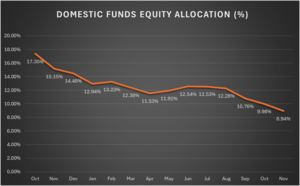

Domestic Mutual Funds and Regulated Retirement Schemes pivoted from equities to money market and fixed income funds. With CB overnight rates at 50%, some CDs yielding up to 53% and Money Markets going as high as 56%, we got massive rotation. Local funds’ equity allocation went down 40-60%, in some cases 80%, from almost 20%s to single digits in just 12 months.

The change in size of Turkish local funds is a tectonic shift that markets are not paying attention to. Historically, these local funds were inconsequential. Traders mostly obsessed about the foreign investor flows. Makes sense, as in December 2019 these local funds combined had only $17bn in assets. In October 2024 that number has grown to $120bn mostly due to changes in tax code, new regulations on retirement schemes and government incentives. You have to keep in mind that the entire market capitalization of BIST100 index is $226.86 bn USD. (This is only the XU100 index, but you really should not be investing outside it) Turkey is a low-float market meaning the total public float out there is $72.49 bn USD. Do you see now why that rotation caused an outsized move?

RETAIL MARGIN

Retail made a lot of money in 2022 & 2023 and began experimenting with leverage. The market rallied hard, and they were rewarded for taking on risk. Extending credit to retail became extremely profitable for brokers, as rates began rising, they made substantial margins on these loans. This exacerbates the recent selloff.

![]()

One data series we follow closely is the aggregate broker credit outstanding that are held by retail. As you can see above, margin data shows that the from to end of 2022 to June 2024 both, the number of margin accounts and average loan per account has grown tremendously, average credit almost double from 610k TRY to 1.26M TRY. This is extremely high, as average salary in TR is roughly TRY40k/month in 2023. While the Q3/24 official data is not out yet, our conversations with local brokers reveal that almost 1.3million accounts were liquidated in the last 3 months, outstanding margin has come down significantly and margin calls have subsided.

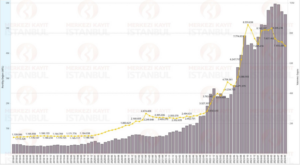

RETAIL INVESTOR INFLECTION

Talking about tectonic shifts that are missed by the market, retail investor participation in Turkey has inflected and is not mean-reverting. There are almost 90m residents in Turkey today. There were only 1.1m retail accounts in Jan 2018. That dipped to 1.2m right before COVID and went screaming to 8.6m in 2023. The number of retail accounts are a 7-bagger in 5 years. Yes, it came down a little with the last selloff, at around 7.1m now. See the chart below that we took from the Capital Markets Authority. The line in yellow shows the explosive growth that began in 2022.

(Number of retail Investors went from 1m to 8.6m and settled at 7.1m after recent correction. Official Market Authority Data)

CATALYSTS

RATE CUTS: No need to go to detail here, the CB overnight rates are at 50% today and they will be cutting rates soon. Their latest meeting this week (11/20/2024) pointed to December or January latest. Don’t try to time it perfectly by dissecting CPI data. Analyzing Turkey’s inflation data and trying to make accurate projections is a fool’s errand. The simple fact is, Erdogan hates high interest rates and will slash them as soon as he is able to. Only reason why they raised this high and kept it for this long was the new head of Treasury Mehmet Simsek (IMF & Merrill Lynch) wanted to draw capital thru carry trade and build back CB’s reserves, which they have done. High rates are not of use to them any longer.

LOCAL MUTUAL FUNDS ROTATION BACK TO EQUITIES: The local funds’ equity exposure is at record lows, as you saw from the charts above. This is caused by the unprecedented level of high rates. Local funds equity exposure went from 18% to 9%. Back of the envelope math, let’s say the allocation needs to go back to 80th percentile of where it was previously, so they need to get to 13.5% equity versus 18% before. That would equate to a $7-8 billion of flow to a public float of roughly $73 billion, or roughly 10%.

CREDIT/RATING UPGRADES: Building CB’s net reserves allowed them to keep the TRY rate relatively steady (they’re running a managed FX regime, 1%-1.2%/month) and improve balance of payments. Surprisingly, in August 2024 TR recorded a net surplus of USD 4,324 million and $2.98 billion in September. The credit rating agencies have taken notice. After a decade, Moody’s upgraded in July. In September, Fitch Upgraded to BB-. S&P upgraded on November 1st. More to come.

SHORT SELLING BAN, SWAPS, FOREIGN FLOWS: Foreign investors have historically owned 45-65% of the equity market. Ratio didn’t fall below 50% even in the 2008 crisis. They relied on Swaps from the Central Bank to mitigate the currency risk. Also, the smart money in London historically do not go net long delta in TR, so they need to short as well. In 2018, the CB made the major error of removing these swap lines and banning short selling. Hence you can see foreign investor ratio really starting to fall in 2018. While outsiders will tell you foreign money left because of Erdogan’s hostile policies against the US and the West. This is simply not true. Erdogan has been in power since 2002, and the peak of is altercation was probably in 2009 where he fought with then Israeli president Shimon Peres at Davos. Erdogan also had a major disagreement with the barons of Washington and Langley over US foreign policy in Northern Iraq and Syria, which led to the 2016 CIA orchestrated Military coup that was coordinated by a retired Turkish Imam that conveniently lived in Pennsylvania, who died last week.

Long story short, even after the coup in 2016 you can see foreign ownership actually went up slightly in 2017 before beginning to fall in 2018 due to the termination of swap lines. Turkish market is a flow market. We are not exaggerating when we say: no swaps, no short selling: no flow. However, there has been a complete top management change with ex-Merrill Lynch and IMF guy Mehmet Simsek now leading everything related to markets/economy. Our local contacts confirmed that the short selling ban is about to be removed and swap lines will be reinstated in the near term, will be a major catalyst for foreign flows returning to the market and ownership ratio to go back to normalized levels. In our opinion, you really want to be fully positioned before the swaps are reopened.

Trump’s Election, lower DXY and end of Russia- Ukraine War: Not going into politics here and I’m definitely not going to debate Russia – Ukraine war. I have a simple view, Turkiye has been caught in the middle between two wars, UKR-Russia to the north and Israel- Hamas & Hezbollah to the south. We think both conflicts get resolved soon. That helps Turkiye everywhere. The tourists that were spooked and cancelled their trip last summer comes back, the export markets reopen, companies can once again look at these markets for investment opportunities without the lingering fear of sanctions. The sentiment of money manager towards the region changes. The post-war boom is going to be substantial.

SUMMARY

A 1%-move in NVDA is roughly $35 billion USD today. You can buy the entire BIST100 public float for a 2% move in NVDA. This is a G20 country with the 17th largest economy globally. It is the 8th largest economy in Europe (I know, Turkey is not fully in Europe!)

The Turkish CB’s rate cut cycle concurrent with weakening DXY is the perfect setup that will unleash a major stock market rally. The limited float will be chased by both local fund flows, and foreign money that is increasingly looking for a home outside the overpriced, over-fished develop markets.

The domestic investing ecosystem has changed significantly, and this is not mean-reverting. There were 1.2m retail investors in 2019, the high was 8.5m in 2023 and 7.3m today. The advantageous demographic nature and young population guarantees that this number will only increase going forward. Don’t listen to self-proclaimed EM experts telling you Turkiye will only work if foreign money comes back in a big way. That’s just ignorant, and wrong. The local market has reached critical mass already. Just look at the rally in 2022. Markets roared without any foreign participation, and only paused when rates went to 50%. Even if a sliver of local money comes out of the Money Market funds and fixed income, and looks for a home in equities, the markets are going to roar. Most of these funds can’t own fixed income when they become negative-yielding on a real-basis with the start of rate cuts. Look, for Turkiye to work, you really don’t need foreign money, but it certainly can’t hurt, so we feel we should mention it again. The foreign ownership normalizing back to historical levels would mean that they need to purchase roughly $25-$30bn in equities. Add another $10bn in local funds rotating back to 80th percentile of their previous ownership, and the flows from organic retail growth. We get to a flow of $35-$45billion that will be chasing a float of $73billion.

Turkish market does extremely well in periods of higher global nominal inflation and low DXY. In this current case, the market will also benefit from a massive rate cut cycle that begins from a record high level.

Let the games begin…