Some highlights from this weekend’s Event Driven Monitor

Have a friend with an ED (“Event-Driven”) problem? Forward this newsletter to them and they can sign up for their own ED fix right to their inbox:

NEW USERS RECEIVE A FREE 4-WEEK TRIAL

The Event of the Week

As you know, we’ve turned bearish. We’re not raging bears, because of “Project Zimbabwe” and all of that stuff. In fact, we think equity markets are dramatically higher, looking out a few years. That said, we think there’s a stumble first, and while everyone is getting excited about 25 or maybe even 50bps of Fed cuts, we are old enough to remember our share of Fed cut rallies, followed by a deluge in the equity markets.

If Jackson Hole really is the top of this rally (or the grind into NVDA earnings is), then we’ll fail around here and turn lower. In retrospect, it will seem almost obvious…

With that in mind, we took a certain interest in two transactions that happened last week. Some people, are just really good at this investing game…

Subscribe Now To Keep Reading…

Kuppy’s Tweet of the Week

Chart and Kliff Note of the Week

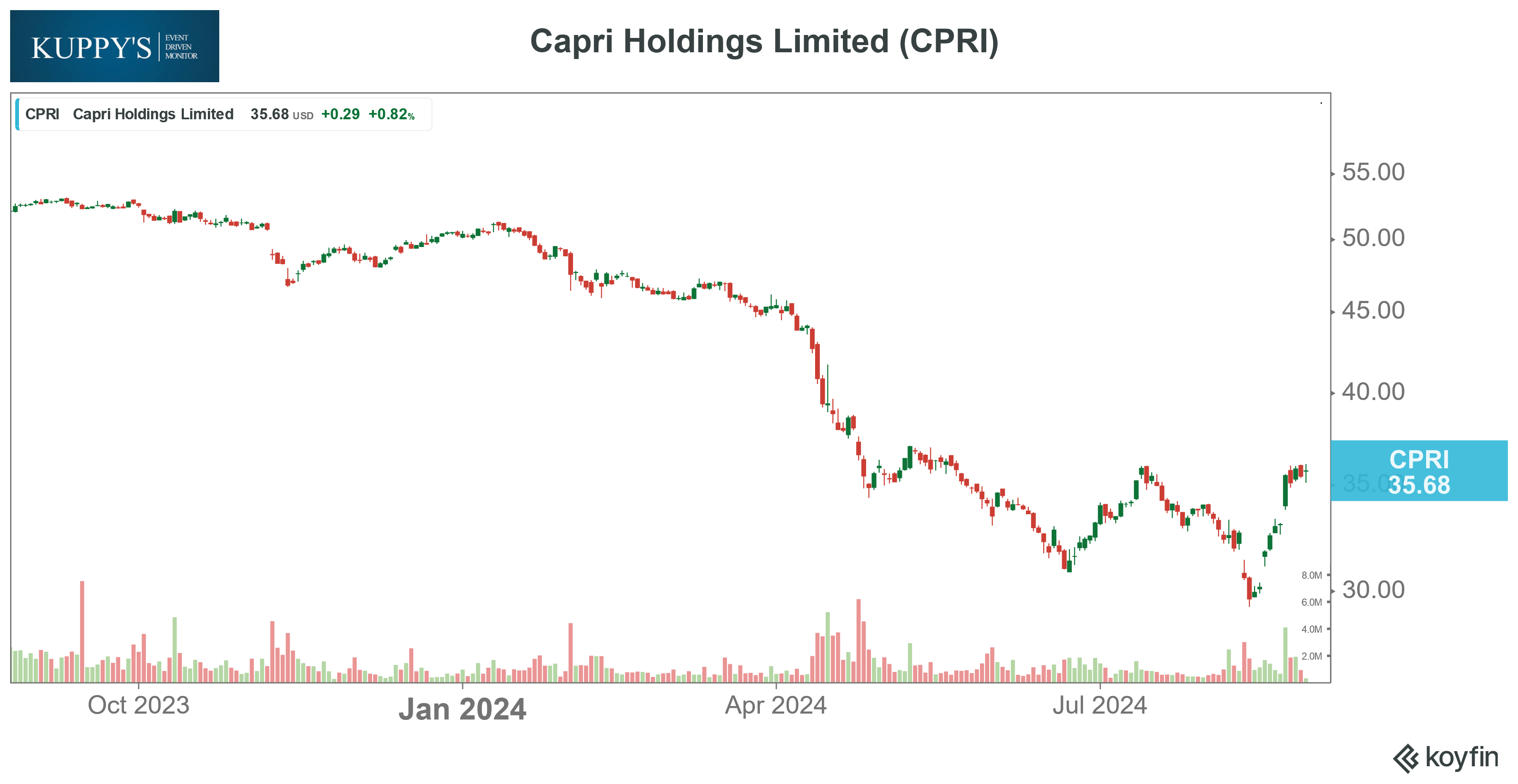

This week, CPRI / TPR filed a motion in defense against the FTC. We are not antitrust lawyers, but the case ‘makes sense’ to us traders. We have been hitting the deal when the spread was 80%. This week, the spread is at 60%.

Subscribe Now for More Event-Driven Opportunities

Kuppy’s Event Driven Monitor scans over 20 corporate events for market moving information and distills them into our propietary “Kliff Notes.” One profitable trade should more than cover an annual subscription and access to the Event Driven chatroom!