Some highlights from this weekend’s Event Driven Monitor

Have a friend with an ED (“Event-Driven”) problem? Forward this newsletter to them and they can sign up for their own ED fix right to their inbox:

NEW USERS RECEIVE A FREE 4-WEEK TRIAL

The Event of the Week

BTC to Gold Ratio Looking Toppy

BTC has converted a new generation of reddit-loving, anti-fiat crusaders to the markets. Once baptized, it’s a sticky mindset and one that use to lead to all things gold. Nowadays, there is a full suite of coins and sh*tcoins, all battling for that incremental dollar, and sucking the funds out of the pet rock. But what happens when crypto momo flips and selling begets selling? Products with no intrinsic have no CF to fall back onto and are simply perception-driven ponzis.

Do these new converts simply lose their new anti-fiat religion?? Will the newly religious begin losing money in their cults and shake their anti-fiat mindset? Or simply maintain their religion and turn to another sect that’s been around since 1500BC? The BTC to gold chart below looks pretty “toppy” and can speak to fund flows…

Subscribe Now To Keep Reading…

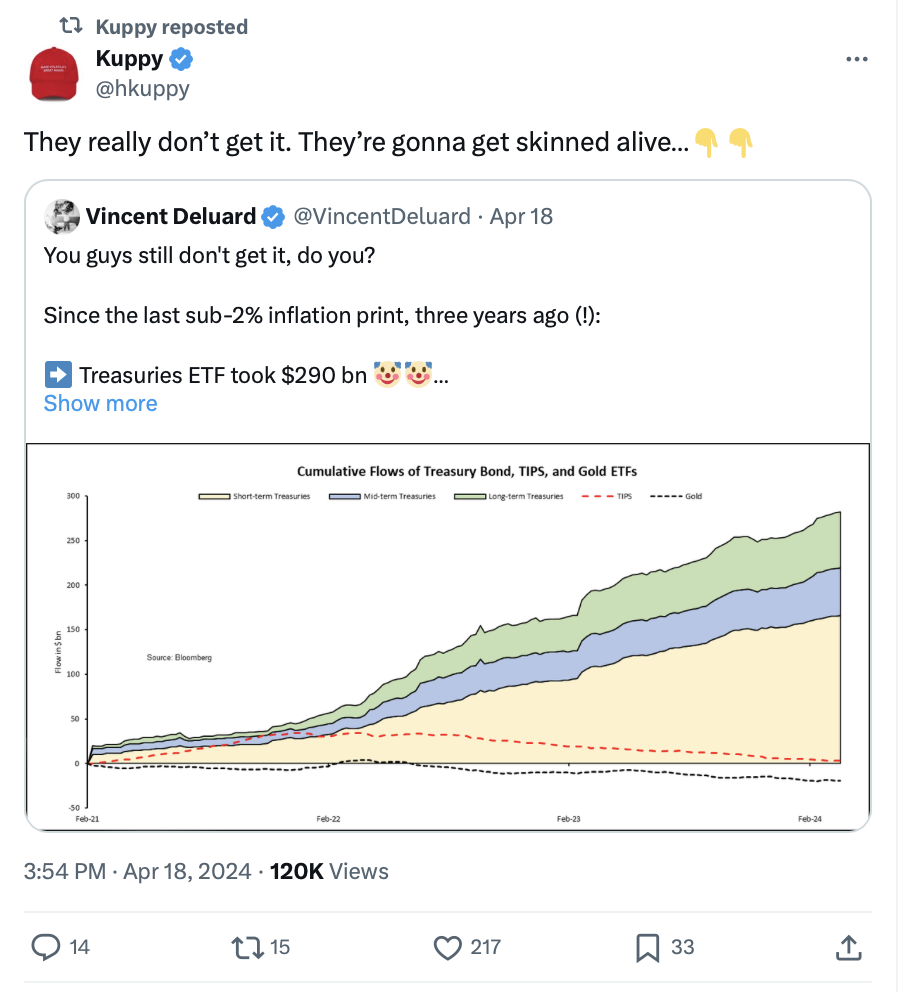

Kuppy’s Tweet of the Week

Treasury ETFs Have Taken in $290b While Gold ETFs Lost $20b

Chart and Kliff Note of the Week

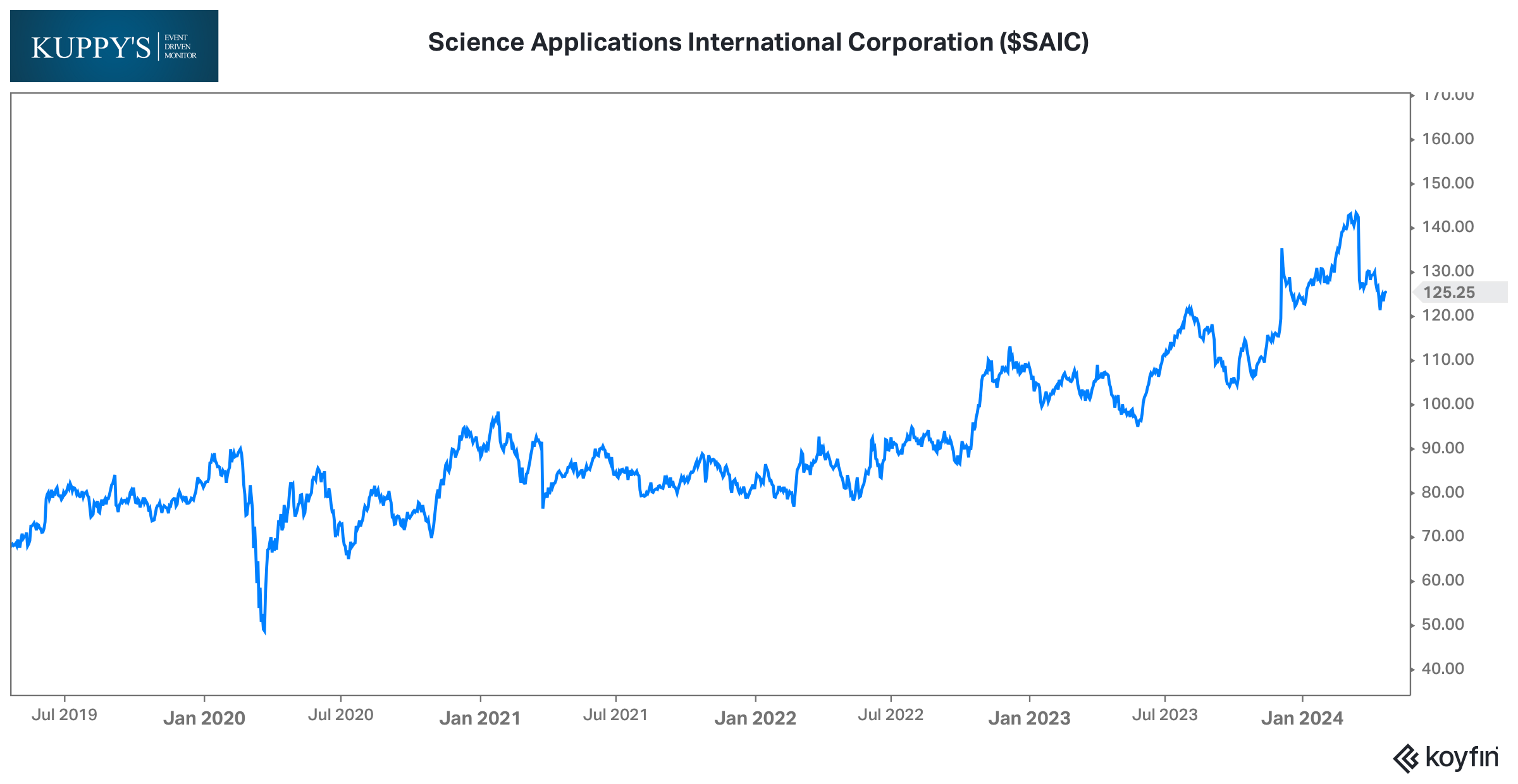

Above our market cap threshold, but insiders bought at Science Applications International Corporation (SAIC). The GC bought ~$13K worth. The EVP (Air Force, Combatant Commands) bought ~$100K worth. The new CEO bought ~$378K worth. A director sold ~$95K worth on 4/12/24. Per the 10K: The company is a leading provider of technical, engineering and enterprise information technology (“IT”) services primarily to the U.S. government (Army, Air Force, Navy, Marines, Coast Guard, Department of Defense, NASA, etc.). The new CEO as of October 2023, was hired from Microsoft, where she held the position as President, U.S. Regulated Industries. In December of 2023, she implemented a business reorganization plan with the goal of “optimizing strategic pivots and increasing organic growth” at SAIC.

Subscribe Now for More Event-Driven Opportunities

Friends of KEDM

- We’ve been so focussed on Gold we haven’t spoken too much about one of our other favorite themes… offshore! Our friend Tommy Deepwater put together a great writeup “Good Assets, Bad Balance Sheet” looking at a handful of “sub scale” drillers that might be interesting M&A targets.

- Two active KEDM subscribers in our Discord channel (Brandon Baylo and Erik Renander) got together for a podcast this past week looking at how higher inflation affects financial markets more broadly with a look at EU banks.

Kuppy’s Event Driven Monitor scans over 20 corporate events for market moving information and distills them into our propietary “Kliff Notes.” One profitable trade should more than cover an annual subscription and access to the Event Driven chatroom!

Subscribe Now