Some highlights from this weekend’s Event Driven Monitor

Have a friend with an ED (“Event-Driven”) problem? Forward this newsletter to them and they can sign up for their own ED fix right to their inbox:

NEW USERS RECEIVE A FREE 4-WEEK TRIAL

The Event of the Week

- Doug’s top 3 books (that he didn’t write) are…

1) Henry Hazzlit’s “Economics in One Lesson”

2) Ayn Rand’s “The Virtue of Selfishness”

3) “The Market for Liberty” by Linda and Morris Tannehill - Over his carreer Doug has developed his 9 Ps of Resource Speculation. Of all the Ps the most important P is “People.” Incredible amounts of money can be made (and saved) by sticking with people who are the combination of “good and competent.” He has had tremendous success following good people who are consistent winners like Robert Friedland and the Lundin Family.

- Doug believes the Western media’s characterization of Millei and of his “lack of support” in Argentina is complete and total crap. He also believes the average Argentinian is willing to take the pain that comes with a hard economic reset like this. Economic pain is all they have known for the last 20+ years and some of the crises they have gone through have been so extreme that this will be nothing in comparison.

- Doug famously invested in Cyprus after their banks failed and was asked if there are any similar examples of extreme value in the aftermath of crisis today. He goes back to Argentina and doesn’t see anything with better post crisis risk reward potential and value. He likes the NYSE listed RE plays.

-

Doug says his signal to exit his gold stocks will be sentiment driven. He’ll be on the lookout for “golden bears destroying the NYSE” on the cover of the Economist. He also notes that in his view the public is not broadly involved enough for the run to be near its end.

Subscribe Now To Keep Reading…

Kuppy’s Tweet of the Week

WWIII isn’t exactly hurting that relentless Chinese bid for gold and silver…

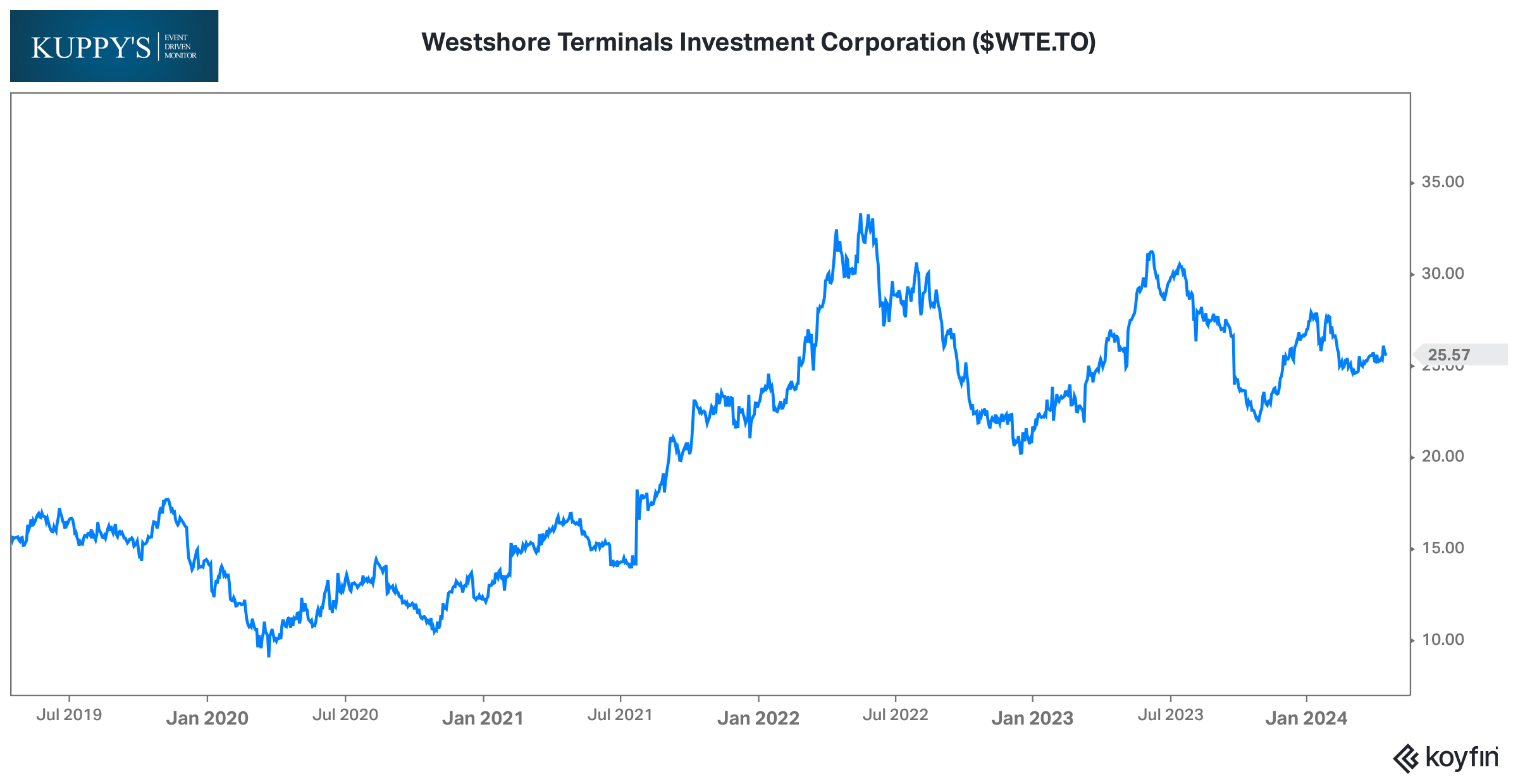

Chart and Kliff Note of the Week

Westshore Terminals, WTE CN, the main terminal for coal out of the Powder River Basin (and soon to be potash terminal), announced a NCIB for 10%, or 3.3m shares. Worth noting the float is only 15m shares as Canadian mogul James Pattison still holds nearly 50%.

Subscribe Now for More Event-Driven Opportunities

Friends of KEDM

- Our good friend Patrick Ceresna hosted Justin Huhn of Uranium insider on the Macro Voices podcast this past week. It’s been a little sleepy in uranium since the recent pull back but this is a great update on the trends driving uranium higher.

- Currencies, commodities, and macro are dominating the market right now. Old KEDM Happy Hour guest Michael Kao was “On the Tape” with big short veteran Danny Moses and Guy Adami last week breaking down currencies, gold, and the risks he sees for oil prices. Worth a listen after Iran attacking Israel resulted in falling oil prices…

Kuppy’s Event Driven Monitor scans over 20 corporate events for market moving information and distills them into our propietary “Kliff Notes.” One profitable trade should more than cover an annual subscription and access to the Event Driven chatroom!

Subscribe Now