Some highlights from this weekend’s Event Driven Monitor

Have a friend with an ED (“Event-Driven”) problem? Forward this newsletter to them and they can sign up for their own ED fix right to their inbox:

NEW USERS RECEIVE A FREE 4-WEEK TRIAL

The Event of the Week

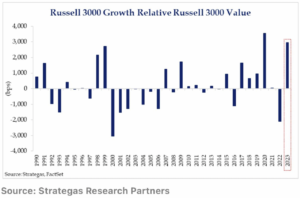

We couldn’t help but re-post the following chart H/T Miller Value Partners

Effectively, 2023 was the 2nd largest divergence between growth and value in the last 33 years. Only 2020 was a wider divergence. We don’t know what to make of this, except to say “wow, I bet value names are cheap these days…

We’ve spent most of the past week reading annual fund letters. Oddly, we cannot remember a year where there was such universal underperformance amongst funds. You can feel it in the frustration and despair in the letters. Everyone blames the MAG7 for screwing it all up by creating an unbeatable benchmark, which is totally fair. Oddly, there were very few hedge funds that were long MAG7 and showing off huge up years (if we had to guess, the winners are mostly boomers with their retirement ETFs). Anyway, the chart above is a chart of the lifeline of fund managers. They’ve had a miserable go of it.

What are the investment implications?? We really don’t know. Seriously, how much further can MAG7 squeeze?? All we know, is that there’s been a lot of frustration out there. Frustration tends to last for a while, before guys dump the value names, and chase what’s working. Could that be what we’re seeing as tech keeps powering higher, and our favorite names sulk….??

Subscribe Now To Keep Reading…

Kuppy’s Tweet of the Week

Apparently a rapidly destabilizing Middle East is bearish oil these days…

Chart and Kliff Note of the Week

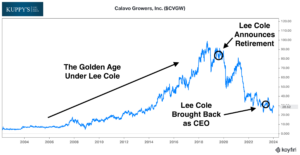

CVGW– The avocado heavy weight is looking to sell its Fresh Cut Business.CEO mentioned that they signed a LOI with one for their co-packing partners for the sale and mentioned a transaction value of approx. $100m.

While the story of founder CEO Lee Cole re-uniting with his baby and company re- focusing on core business, the day after the announcement company released that they are delaying fourth quarter and FY23 results as the “…Company’s operations in Mexico merited further investigation in connection with the completion of the Company’s financial statements for the year ended October 31, 2023”. Be wary when you read “Mexico” and “internal audit related to financial statements” but be extremely cautious when they are in the same sentence.

In the last 12-months we’ve had this one on our CEO Change Monitor and now on our Strategic Alternatives Monitor.

Subscribe Now for More Event-Driven Opportunities

Friends of KEDM

- Judd Arnold of Lake Cornelia Research went on the Yet Another Value Podcast to discuss one of KEDM’s favorite themes… Offshore Oilfield Services.

- We’re always surprised when we link out to them but the NYT actually wrote a decent primer on what is happening in the Red Sea with the Houthi Rebels is affecting global shipping.Remind that we have our Shipping Happy Hour with Charles Bonner from Marhelm this Friday after market close. Sign up for your 28-day free trial to get access to the event.

Kuppy’s Event Driven Monitor scans over 20 corporate events for market moving information and distills them into our propietary “Kliff Notes.” One profitable trade should more than cover an annual subscription and access to the Event Driven chatroom!