Mineral Drilling

A low frequency but juicy strategy where the edge is government incompetence.

Let’s dig in…

Crypto Treasury Strategies – Update

Thinking back to the summer of 2025, we hit a period where every company with a failed business model had a chance at a second life if they transitioned to a bitcoin treasury strategy.

Back in September, we wrote about the reflexive nature of those crypto treasury plays. While they all traded at massive premiums to NAV, ‘value creation’ consisted of issuing shares and buying more bitcoin. As we wrote, this premium would eventually flip to a discount, given that there is no real reason to own a C-Corp with corporate overhead to gain exposure to bitcoin. And once those stocks traded at a discount, they would lose their ability to issue shares and buy more bitcoin, thereby affecting bitcoin’s price.

In hindsight, the timing of our piece was solid. But the collapse itself? Inevitable. Greek Tragedies have endured for 2500 years, even though everyone knows how each play ends. The interest is in the personal drama and anguish along the way…

We have been outspoken in our views on crypto. If you look at crypto trying to find intrinsic value, you won’t find any. Despite tens of billions of dollars in VC investment to find bitcoin use cases, no real use case has emerged. Yes, there are some stores where you can trade in your bitcoin for a pizza, but we don’t know anyone who’s been buying bitcoin with the intention of using it. We don’t even know people who can honestly claim to own bitcoin for capital preservation. People own it because its price goes up. If crypto ever stops going up, there would be no reason to own it.

Ponzis don’t have a state of equilibrium. They either inflate or they deflate. They go up when more money goes in than out, and they go down when that trend reverses. The only way to make money owning a Ponzi is if you expect an even larger buyer to step in and bid up the price. It’s the greater fool theory. The only surprise over the last years is that we never seemed to run out of greater fools.

In 2023, that buyer was the IBIT ETF, which opened up the market to institutional asset allocators. Then, in 2024, crypto went up in anticipation of the US Government stepping in as a major buyer. That never materialized. If it hadn’t been for the likes of MSTR stepping in and spending more than $40b on crypto in 2025, 2025 would have been a lot worse for crypto. Instead, we needed $40b in incremental buyers to keep bitcoin’s price flat.

With MSTR no longer trading at a premium to NAV, that game seems to have run its course. Suddenly, the attention has shifted to MSTR’s complex capital structure and the small print on some of the converts. Under what conditions will MSTR have to repay, and will they have to sell bitcoin to fund it? Once MSTR turns into a seller, it’s game over.

Gold

We’re not here to dunk on crypto bulls. Instead, our interest is whether Western consumer demand for crypto could pivot to gold. If you want to call gold another Ponzi that has existed for several thousand years, we wouldn’t argue with you. Apart from some industrial use cases and jewelry-related demand, the price of gold is primarily set by flows. The only difference is that industrial and jewelry demand do provide a more normal demand curve (one that shows more demand when prices go down rather than the other way around), and that investment demand is much more stable: gold investors actually look for capital preservation.

It won’t have escaped anyone that gold has been on a tear since 2022, when both the US and Europe decided that Russian savings in USD or EUR could easily be frozen or confiscated. In the short run, gold also tends to correlate with real interest rates. A Federal Reserve under pressure to cut interest rates despite inflation hovering around 3% is certainly bullish for a shiny rock whose claim to fame is being a store of value.

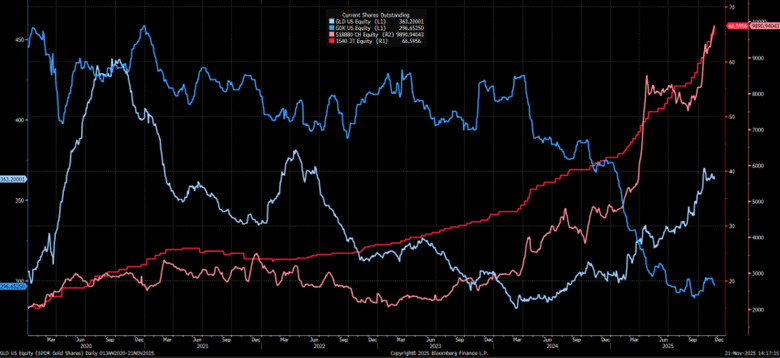

Figure: shares outstanding for GLD (light blue), GDX (blue), China Gold ETF (pink), Japan gold ETF (red).

Source: Bloomberg

What’s been surprising about the bull run is the absence of US retail investors. Inflows in the GLD ETF have been muted, and mining ETFs (GDX, GDXJ) are even seeing outflows. Instead, Chinese and Japanese funds have seen a steady increase in shares outstanding, clearly showing us where the demand has been coming from.

Other than a few die-hard gold investors, Western interest in gold has largely disappeared since the 2022 peak. Now and then, a brave soul stands up and predicts the next commodity supercycle, but until 2022, none of those predictions has come true.

Commodity investors from 2013 to 2022

Is the slow deflation of the crypto bubble (yes, we’re calling it a bubble, and we know this upsets a few of our friends who are hardcore crypto believers) the final push that US retail needed to get interested in gold?

While we have been outspoken and bullish on the shiny rock, the real difficulty has been in finding a way to express our view. A-mark Precious Metals (AMRK) benefited from a supply shortage during the 2021-2023 period, but with retail demand largely absent, the market has since normalized.

Owning gold outright might work, but will a commodity with no FCF yield really outperform a portfolio of cash-generating companies over the long run?

Mineral Drilling

Which brings us to hard rock mineral drillers. In March (KEDM Volume 217), we wrote about Trump’s EO to accelerate the permitting process for strategic mineral deposits.

We think Trump is actually serious about this one. He wants to create well-paying jobs. He wants to bring mining back to the USA. He wants to make us self-sufficient in as many commodities as possible. Longer term, he wants the US to do to the periodic table, what the Permian did to Crude oil. He wants America to lead the creation of a global export glut. This is VERY much MAGA. Most importantly, this is one that he can actually accomplish. Anything on government land can get permits. It can get fast-tracked. It can even get financed. Quite frankly, there are a LOT of well-known deposits on government land.

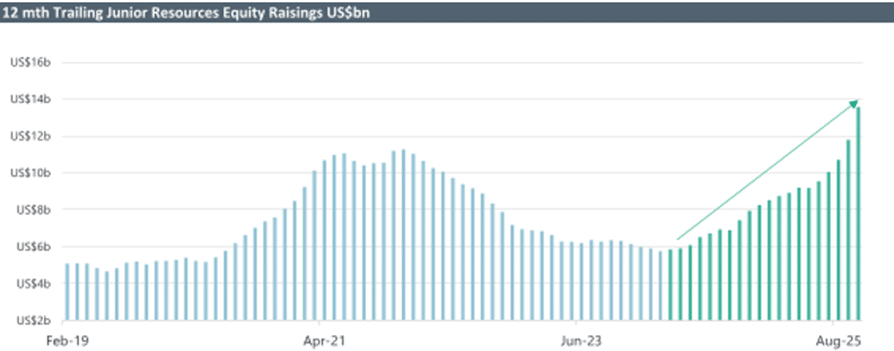

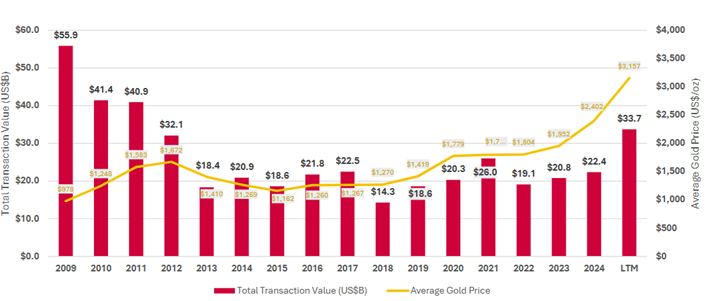

Only 8 months later, we are seeing our first indication that gold miners are successfully raising fresh capital.

To what extent this is due to Trump’s EO, or whether gold miners are just experiencing a tailwind because of higher gold prices, we don’t really care. All we know is that miners are raising capital, and when they do, they plan to spend it. The dilution for mining investors leads to revenues in mining services. And mining companies love to dilute their shareholders. If the capital raising window opens, you can be sure that they will exploit this opportunity.

One of the few good things about mining services is that upcycles can keep going for a long time. The average mine takes over 10 years from discovery to production (ignoring the fact that most don’t make it to production at all). So once the cycle gets going, there is no risk of fresh supply spoiling the party.

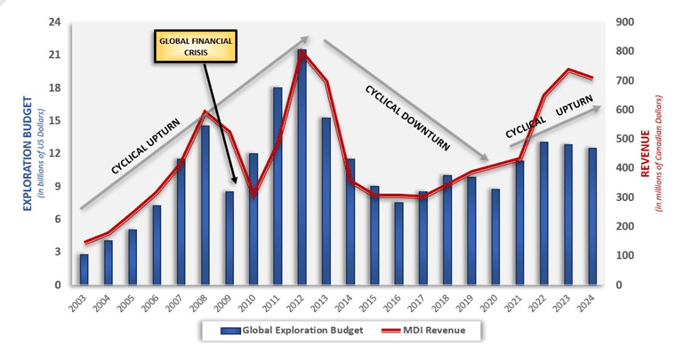

Source: Major Drilling investor presentation

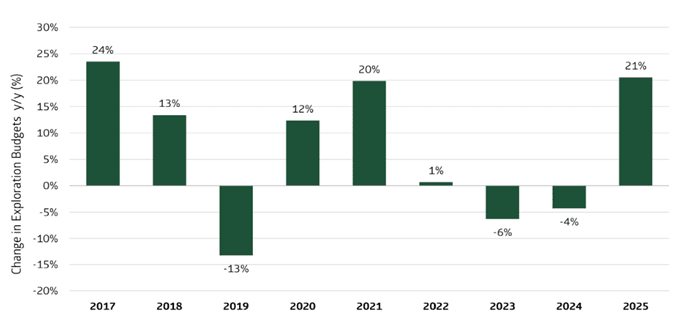

Look, there is only one relatively liquid way to play it, which is Major Drilling (MDI CN). There are a bunch of smaller companies doing the same thing, but we never make recommendations, and we shy away from naming small caps, so do your own work! But when you do, realize that during 2022-2024, mineral drillers have been in a bear market with declining exploration budgets leading to declining revenues.

The uptick in capital raises is only the first signal that things are about to change, but this is not yet apparent in Major Drilling’s reported revenues. MDI has disappointed in most of its recent quarterly reports. But if we are indeed at the start of a multi-year upcycle, those corrections provide very interesting buying opportunities. Caveat emptor!

Figure: Senior Mining Exploration Budgets

Source: Major Drilling investor presentation

Figure: Junior Mining Capital Raises

Source: Major Drilling investor presentation

Start your 28-day free trial

Kuppy’s Event Driven Monitor (“KEDM”) is not a financial or investment advisor and the information contained in this publication is not intended to constitute legal, accounting, or text advice or individually-tailored investment advice and is not designed to meet your personal financial situation. The investments discussed in this publication may not be suitable for you. You are required to conduct your own due diligence, analyses, draw your own conclusions, and make your own investment decisions. Any areas concerning legal, accounting, or tax advice or individually-tailored investment advice should be referred to your lawyers, accountants, tax advisors, investment advisers, or other professionals registered or otherwise authorized to provide such advice. KEDM makes no recommendations whatsoever regarding buying, selling, or holding a specified security, a class of securities, or the securities of a class of issuers, and all commentary is for educational purposes only. The investment examples noted are intended to provide and example of the events and data KEDM flags each week and is not representative of typical returns generated by each event or any future returns.