Some highlights from this weekend’s Event Driven Monitor

Have a friend with an ED (“Event-Driven”) problem? Forward this newsletter to them and they can sign up for their own ED fix right to their inbox:

NEW USERS RECEIVE A FREE 4-WEEK TRIAL

The Event of the Week

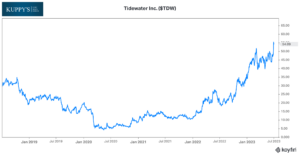

Talk about good timing. Bob’s largest holding ($TDW) broke out to 5-year highs the day of our interview with him…

This week in KEDM we broke down our 17 biggest takeaways from the KEDM members only happy hour with Bob Robotti. Here are a few of our favorites…

1) On inflation – The continued migration from China to North America will require new building and this supply build out will have inflationary impacts. There is a capital cycle that’s underway across the globe that will drive price pressures. This is sticky, not transient.

2) On “Globalization 2.0 – Not Just China” – This is the internal title at Bob’s firm for their view on reshoring and friend shoring. While many focus on the geopolitical and social reasons why these shifts are taking place he argues that shifting competitive advantages have a lot to do with it. Just like investors who have a frozen understanding of industries that adapt and evolve people have failed to properly evolve their understanding of China as the economy has shifted. Incredibly cheap labor previously made up for higher energy costs. While still cheaper than western labor, the gap has narrowed such that energy costs may be the driving factor of cost concerned international industrial companies.

3) On China’s Economic Weakness – China is the 800lb gorilla. China in a recession is not the permanent state of affairs in general. Globalization 2.0 means businesses are moving out of China. It’s the same thing that happened to America 20 years ago, 40 years ago. Businesses moved out of America. {But} The American economy grew. The Chinese economy is going to do something different – it is just a mature economy that’s internalizing that has its own consumption, but economic activity will continue to grow in China and power consumption will probably continue to grow in China.

Subscribe Now To Keep Reading…

Kuppy’s Tweet of the Week

Rising long-end yields aren’t exactly the fireworks most are expecting…

Chart and Kliff Note of the Week

CSV – Funeral home and cemetery operator Carriage Services announced strategic review, after receiving an all cash proposal from Park Lawn Corp. Look, we have been following this company since COVID, as a play on excess mortality, however the high leverage have been a mood-killer. This offer and the strat-review make sense to us, as the CEO/Founder Melvin Payne (age 82) himself could soon be a customer of Carriage Services, and we are having a difficult time imagining his millennial kids are thrilled to run this delightful business. Keep an eye.

Subscribe Now for More Strategic Alternative Events

Friends of KEDM

- Needless to say the price movement in oil has surprised us through the first half of this year. Our friend Paulo Macro admitted the same, broke down what he thinks has been going on in the oil market and updated his current view of risk reward in oil in this Twitter thread.

- While we were busy chatting offshore with Bob Robotti last week, Brandon Beylo at Macro Hive also hosted Lake Cornelia Research Management for their own discussion of offshore services. Quite the timing for this episode with the massive Friday rally in most offshore names…

Kuppy’s Event Driven Monitor scans over 20 corporate events for market moving information and distills them into our propietary “Kliff Notes.” One profitable trade should more than cover an annual subscription and access to the Event Driven chatroom!