Some highlights from this weekend’s Event Driven Monitor

Have a friend with an ED (“Event-Driven”) problem? Forward this newsletter to them and they can sign up for their own ED fix right to their inbox:

NEW USERS RECEIVE A FREE 4-WEEK TRIAL

The Event of the Week

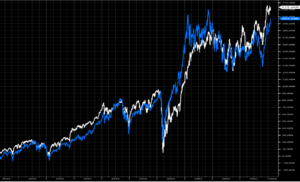

Buybacks (in white) are even beating out the Momentum factor (in blue)

We noted a few weeks back that buybacks have been the key factor in outperformance over the past few years. C-suites aren’t dumb and are leaning in (their comp depends on it…), realizing that active fund managers will no longer find their cheap stock and bid it too intrinsic. Market structure has shifted and cheap stocks will continue to get cheaper as active gets replaced with passive flows.

Turning back to buybacks, our friend Paulo (and fellow KEDM’er) noted it perfectly, “the point is this: 4x Ebitda will become 3x, 2x, 1x… The only solution to non-Mag7 and especially Value/Smallcap equity underperformance is for managements to introduce a price-insensitive buyer — the corporate buyback — to offset relentless price-insensitive Active redemption sales that weigh on their share price…”

Subscribe Now To Keep Reading…

Kuppy’s Tweet of the Week

The Chiefs Won the Super Bowl… Gotta Go Buy More $NVDA

Chart and Kliff Note of the Week

The Economist may have just marked the bottom in China, so let’s see who in China is doing the market’s favorite thing… buying back shares!

Yum China, $YUMC, stepped up aggressively in the Q with 8m shares (~$335m) and about 3% of SO in the TTM. They have $1.25B authorized going into 2024 (~8% of mkt cap)…

Subscribe Now for More Event-Driven Opportunities

Friends of KEDM

- Pick your favorite folks, Kuppy recorded two podcasts this past Friday. One with our friends Patrick and Kevin at the Market Huddle and another for a good friend Tony Greer and the Morning Navigator crew.

- We alluded to this piece above but we can not recommend enough that everyone check out Paulo Macro’s recent piece on buybacks and passive. In our financialized US economy with increasingly indexed securities markets, capital appreciation and alpha require a forcing function: the price-insensitive buyer.

Kuppy’s Event Driven Monitor scans over 20 corporate events for market moving information and distills them into our propietary “Kliff Notes.” One profitable trade should more than cover an annual subscription and access to the Event Driven chatroom!