Some highlights from this weekend’s Event Driven Monitor

Have a friend with an ED (“Event-Driven”) problem? Forward this newsletter to them and they can sign up for their own ED fix right to their inbox:

NEW USERS RECEIVE A FREE 4-WEEK TRIAL

The Event of the Week

It seems like groundhog day at KEDM. Wasn’t that long ago (Q4 2024-Q1 2025) when NVDA was dominating the headlines, and we were leaning into SMH/SOXX as a proxy, all the while hunting EMs. Fast forward 6 months and here we are with NVDA & Co. still propping up the entire market at 14% of QQQ and the MAG again at nearly a third of the S&P. Sprinkle in alt season/treasury companies, and everyone is back to dancing.

But since its groundhog day and we aren’t doomers, its worth circling back on EM again. In particular LatAm which is waking up and one of our main focuses given the upcoming election cycles. Back in Issue 200 and 210 we laid out our LatAM thoughts. While it hasn’t outpaced Fartcoin (up 77% ytd!!), theres a ton of time to play catchup when EMs flip…

Subscribe Now To Keep Reading…

Kuppy’s Tweet of the Week

Chart and Kliff Note of the Week

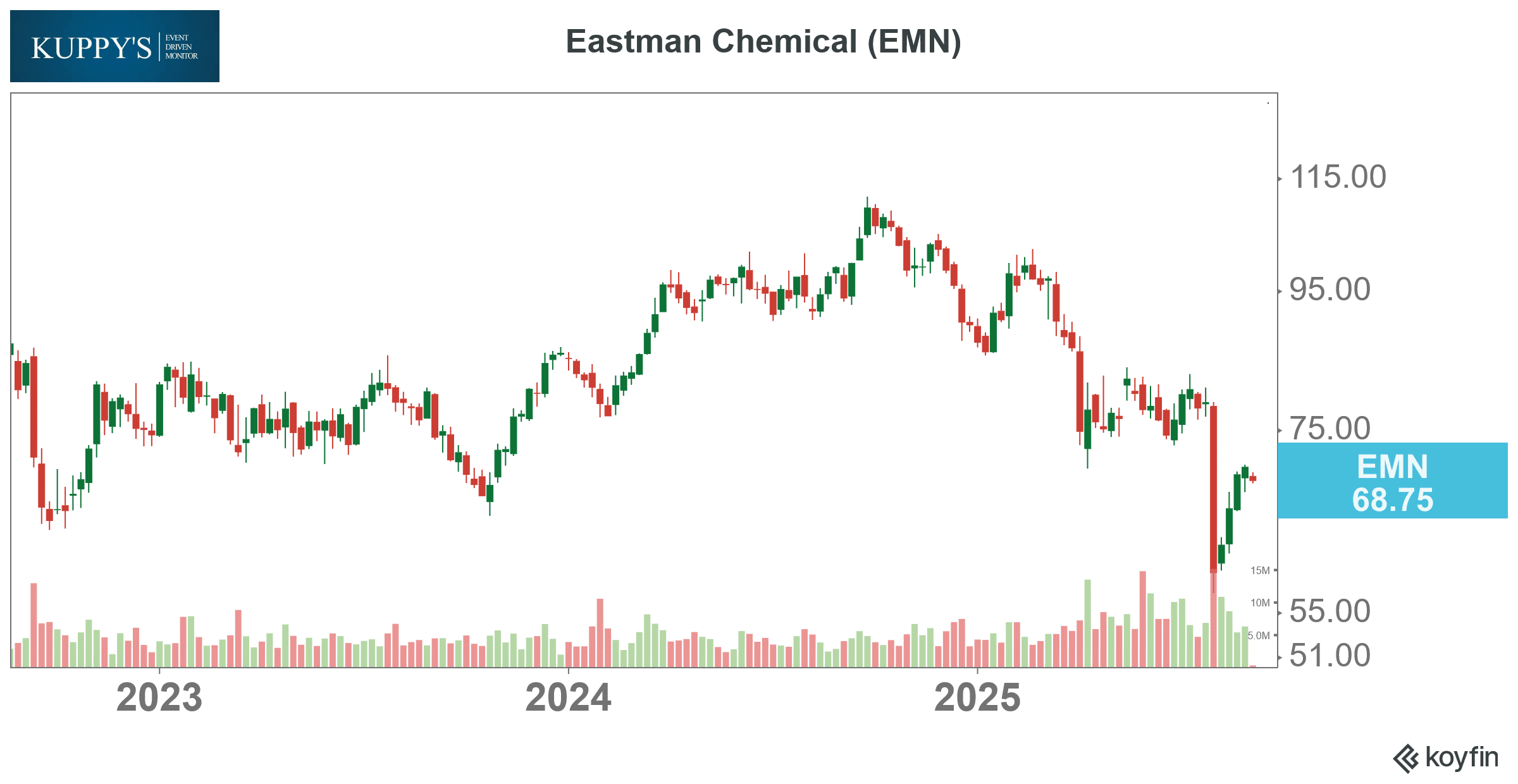

Cluster Buying Monitor: More Chemical buying with the CEO & COB of specialty chemicals company Eastman Chemical Co (EMN), purchasing 7,400 shares totaling $502,386. Nine other insiders including the CFO also purchased shares bringing the total amount to almost $2m. Chemical names are popping up all over this monitor lately…

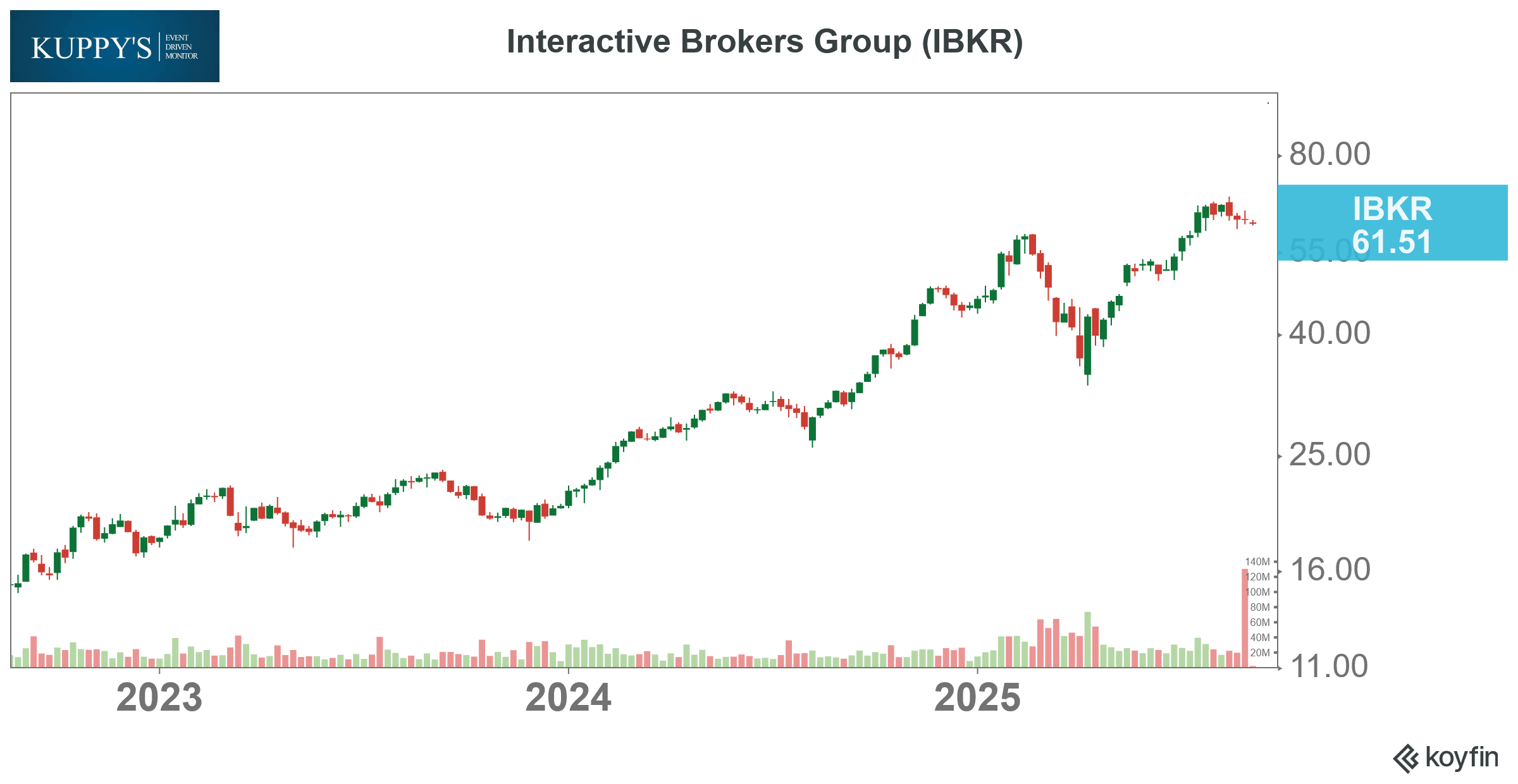

Index Addition / Deletion Monitor: IBKR finally got the nod to enter the 500 as S&P dragged their heels around their $80b tied up in partnership units. Lets see if Peterffy uses the 500 flows to loosen his grip and hit the bid as he has expressed concern at this market overall…

Subscribe Now for More Event-Driven Opportunities

Kuppy’s Event Driven Monitor scans over 20 corporate events for market moving information and distills them into our propietary “Kliff Notes.” One profitable trade should more than cover an annual subscription and access to the Event Driven chatroom!