Some highlights from this weekend’s Event Driven Monitor

Have a friend with an ED (“Event-Driven”) problem? Forward this newsletter to them and they can sign up for their own ED fix right to their inbox:

NEW USERS RECEIVE A FREE 4-WEEK TRIAL

The Event of the Week

But we are back in the saddle, and excited to pop a Medalla, and catch up with TWO planned KEDM Happy Hours in the coming month!

We couldn’t think of a better guy to have on than the ax of financials, Gator Capital’s Founder and CIO, Derek Pilecki! Prior to launching Gator, Derek was the PM and Co-Chair of Goldman Sachs Asset Management Growth Equity team, and before that, he was an analyst at Clover Capital, Burridge Partners, and spent some time at FNMA on the investment portfolio side. He knows this space, to say the least…

Moving onto a trend that’s suddenly become interesting, we want to chat briefly about currency pegs. As you’re well aware, certain hedge funds have made their careers out of breaking currency pegs. However, we aren’t going to be looking at those. Instead…

Subscribe Now To Keep Reading…

Kuppy’s Tweet of the Week

Chart and Kliff Note of the Week

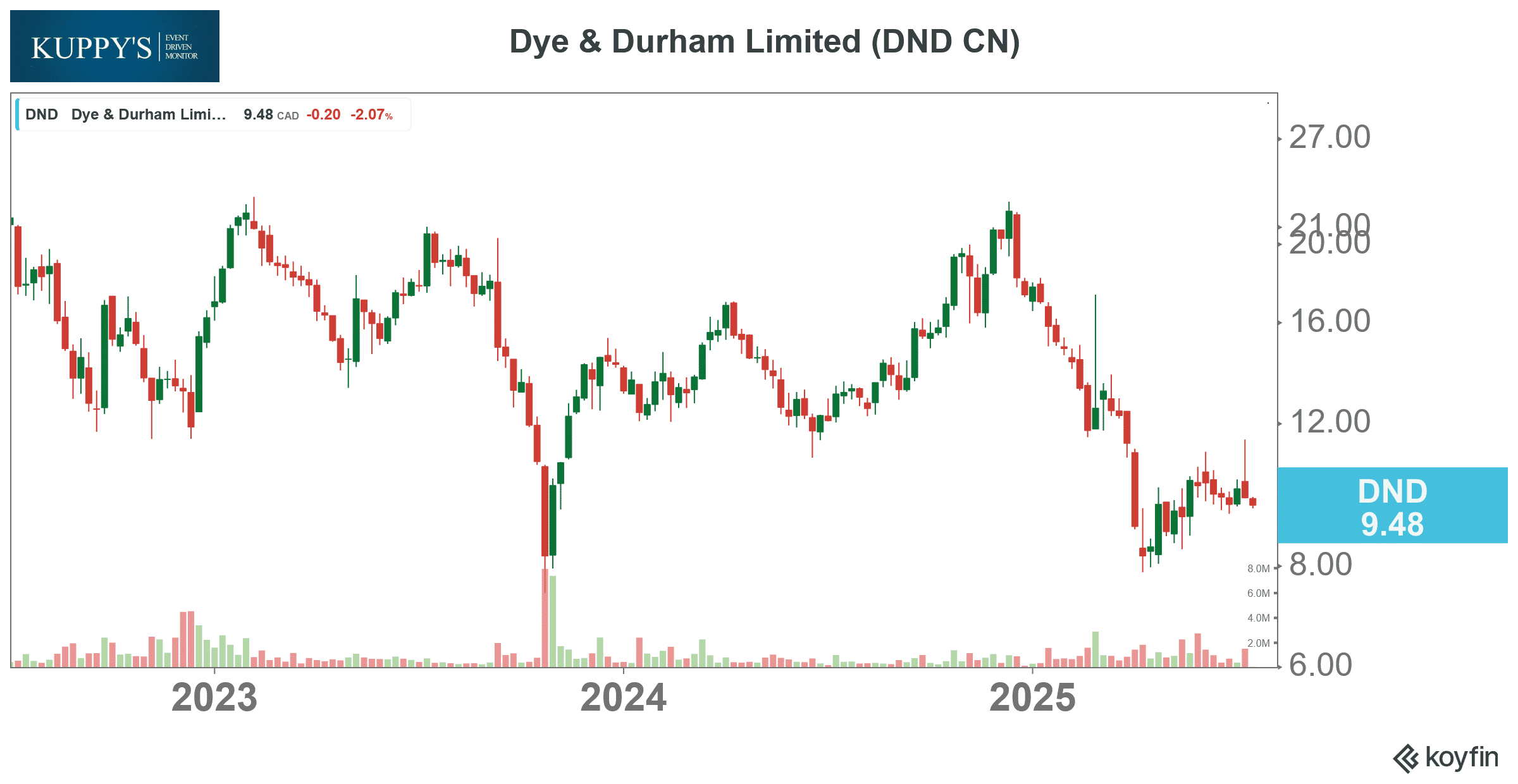

M&A Monitor: The proxy fight between the management of Dye & Durham (DND CN) and one of its largest shareholders, with 11% ownership, Plantro, is ongoing. Plantro urges the company to hold the EGM, and eventually needs to be sold in order to transfer the full value to shareholders. Reportedly, the Board is evaluating options. Worth a look

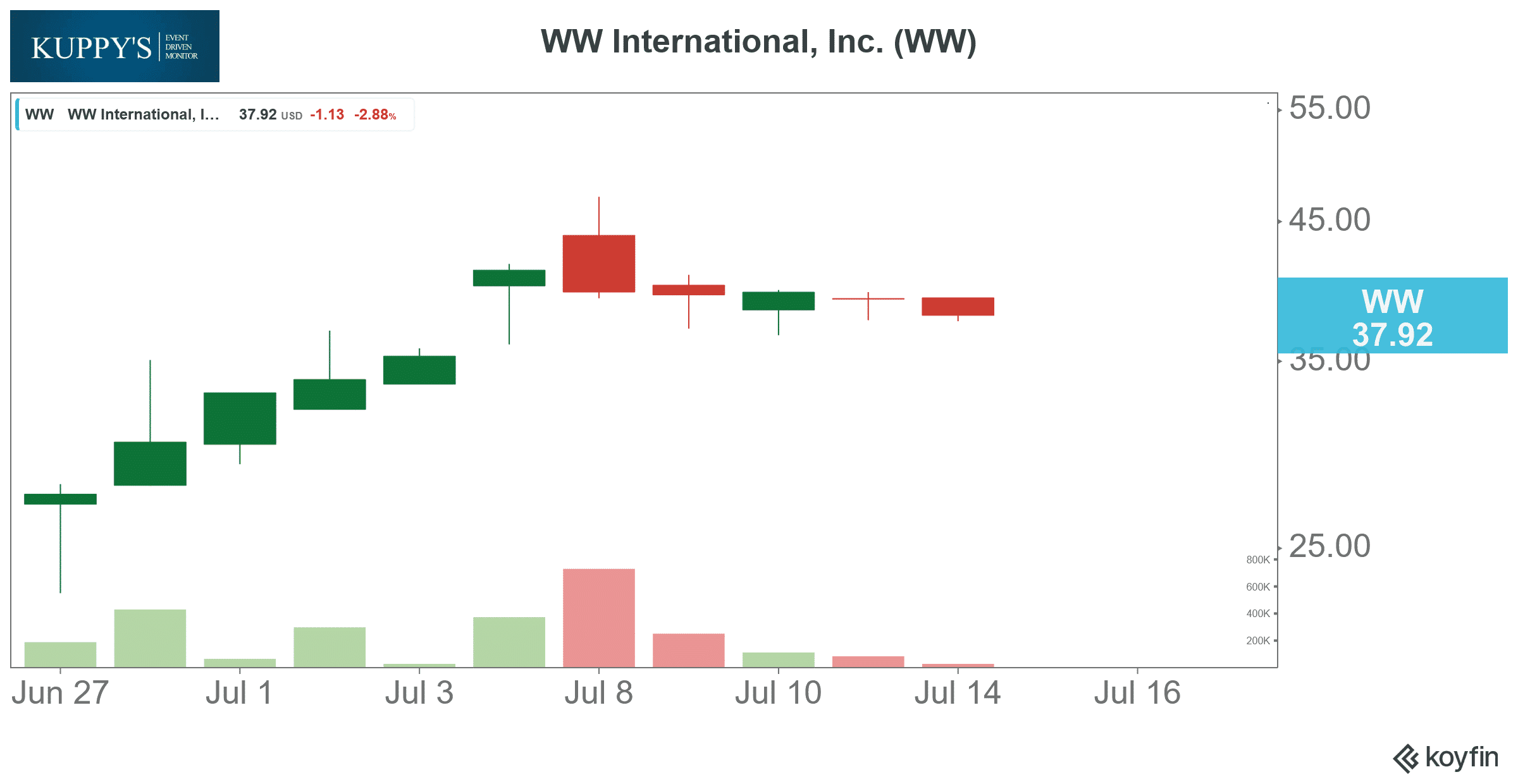

Bankruptcy Exit: WW International, got off to a hot start as it floated under WGHW on 6/17 before officially wrapping up bankruptcy and listing under WW on 7/8. WW is riding GLP-1s as they’re coming out of bankruptcy, especially with the recent missteps from competitors. Their capital structure might actually let them, now that they’ve shed $1.15bn of debt. WW emerges with $465m of new debt and equity interest holding 9% of the 10m shares outstanding. At $40/share, this puts WW at ~$700m EV on ~$130m of EBITDA stated in its disclosure statement. WW does expect to be FCF positive, with any cash above its $100m balance being used to pay down debt.

Subscribe Now for More Event-Driven Opportunities

Kuppy’s Event Driven Monitor scans over 20 corporate events for market moving information and distills them into our propietary “Kliff Notes.” One profitable trade should more than cover an annual subscription and access to the Event Driven chatroom!