Some highlights from this weekend’s Event Driven Monitor

Have a friend with an ED (“Event-Driven”) problem? Forward this newsletter to them and they can sign up for their own ED fix right to their inbox:

NEW USERS RECEIVE A FREE 4-WEEK TRIAL

The Event of the Week

PBoC Assets Explode

In a further push to fade the masses, we became intrigued when one of our subscribers sent us over the fund flows for a true left for dead country – “Chyna.” Yes, it’s the graveyard of all successful stock pickers and a black box of financials. And yes, we’ve heard this story before. That said, it is truly washed out.

Meanwhile, China has started to unleash new stimmies to perk up the economy. In Q4, they approved 1T trillion yuan of bond issuance for the year – the first deficit expansion in a year in 23.

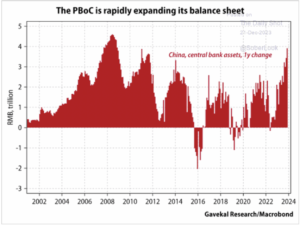

The PBOC also injected a net 600 billion yuan of cash via MLF loans (chart above from Gavekal Research) in November, the biggest monthly increase since 2016.

Let’s be clear, we are not China bulls per se and likely won’t be playing in their ADRs or reverse mergers (anyone old enough to remember how the ole Rodman and Renshaw companies turned out???). As mentioned China is a graveyard riddled with “value” investor corpses.

That said, we firmly believe in the adage – get long what China needs or is focused on, especially when stimmies are inflecting.

Subscribe Now To Keep Reading…

Kuppy’s Tweet of the Week

China’s first order of business in 2024? Buy sh*tloads of oil!

Chart and Kliff Note of the Week

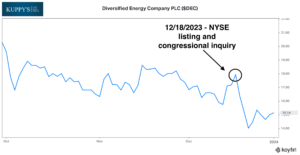

DEC, which buys old/depleted wells then milks them for all they’re worth, popped over to NYSE (from LN) on December 18. And as a nice welcome gift, the same day, US House Democrats smacked them with a request for more information surrounding the damning 2021 piece from Bloomberg. Well worth the read.

Subscribe Now for More Event-Driven Opportunities

Friends of KEDM

- While we’re on the subject of China and what they might do with all of that stimulus money we think it is worth listening to this conversationwith Louis-Vincent Gave and Payne Capital Management. Global trade, emerging markets, and the interconnected world.

- Keeping with the “What Will China Be Buying?” theme, we enjoyed this writeup on tin from KEDM Subscriber and regular contributor in our KEDM Members Discord, Brandon Beylo. He highlights that “China is going PARABOLIC on solar capacity.” And that means a lot of demand for tin.

Kuppy’s Event Driven Monitor scans over 20 corporate events for market moving information and distills them into our propietary “Kliff Notes.” One profitable trade should more than cover an annual subscription and access to the Event Driven chatroom!