Some highlights from this weekend’s Event Driven Monitor

Have a friend with an ED (“Event-Driven”) problem? Forward this newsletter to them and they can sign up for their own ED fix right to their inbox:

NEW USERS RECEIVE A FREE 4-WEEK TRIAL

The Event of the Week

We love higher contract rates but we’ll also take higher utilization %

It was a long week of earnings throughout some of our themes, e.g. Florida migration and Oil Services, both of which seem to be trending in the right direction, albeit slowly.

E&Ps are starting to look for multi-year contracts covering larger groups of wells that previously would have been broken up into multiple tenders. While many investors seem to have grown tired of offshore after the contracting binge of FY22 and 1H23, these long-term/solid rate contracts seem to offer better economics to the drillers vs the short-term/high rate contracts that leave a bunch of whitespace in the contract book.

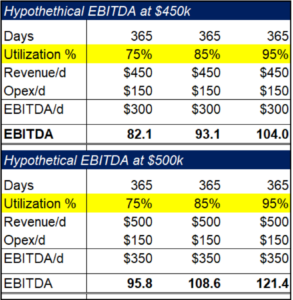

Utilization is such a potent lever for profitability that it can cause a $450k/day long-term contract to be more profitable than a $500k/day short-term contract. Now, of course we’d rather long-term contracts at $500k, but the point is that pushing for the mythical $500k rate contract at the expense of term becomes increasingly unprofitable if it costs you ~a month of working days.

Subscribe Now To Keep Reading…

Kuppy’s Tweet of the Week

New trading strategy just dropped… Print unlimited money and buy AI stocks

Chart and Kliff Note of the Week

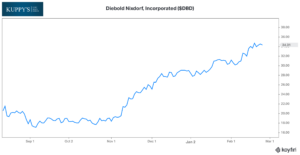

KEDM stalwart (BK Exit and previous Cluster Buy), DBD, saw another token buy by a Director. Pull up a chart, these BK Exits names are still one of the highest hit ratios in KEDM…

Subscribe Now for More Event-Driven Opportunities

Friends of KEDM

- We’re not the only ones tracking OFS as earnings come out. Our good friend Tommy Deepwater is keeping up with the offshore space as well. He puts his near weekly updates on his Twitter account…

- The “We Study Billionaires” podcast hosted the legendary Bruce Berkowitz. In a market increasingly driven by FOMO it’s a good time to listen to Bruce, arguably the master of FOMO avoidance.

Kuppy’s Event Driven Monitor scans over 20 corporate events for market moving information and distills them into our propietary “Kliff Notes.” One profitable trade should more than cover an annual subscription and access to the Event Driven chatroom!