Some highlights from this weekend’s Event Driven Monitor

Have a friend with an ED (“Event-Driven”) problem? Forward this newsletter to them and they can sign up for their own ED fix right to their inbox:

NEW USERS RECEIVE A FREE 4-WEEK TRIAL

The Event of the Week

In equities, people obsess over product launches, management changes, or Fed policy pivots (and Reddit threads) but ultimately it comes back to supply and demand. Think of Lululemon – ten years ago if you wanted some athleisure there was only one place to get it. LULU, being the first on this trend, had a monopoly on supply and capitalized on it appropriately. They sold these products at huge mark ups with little advertising and ran zero sales or discounts, resulting in fat profit margins. If you were long during this stage you printed cash. But capitalism did its thing and the excess profits invited a flood of new entrants…

Commodities though, are a bit more straightforward without all the distractions. It always comes back to how much is being produced versus how much is being consumed. Demand is a moving target—good luck modeling it with any precision. Supply, on the other hand, is usually knowable, and it’s where the big money gets made.

But so what? We’re not making the case to trade LULU or to go short Labubus (9992 HK) as both go through their cycles. We are just plain, old grumpy value investors. And as such, we once again revisit our old friend- the O&G Sector- for a new supply and demand mismatch and new KEDM theme…

Subscribe Now To Keep Reading…

Kuppy’s Tweet of the Week

Chart and Kliff Note of the Week

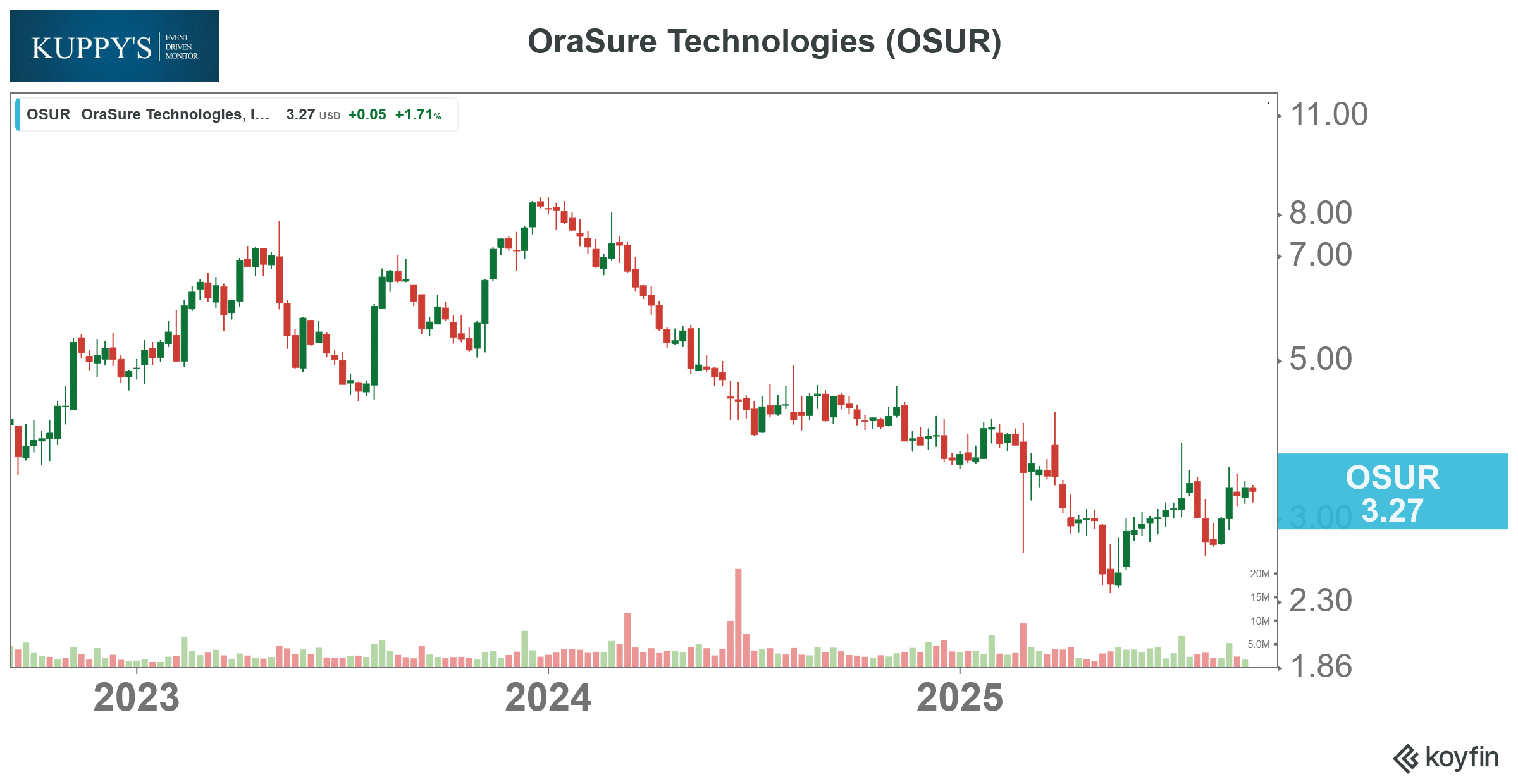

13D Monitor: Altai Capital (5% holder) is leaning hard on covid tester, OraSure, OSUR upping its stake and pushing for board seats to combat the $3.50-4 stink bid that Ron Zwanziger waved in May. The board’s dragging its feet and Zwanziger is seeking an “adversarial path” so this standoff is starting to feel like it’ll get nastier before it gets resolved.

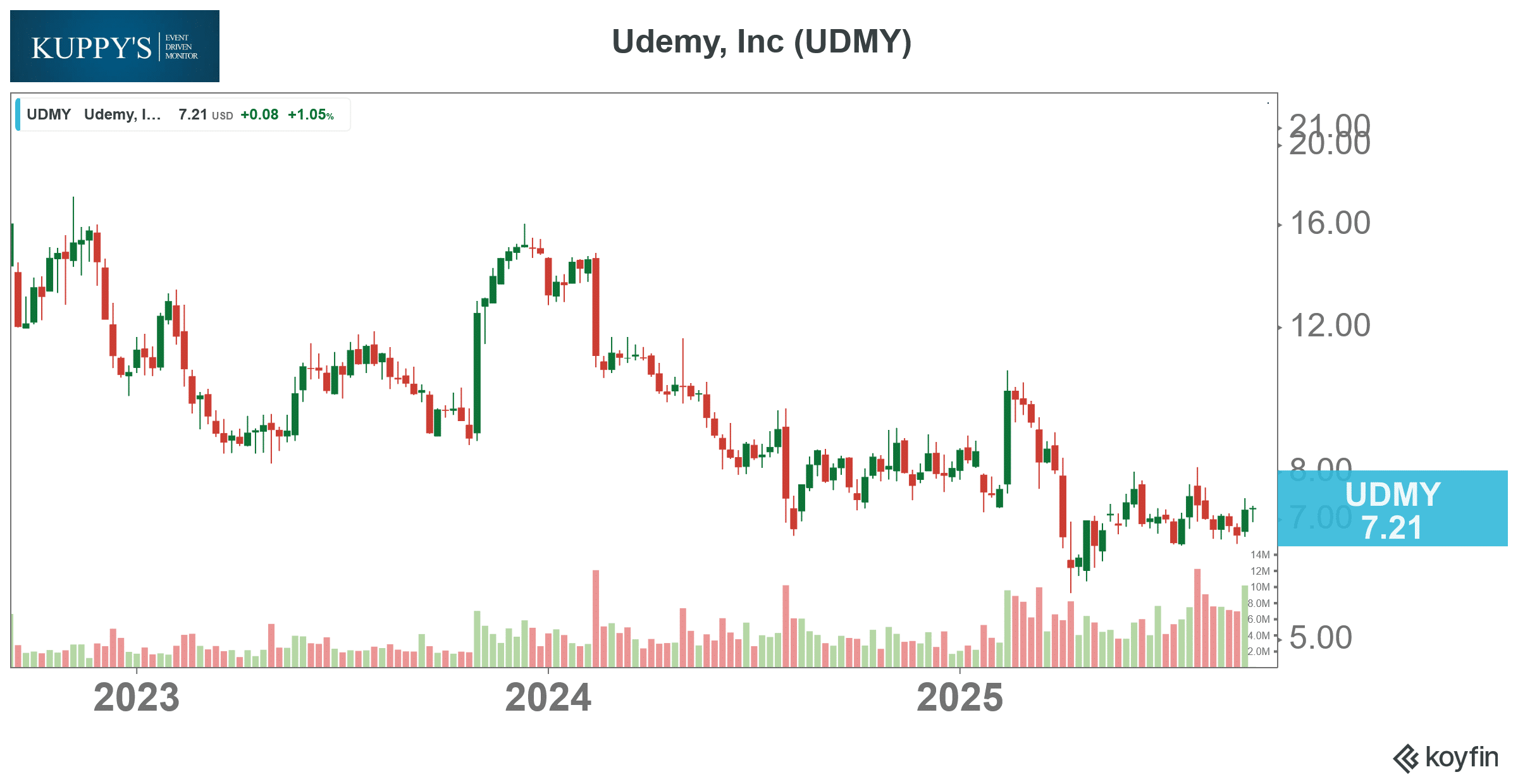

Announced Buyback Monitor: Udemy, UDMY, announced a new $50m program (~5%). They took in $150m in 2024 (~15%). COUR seems to be inflecting as the unemployed scramble for AI certificates. Will UDMY catch up? Worth noting they replaced the CEO in March of this year too…

Subscribe Now for More Event-Driven Opportunities

Kuppy’s Event Driven Monitor scans over 20 corporate events for market moving information and distills them into our propietary “Kliff Notes.” One profitable trade should more than cover an annual subscription and access to the Event Driven chatroom!