Some highlights from this weekend’s Event Driven Monitor

Have a friend with an ED (“Event-Driven”) problem? Forward this newsletter to them and they can sign up for their own ED fix right to their inbox:

NEW USERS RECEIVE A FREE 4-WEEK TRIAL

The Event of the Week

Have we reached the stage were utilities finally step in to the market?

Look, there are a number of public RFPs out there where not a single producer has even responded. There’s hardly any lbs in the next few years from CCJ or KAP that aren’t spoken for. If you need lbs, you need to do venture capital and back a junior and hope the damn thing produces. The spot market has been cleansed of lbs and now the producers are missing their targets too. Imagine how scary that must be for a utility when your inventory is drawing down and no one will even pick up the phone. There’s an old saying, “If you’re going to panic, make sure you panic first.” We think that someday soon, a utility will sweep the book for a few million lbs, then every other utility is going to be forced to follow…

Subscribe Now To Keep Reading…

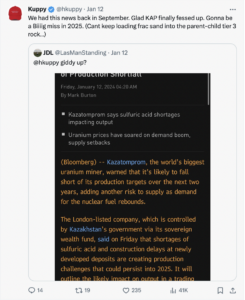

Kuppy’s Tweet of the Week

What pushed U in to overdrive on Friday? Only the world’s largest producer finally coming clean about production misses.

Chart and Kliff Note of the Week

It has not been a strong IPO market of late both for volume and price. Flagging this one from old KEDM homebuilder theme…

The US homebuilder in the Southeast – Smith Douglas Homes, SDHC, priced its IPO at $21 per share. The shares opened higher and trading well above the IPO level. S1 filing here.

Subscribe Now for More Event-Driven Opportunities

Friends of KEDM

- Our good friend Paulo Macro is going out on his own and has started a Substack. You can read his thread outlining the move from Twitter to Substack. Of course, you can still find him from time to time in the KEDM Discord.

- While we all focussed our attention on Bitcoin ETFs and uranium’s move higher, last week’s inflation report flew under the radar. Our friend Kevin Muir went on Forward Guidance this week to remind us all and discuss why he thinks inflation and not recession is the biggest risk facing markets.

Kuppy’s Event Driven Monitor scans over 20 corporate events for market moving information and distills them into our propietary “Kliff Notes.” One profitable trade should more than cover an annual subscription and access to the Event Driven chatroom!