Theme of the Week

We recently returned from a week-long trip to Hong Kong and Shenzhen. We were planning on updating you on HK property developers, a theme we touched on in the July write-up on the HKD peg. But we’re a little more excited about Macau casinos as a play on the Chinese consumer and the overall wealth effect as the Chinese stock market goes up.

In late 2024, Xi Jinping decided that pumping stonks had become a national priority. Chinese millennials in tier 1 cities were all underwater on the purchase of their first couple of apartments (all of them built in sizes appropriate for speculation, not for living).

And rather than risk having them go onto the street to protest, he decided to boost their stock portfolio. Insurance companies were nudged to pile into equities, while credit was made available to fund corporate buybacks.

While we are bullish on the Chinese consumer, as well as on fund flows shifting into Chinese equities, the problem with investing in China has always been the never-ending oversupply that’s plagued most industries.

Under the Chinese stimulus model, state banks provide endless credit to industrial companies.

The resulting oversupply means low prices for Chinese consumers, as well as low profitability for Chinese corporates. The bottom half of the corporates would go bankrupt and the local banks would get recapitalized by the government. That’s stimulus, the Chinese way.

Just before our trip, the Chinese Politburo met to sketch out the 15th Five-Year Plan, Beijing’s version of a corporate strategy retreat, minus the trust falls. The big shift this time? “Anti-involution.” Which loosely translates to: stop killing each other on price.

The government has realized that a country can’t build world-class industries if everyone’s busy running their business into the ground. Maybe, just maybe, 200 EV makers are 190 too many.

Back in the 1980s, Deng Xiaoping famously declared that “to get rich is glorious,” kicking off a multi-decade sprint toward prosperity. Xi’s latest plan feels like the sequel: “Corporate profits are mandatory.” Profitability, long treated as optional or even suspicious in certain Chinese sectors, is now state policy.

So where do Macau’s casinos fit in all of this? They’ve been quietly living the anti-involution dream for years.

Kuppy’s Tweet of the Week

Kliff Note of the Week

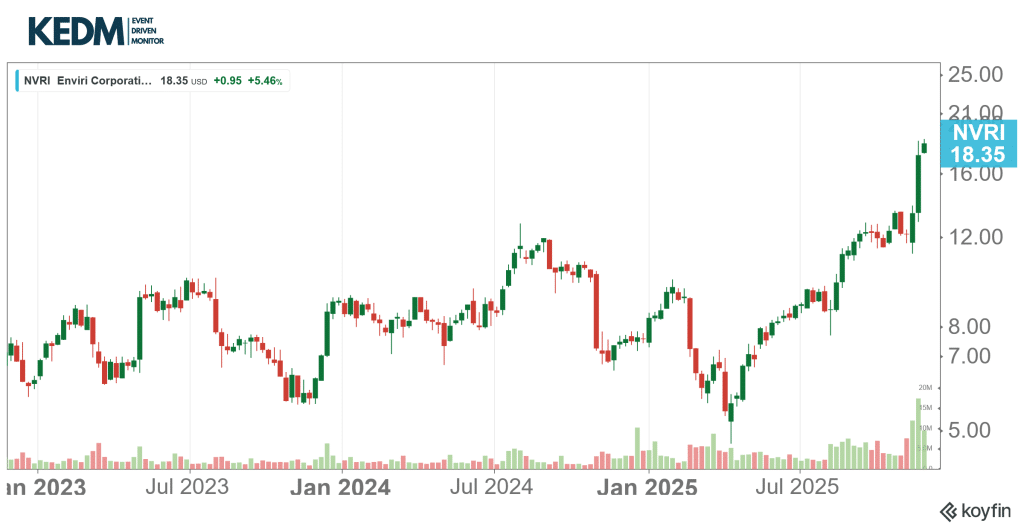

Spin-off Monitor: Enviri, NVRI, announced a sale and spin with Veolia, VIE FP, where Veolia will acquire NVRI’s Hazardous Waste Business Clean Earth for $3.04bn and NVRI will spin the remaining Harsco Environment and Rail to shareholders.

NVRI will use $1.35bn of the proceeds to repay existing debt, while NVRI shareholders will receive $14.50-16.50 in cash and 0.33 shares of the Spin-Co per NVRI share. New Enviri expects pro forma revenue of $1.3bn and EBITDA of $135m with 2.0x net leverage at closing.

With NVRI around $17.40, New Enviri’s Enterprise Value sits around $350m to $515m… NVRI has long struggled with its Environment and Rail segments, but it’s looking pretty cheap, especially if management is serious about realizing value.

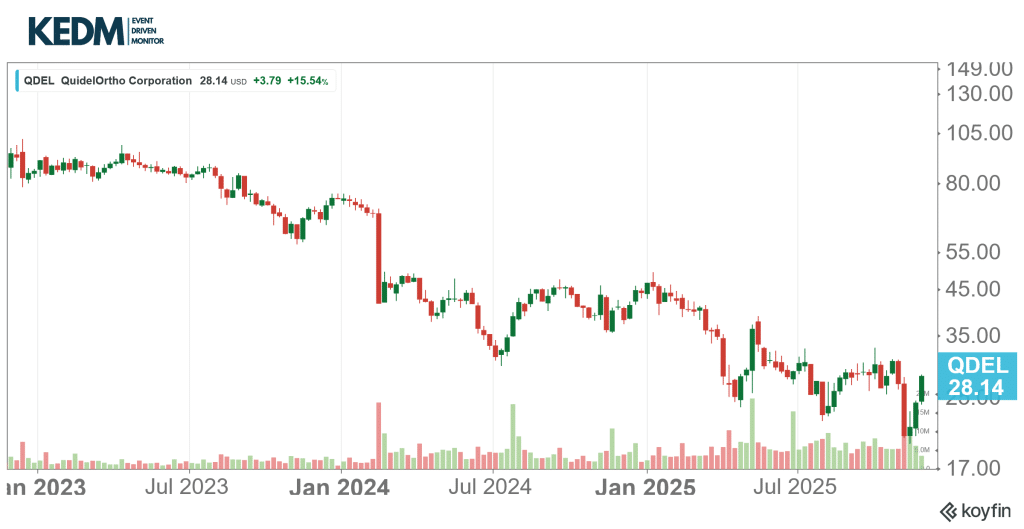

Cluster Insider Buy Monitor: The CEO at QuidelOrtho (QDEL) stepped in for $500k. The diagnostics company recently reported a massive beat on heavily adjusted earnings.

But the market remains skeptical of the amount of non-recurring charges and overall FCF conversion so QDEL sold off – massively. If QDEL manages to get their invoices paid in 2026, without collapsing their business, there could be material upside.

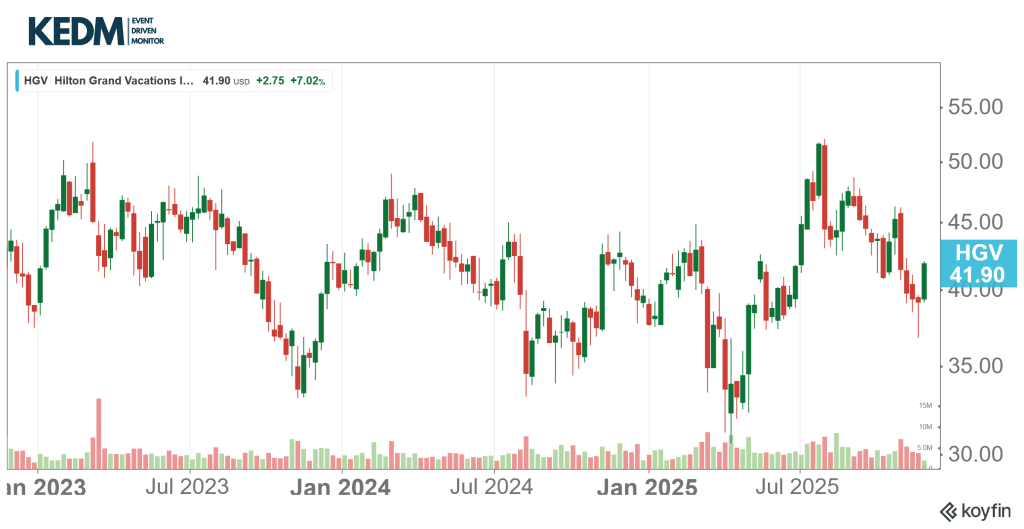

Announced Buyback Monitor: Hilton Grand Vacations (HGV) is another one that popped on the buyback monitor, retiring 3.3m shares in Q3 for $150m.

They mentioned being on track to return $600m to shareholders this year; that’s another ~17% of the market cap for the remaining buyback amount.

Strategic Alternatives Monitor: Nippon Active Value further added to Meisei (1976 JP), now at 11.4% and the largest shareholder (excl. the company itself).

While this one had a good run, it still trades at ~8x EV/EBITDA despite strong growth, margins, and profitability, with almost 60% of the market cap in current assets and LT investments, net of total liabilities.

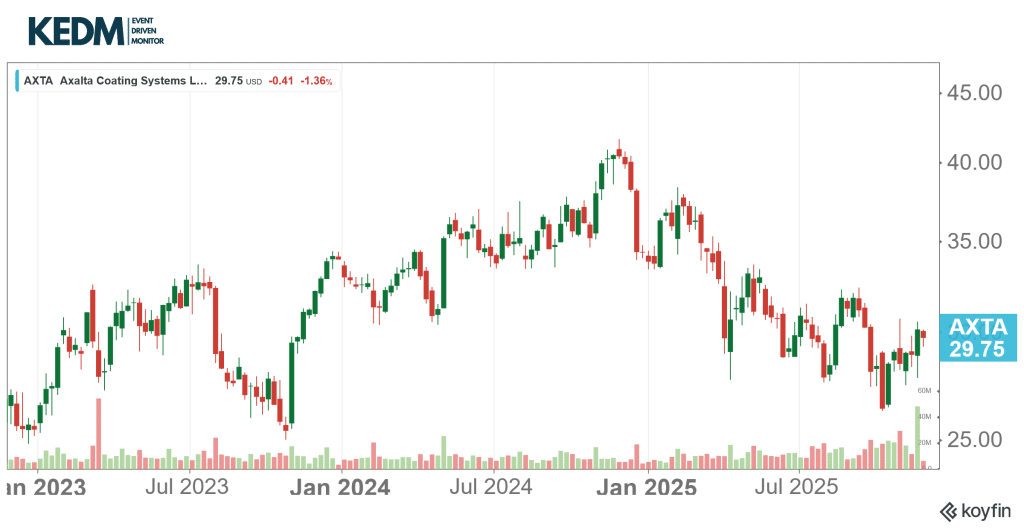

M&A Monitor: When did “no more large-scale M&A over the next few years” become “let’s do a massive deal now”?? Akzo Nobel (AKZA NA) is buying Axalta (AXTA) in an all-stock transaction valued at around $25bn.

A few interesting things here. Akzo has been pivoting strongly towards Coatings, and this move will create a major Coatings player. Coatings is where stronger growth and margins are, and hopefully an overall higher valuation.

Akzo has also been restructuring its Paints assets, and we can assume this to continue if not accelerate. There are quite a few assets left to divest here. Also, the deal includes a €2.5bn cash dividend to Akzo shareholders, i.c. roughly 30% yield at current prices.

Listing Change Monitor: Not really a listing ‘change’, but more like ‘will start trading again’. Battered Australian chemical distributor DGL (DGL AU) had its shares suspended due to delays in filing its financials.

The delays were caused by auditors/regulators pushing the company to improve its accounting department and inventory administration. There was also a woman caught stealing ~A$400k.

Obviously not a great picture, but overall small and, honestly, unsurprising after the big string of acquisitions that the company has made over the past years. Acquisitions are normal in such a fragmented industry, but you need to integrate them correctly (which they

didn’t).

Strategic Alternatives Monitor: MTY Food Group (MTY CN) kicked off a strategic review and hired TD Bank to explore options, with the aim of selling itself. The multi-brand franchisor, owning over 80 chains such as Pinkberry, is under pressure due to weak same-store sales and margin pressures.

A bloated balance sheet on past deals also doesn’t help. That said, despite softer growth, earnings and cash flow generation remain pretty resilient. EPS and share price trends have been diverging since 2023. The company has been actively buying back shares over the past few quarters.

Index Addition/Deletion Monitor: MSCI has launched a consultation (ending Dec 31, with a decision expected around Jan 15, 2026) to exclude companies from its Global Investable Market Indexes whose business model is primarily a digital-asset treasury.

Estimates suggest MSTR could see $3b in passive fund outflows if removed from MSCI indices, and $9b if other indices follow suit.

KEDM Event Driven Monitor scans over 20 corporate events for market moving information and distills them into our propietary “Kliff Notes.” One profitable trade should more than cover an annual subscription and access to the Event Driven chatroom!