Some highlights from this weekend’s Event Driven Monitor

Have a friend with an ED (“Event-Driven”) problem? Forward this newsletter to them and they can sign up for their own ED fix right to their inbox:

NEW USERS RECEIVE A FREE 4-WEEK TRIAL

The Event of the Week

Headlines You Don’t Want to See at Breakouts

Gold is trying to work off one of the nastiest wicks and technical damage I’ve seen in a while as traders went stop hunting on last Sunday night. KEDM started getting bullish on the pet rock on October 1 when GC was in the low 1800s.

While the fundementals still stand with CBs (i.e. China) hoovering it up, caution must be heeded after this week (even if we aren’t chart monkeys!)…and especially as it received the kiss of death on Barrons this week…

Subscribe Now To Keep Reading…

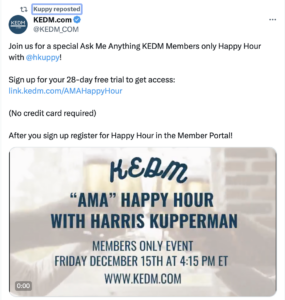

Kuppy’s Tweet of the Week

Have questions for Kuppy??? Sign up for a trial and join us…

Chart and Kliff Note of the Week

Hornbeck Offshore, HOS, is finally re-listing after its Chapter 11 years ago as its PE owners – Ares and Whitebox look ready to tap into the offshore liquidity/theme. Worth keeping an eye on the S1 here.

Subscribe Now for More Event-Driven Opportunities

Friends of KEDM

- The dynamic duo of Kuppy and Louis-Vincent Gave got back together on Meb Faber’s Podcast to discuss the future of China, Globalization and the Dollar. You can watch the full interview on Youtube here.

- Our friend Paulo Macro put together a fantastic thread to update the status of “DMs Becoming EMs.” He highlights the very important point that in EMs markets do not follow the “Stairs up and Elevator Down” paradigm in the same way that DMs do.

Kuppy’s Event Driven Monitor scans over 20 corporate events for market moving information and distills them into our propietary “Kliff Notes.” One profitable trade should more than cover an annual subscription and access to the Event Driven chatroom!