Macau Casinos

We just returned from a week-long trip to Hong Kong and Shenzhen. We were planning on updating you on HK property developers, a theme we touched on in the July write-up on the HKD peg. But we’re a little more excited about Macau casinos as a play on the Chinese consumer and the overall wealth effect as the Chinese stock market goes up.

In late 2024, Xi Jinping decided that pumping stonks had become a national priority. Chinese millennials in tier 1 cities were all underwater on the purchase of their first couple of apartments (all of them built in sizes appropriate for speculation, not for living). And rather than risk having them go onto the street to protest, he decided to boost their stock portfolio. Insurance companies were nudged to pile into equities, while credit was made available to fund corporate buybacks.

While we are bullish on the Chinese consumer, as well as on fund flows shifting into Chinese equities, the problem with investing in China has always been the never-ending oversupply that’s plagued most industries. Under the Chinese stimulus model, state banks provide endless credit to industrial companies. The resulting oversupply means low prices for Chinese consumers, as well as low profitability for Chinese corporates. The bottom half of the corporates would go bankrupt and the local banks would get recapitalized by the government. That’s stimulus, the Chinese way.

Just before our trip, the Chinese Politburo met to sketch out the 15th Five-Year Plan, Beijing’s version of a corporate strategy retreat, minus the trust falls. The big shift this time? “Anti-involution.” Which loosely translates to: stop killing each other on price. The government has realized that a country can’t build world-class industries if everyone’s busy running their business into the ground. Maybe, just maybe, 200 EV makers are 190 too many.

Back in the 1980s, Deng Xiaoping famously declared that “to get rich is glorious,” kicking off a multi-decade sprint toward prosperity. Xi’s latest plan feels like the sequel: “Corporate profits are mandatory.” Profitability, long treated as optional or even suspicious in certain Chinese sectors, is now state policy.

So where do Macau’s casinos fit in all of this? They’ve been quietly living the anti-involution dream for years. While the rest of China was fighting for slivers of market share, Macau had a monopoly on vice. You can’t open a casino on the Mainland, but you can take a ferry to one. The supply is fixed, the demand is cultural, and the margins are as protected as they come.

The house always wins. And in the rare event that a gambler walks out of the casino as a winner, the landlord of the Rolex store next door is the same casino operator.

From 1962 to 2002, Macau casinos were run as a monopoly led by Stanley Ho. This monopoly came to an end in 2002, when six companies (Galaxy, SJM, Wynn, Las Vegas Sands, Melco Crown, and MGM China) were given a concession to operate casinos until 2022.

The new gaming law of 2022 extends this concession until 2032 and puts limits on the number of gaming tables and slot machines, as well as maximum revenue per gaming table. During the new concession period, the 6 operators have the obligation to spend ~$15b on Capex, of which only ~10% can be spent on gaming, with the other 90% earmarked for tourism diversification.

While this seems like a big negative, given the much higher ROE on gaming-related Capex, further rollout of entertainment or the construction of new suites can indirectly benefit gaming demand. When Jacky Cheung played a series of concerts at Galaxy Macau, gaming revenue jumped 19% that month.

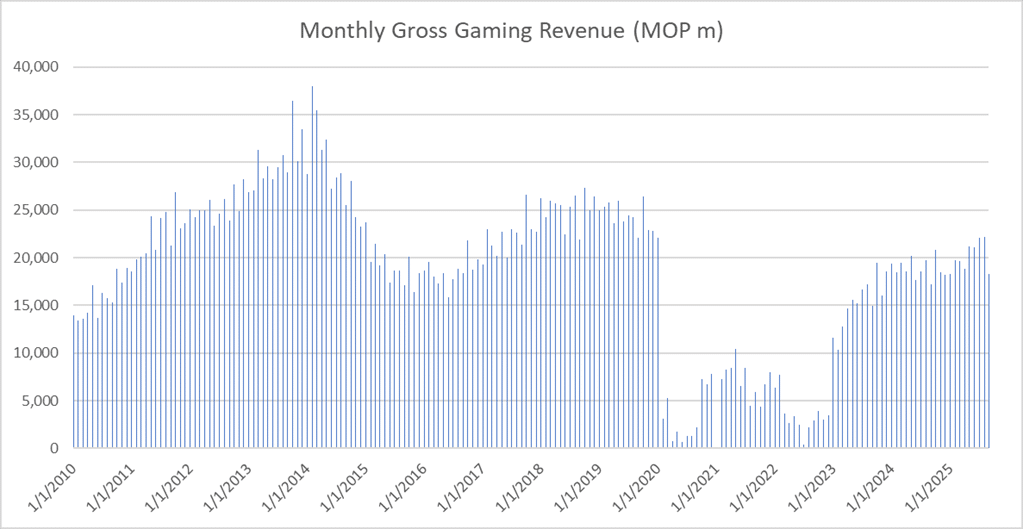

Over the last 12 years, Macau has had two setbacks because of Beijing’s crackdown on money laundering / VIPs. To understand this, it’s important to dive into the Macau junket operators.

China has strict rules about how much money you can take out of the mainland: 20,000 yuan in cash per trip. But the whales (the VIPs who made casinos rich) don’t fly to Macau to play baccarat with pocket change. So, the triad-backed junket operators “helped.” They extended credit to mainland gamblers, set them up in VIP rooms, handled collections back home, and took a generous cut in their losses.

Casinos loved junkets because they outsourced all the risky stuff: marketing to high rollers, vetting clients, fronting capital, and occasionally breaking a few kneecaps when someone forgot to pay. In return, junkets got 40–50% of the house take from VIP rooms. The junkets’ strong link with the Hong Kong ‘Triads’ can make them very persuasive.

So Xi Jinping started cracking down on money laundering, and suddenly Macau’s VIP industry looked less like “tourism promotion” and more like “money laundering with free dim sum.” The biggest junket, Suncity, got taken apart in 2021, its boss got arrested, and the whole model imploded faster than a leveraged SPAC portfolio in 2022.

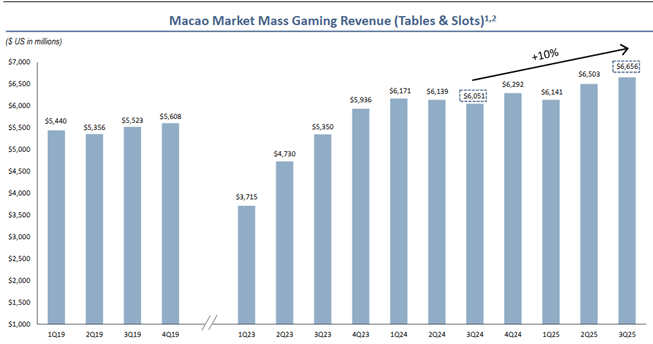

As a result, VIP Gross Gaming Revenue (GGR) crashed in 2014 and in 2020. But Mass Market GGR has recovered from pre-COVID levels. The mass market is now 85% of total Macau GGR, versus 30% two decades ago.

Split VIP vs Mass, and it’s obvious: VIP revenue is down 74% since 2019. Mass is up 18%. Macau is finally earning from people who are not just there to launder money. And while this GGR is volatile, depending on things like the severity of typhoons or the concert schedule of Jacky Cheung, the general direction of this gaming spend is up.

Source: Sands China presentation

All in all, the Macau investment thesis comes down to 3 things.

As the Chinese consumer recovers, a small portion of this money will continue to find a way into Macau. Even if some of the money spent in Macau is the result of corruption, Beijing prefers that this money gets spent in Macau instead of offshore.

Now that Sands China completed the Londoner in H1 2025, and after Galaxy will have completed the Galaxy Macau in 2027, supply of gaming tables will be more or less fixed. Smart gaming tables might make it possible to fit in slightly more people per table, but this is marginal. Casinos might get slightly better at monetizing their customers. Hold rates might drift up a tiny bit as casinos introduce long-tail side bets, as they have done in places like Singapore. Margins might creep up a little.

Finally, Capex for most operators will drop to maintenance plus the minimums as set under the concession. For most casino operators, you pay around 10x FCF looking out 1-2 years. Most of this will be returned in the form of dividends, and FCF could keep growing at double digits. What is a fair multiple for that with Hibor below 3%? We believe it’s significantly higher.

Reflecting on the trip, which included a tour of the freshly polished Londoner alongside our KEDM friend Erik Renander, we came away bullish on Macau Casinos. It’s the cleanest way to play the Chinese consumer without getting caught in the usual mess of oversupplied factories and half-built apartment blocks.

The casinos themselves are boring: It’s quiet. Sober. Surgical. Like a hedge fund floor where everyone’s down 20% and pretending it’s fine. But they’ll make good investments.

But we can’t stop wondering if this is just the Chinese version of a boomer trade. Shouldn’t we also be exposed to the faster growing Chinese tech sector? Margins are often non-existent, but is Xi’s anti-involution about to change all of that?

We’ve had tours at various Chinese tech companies in Shenzhen, and to say we were impressed is an understatement. BYD has 120k engineers working on R&D. Remember those Chinese students sitting in the front row of the lecture room, quietly taking notes? They have learned from the West, and then they improved on it. Tesla’s still patching phantom braking and whompy wheels; BYD’s building cars that spin in place, float through floods, and go 496 km on a charge.

Now over to our events…