Last week, we showed the 1 chart to rule them all. It was the chart of Q4/Q1 of 2021/2022 overlayed with the current market tracking almost perfectly. Since then, this year has tracked reasonably well (shocking…). If the comparison holds, then the selling starts this week when everyone gets back from vacation. Though, we’re willing to keep an open mind and accept that the selling may not happen until inauguration. In any case, we’ve ventured into the dark side, and started putting on some shorts. We intend to use any weakness to press them. We’re not short-sellers, in fact, we really suck at shorting. So Caveat Emptor on this…

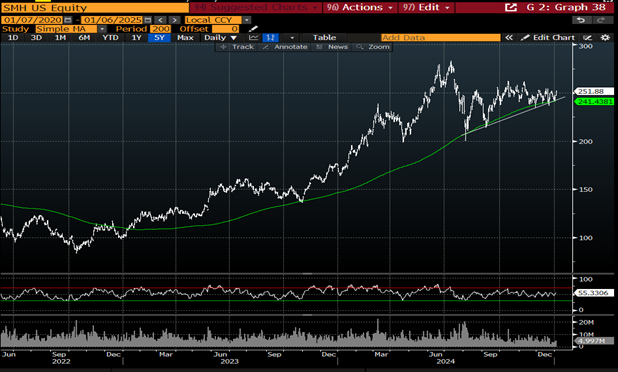

If there’s 1 chart to rule them all, then SMH is our Sauron. It’s the chart to track. To our eyes, it looks like a massive failing rally. After leading the market higher in H1 2024, key component NVDA stopped making highs, other components like MU, ASML and AMD have clearly rolled over. Only AVGO is making highs today. So you have divergence of the sector from the market, after being a leader, and now you have intra-sector divergence. For those of you who’ve followed us for some time, you know we fixate on divergences…

SMH

For our entire careers, semiconductors were seen as being highly cyclical shitcos. They’re massively capital intensive, with high obsolescence, extreme cyclicality, with multiple evolutionary dead-ends. They’re the graveyard of capital and in many ways, they’re one of the few industries worse than small cap E&Ps. However, they have an odd sex-appeal and tend to meme about once a decade, trapping whole generations of baggies. This meme-cycle was extreme, even by past standards (we were around during the 2000 bubble and remember how stupid QCOM and RMBS got). For a while, AI captured the world’s imagination, and why wouldn’t it. Before, I had to rely on stock images of Granholm for my memes. Now I just type in ‘sexy Granholm’ and a whole new genre of memes comes available!! This is the definition of American Exceptionalism!! All the promise of AI in the capacity to meme, and not much else…

Anyway, we think this semis cycle is nearing an end. The economy is sort of slowing and people are realizing that AI is somewhat of a dead end. After something like $200 billion has been thrown at the chips and tech, no one really knows what to do with it, except make more targeted memes…

Anyway, if SMH led us up, it’s going to likely lead us down again. We’re short, we have stops at the breakout level, we expect to press weakness under $240. If SMH breaks, so does everything else. We’re short everything else too. We tend to think the wheels come off. While the timing is hard, we’re cutting back even further, and even sold down some uranium. We believe in the uranium trend, but we believe more in the ideal of de-grossing even further, and we’ve sort of run out of virgins to throw in the volcano around here (…and yes, GROK gave us some odd satanic image when we asked for “image of portfolio manager throwing virgins in volcano”)

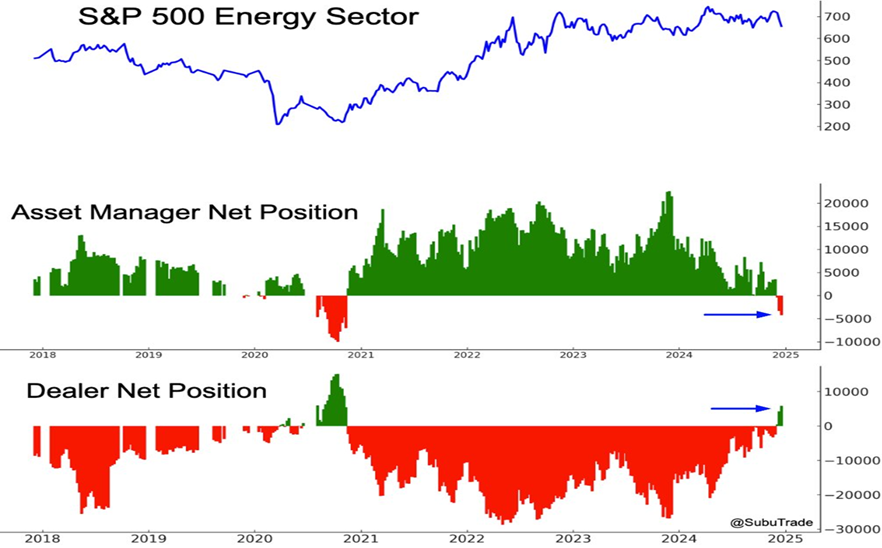

Just like we feel that the move lower is somewhat imminent on many of the Ponzi and high multiple names, we think the mean-reversion may be imminent in the themes we love. Oil sorta caught a bid this week. The tax loss selling in offshore seems to have abated. We’re looking at positioning extremes (even more extremes than the usual extremes in energy…)

@subutrade

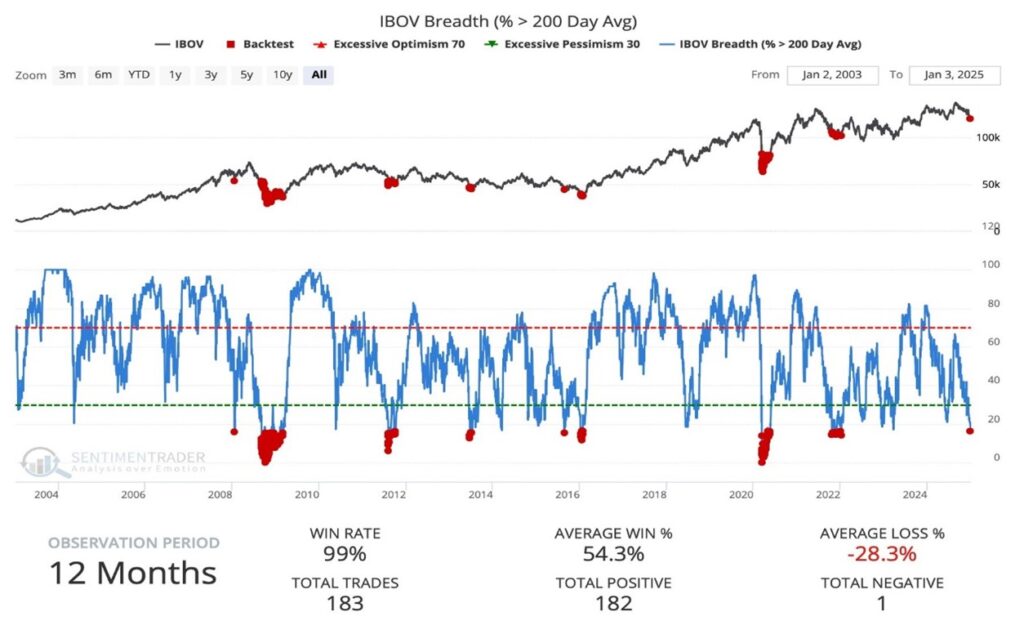

Meanwhile, Jason Gopefelt had great data on how IBOV is in a buying pattern with a 99% hit ratio (see our LatAm KEDM here), though we may want to wait until a cluster of indicators fires off. Still, this is another extreme that really ought to snap back…

We still think everyone will want to play Milei Round II, and that’s Brazil, with elections coming up in late 2026, which means you need to buy when they announce the opposition candidate in 2025. We are looking for The Spot to max it out.

I know we’ve been light on themes lately. We’re really focused on cutting back around here. We’re even playing shorts. We really think 2025 will be an epic klusterfuk. Ohh, and bonds can’t catch a bid. Atlanta GDP Nowcast keep ticking down, and there’s no bid on bonds. For that matter, the UK is in a recession that’s deepening, and GILT yields are about to break out.

What if all the rules are inverted now. We think the former DMs are acting like EMs, and if that’s the case, you need to use EM rules when you invest. Bonds are leading, but equities should catch up, meaning they catch down. Meanwhile, oddly, Chinese bonds are bid to the moon. China is also in a tough spot, but China is acting like the US used to act in a slowdown. We remain sympathetic to the view that you buy China (probably though calls just to avoid getting Gazprom’d). They have low rates, they haven’t really stimulated, they have all the cards at their disposal now. We think they’re waiting to see Trump make his first move, then they strike. It’s likely bullish Chinese equities/bearish ours…

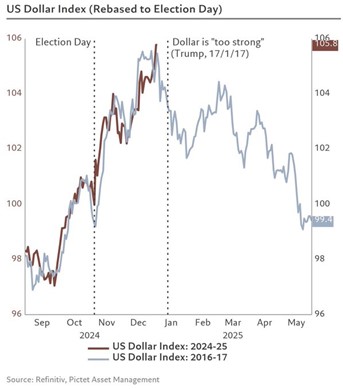

With that in mind, we might as well remind you that the Dollar is “too damn strong!!” We don’t know if Trump 2.0 tracks Trump 1.0, but we have a hunch that it will sorta play out that way. Which only helps the unwind of tech and our value/energy/EM names…

Besides, why would you want to own US assets when the US economy is clearly having issues, despite 7% deficits…??

It feels strange to be such raging bears. We haven’t felt this way in ages. Besides a brief stint in February of 2020, we haven’t really contemplated looking for things that could go down. Now that’s most of what we are doing. Then again, we really haven’t stepped on the accelerator in terms of pushing shorts—we’re just cutting back, watching and waiting for a spot to really press it. We think the 21/22 models will overlap with the Trump 1.0 in currency. We think all these trends set in motion in January. We’re on high alert. Could be a false alarm, been many of those in our careers, but we’re not taking chances—if only because it all lines up so well…

Stay safe out there, 2025 will be a wild one…

Mean-reversion is imminent…

A low frequency but juicy strategy where the edge is government incompetence.

Let’s dig in…

Last week, we showed the 1 chart to rule them all. It was the chart of Q4/Q1 of 2021/2022 overlayed with the current market tracking almost perfectly. Since then, this year has tracked reasonably well (shocking…). If the comparison holds, then the selling starts this week when everyone gets back from vacation. Though, we’re willing to keep an open mind and accept that the selling may not happen until inauguration. In any case, we’ve ventured into the dark side, and started putting on some shorts. We intend to use any weakness to press them. We’re not short-sellers, in fact, we really suck at shorting. So Caveat Emptor on this…

If there’s 1 chart to rule them all, then SMH is our Sauron. It’s the chart to track. To our eyes, it looks like a massive failing rally. After leading the market higher in H1 2024, key component NVDA stopped making highs, other components like MU, ASML and AMD have clearly rolled over. Only AVGO is making highs today. So you have divergence of the sector from the market, after being a leader, and now you have intra-sector divergence. For those of you who’ve followed us for some time, you know we fixate on divergences…

SMH

For our entire careers, semiconductors were seen as being highly cyclical shitcos. They’re massively capital intensive, with high obsolescence, extreme cyclicality, with multiple evolutionary dead-ends. They’re the graveyard of capital and in many ways, they’re one of the few industries worse than small cap E&Ps. However, they have an odd sex-appeal and tend to meme about once a decade, trapping whole generations of baggies. This meme-cycle was extreme, even by past standards (we were around during the 2000 bubble and remember how stupid QCOM and RMBS got). For a while, AI captured the world’s imagination, and why wouldn’t it. Before, I had to rely on stock images of Granholm for my memes. Now I just type in ‘sexy Granholm’ and a whole new genre of memes comes available!! This is the definition of American Exceptionalism!! All the promise of AI in the capacity to meme, and not much else…

Anyway, we think this semis cycle is nearing an end. The economy is sort of slowing and people are realizing that AI is somewhat of a dead end. After something like $200 billion has been thrown at the chips and tech, no one really knows what to do with it, except make more targeted memes…

Anyway, if SMH led us up, it’s going to likely lead us down again. We’re short, we have stops at the breakout level, we expect to press weakness under $240. If SMH breaks, so does everything else. We’re short everything else too. We tend to think the wheels come off. While the timing is hard, we’re cutting back even further, and even sold down some uranium. We believe in the uranium trend, but we believe more in the ideal of de-grossing even further, and we’ve sort of run out of virgins to throw in the volcano around here (…and yes, GROK gave us some odd satanic image when we asked for “image of portfolio manager throwing virgins in volcano”)

Just like we feel that the move lower is somewhat imminent on many of the Ponzi and high multiple names, we think the mean-reversion may be imminent in the themes we love. Oil sorta caught a bid this week. The tax loss selling in offshore seems to have abated. We’re looking at positioning extremes (even more extremes than the usual extremes in energy…)

@subutrade

Meanwhile, Jason Gopefelt had great data on how IBOV is in a buying pattern with a 99% hit ratio (see our LatAm KEDM here), though we may want to wait until a cluster of indicators fires off. Still, this is another extreme that really ought to snap back…

We still think everyone will want to play Milei Round II, and that’s Brazil, with elections coming up in late 2026, which means you need to buy when they announce the opposition candidate in 2025. We are looking for The Spot to max it out.

I know we’ve been light on themes lately. We’re really focused on cutting back around here. We’re even playing shorts. We really think 2025 will be an epic klusterfuk. Ohh, and bonds can’t catch a bid. Atlanta GDP Nowcast keep ticking down, and there’s no bid on bonds. For that matter, the UK is in a recession that’s deepening, and GILT yields are about to break out.

What if all the rules are inverted now. We think the former DMs are acting like EMs, and if that’s the case, you need to use EM rules when you invest. Bonds are leading, but equities should catch up, meaning they catch down. Meanwhile, oddly, Chinese bonds are bid to the moon. China is also in a tough spot, but China is acting like the US used to act in a slowdown. We remain sympathetic to the view that you buy China (probably though calls just to avoid getting Gazprom’d). They have low rates, they haven’t really stimulated, they have all the cards at their disposal now. We think they’re waiting to see Trump make his first move, then they strike. It’s likely bullish Chinese equities/bearish ours…

With that in mind, we might as well remind you that the Dollar is “too damn strong!!” We don’t know if Trump 2.0 tracks Trump 1.0, but we have a hunch that it will sorta play out that way. Which only helps the unwind of tech and our value/energy/EM names…

Besides, why would you want to own US assets when the US economy is clearly having issues, despite 7% deficits…??

It feels strange to be such raging bears. We haven’t felt this way in ages. Besides a brief stint in February of 2020, we haven’t really contemplated looking for things that could go down. Now that’s most of what we are doing. Then again, we really haven’t stepped on the accelerator in terms of pushing shorts—we’re just cutting back, watching and waiting for a spot to really press it. We think the 21/22 models will overlap with the Trump 1.0 in currency. We think all these trends set in motion in January. We’re on high alert. Could be a false alarm, been many of those in our careers, but we’re not taking chances—if only because it all lines up so well…

Stay safe out there, 2025 will be a wild one…

Start your 28-day free trial

Kuppy’s Event Driven Monitor (“KEDM”) is not a financial or investment advisor and the information contained in this publication is not intended to constitute legal, accounting, or text advice or individually-tailored investment advice and is not designed to meet your personal financial situation. The investments discussed in this publication may not be suitable for you. You are required to conduct your own due diligence, analyses, draw your own conclusions, and make your own investment decisions. Any areas concerning legal, accounting, or tax advice or individually-tailored investment advice should be referred to your lawyers, accountants, tax advisors, investment advisers, or other professionals registered or otherwise authorized to provide such advice. KEDM makes no recommendations whatsoever regarding buying, selling, or holding a specified security, a class of securities, or the securities of a class of issuers, and all commentary is for educational purposes only. The investment examples noted are intended to provide and example of the events and data KEDM flags each week and is not representative of typical returns generated by each event or any future returns.