Some highlights from this weekend’s Event Driven Monitor

Have a friend with an ED (“Event-Driven”) problem? Forward this newsletter to them and they can sign up for their own ED fix right to their inbox:

NEW USERS RECEIVE A FREE 4-WEEK TRIAL

The Event of the Week

We are still trying to dig out of our inbox and deliverables after 3 months of being on the road, so bear with us as we get our head back into KEDM’s macro themes. In the meantime, hedge fund letter season is fast approaching and we are gearing up for pages of deep value sh*tcos pitches and fancy numbers that prove being down 20% is still a win because they did it with less volatility and risk.

That said, we do get some value skimming the thoughts of the industry. There is a small subset of managers out there that still crush it and earn their fees. KEDM introduced our Letter Monitor a couple years ago to highlight some of these managers and their thoughts…

Click below to see where those Funds will flow to next and were KEDM will be kicking tires…

Subscribe Now To Keep Reading…

Kuppy’s Tweet of the Week

Chart and Kliff Note of the Week

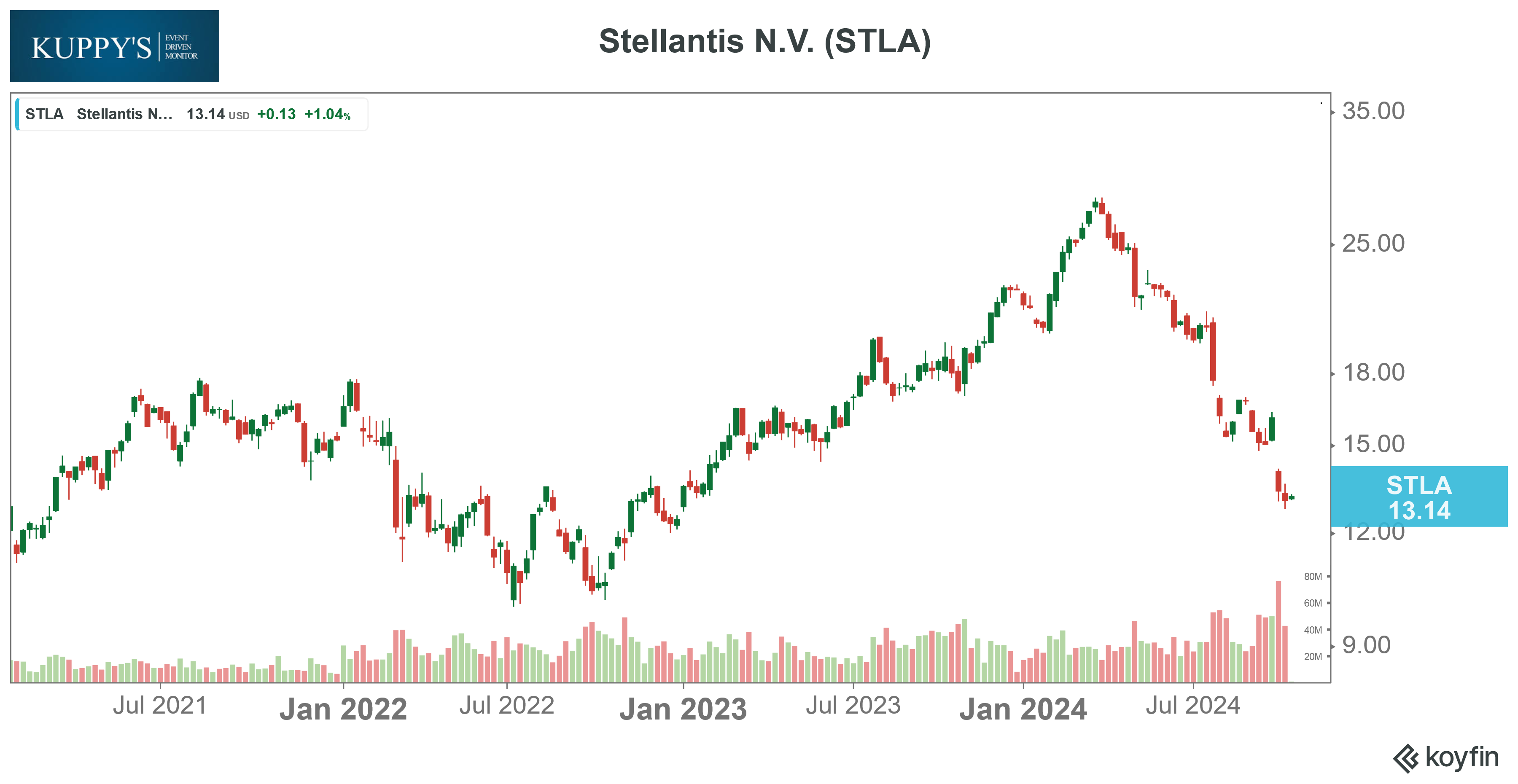

CEO Turnover Monitor: The STLA CEO announces his retirement in 2026 shortly after an absolutely brutal cut to guidance last week. The new head will have a tough fight to recover share globally and reset the business. If the buyback keeps plugging away there could be a nice future setup should they emerge from their adapt or die moment.

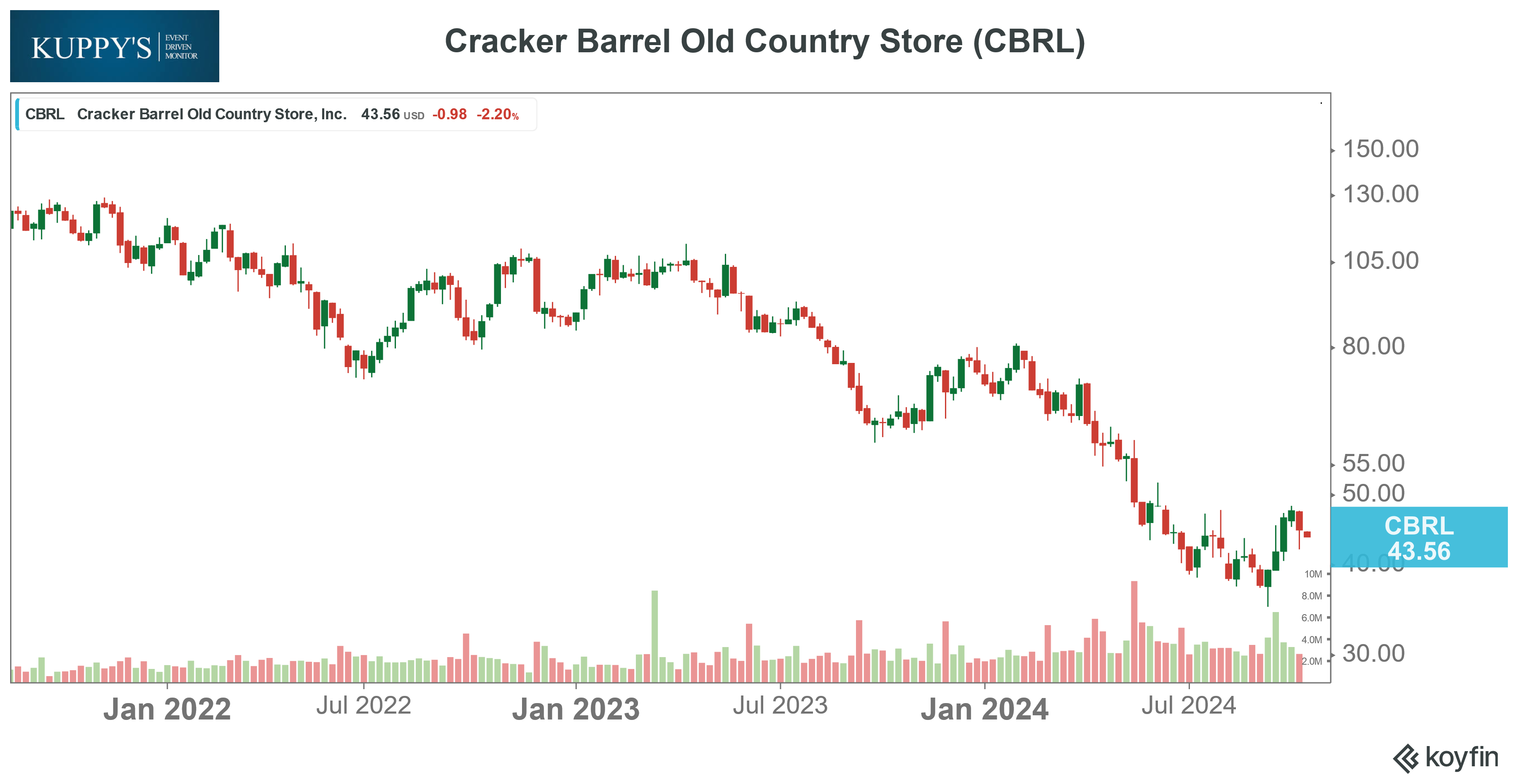

13D Monitor: Cracker Barrel gains as activist investor Biglari Capital (9.3% owner) sent a letter to the board. TLDR Biglari wants CBRL to find a buyer for Maple Street Biscuits, stop investing in new stores, trim the fat on store level costs and buy back shares.

Subscribe Now for More Event-Driven Opportunities

Kuppy’s Event Driven Monitor scans over 20 corporate events for market moving information and distills them into our propietary “Kliff Notes.” One profitable trade should more than cover an annual subscription and access to the Event Driven chatroom!