Theme of the Week

Hong Kong Property

Long before it was popular to announce to your shareholders that you were pivoting to a bitcoin treasury strategy, every HK-listed company had a real estate investment business.

And for about three decades, who could blame them? Hong Kong property only went one way. Every crisis: the Asian Financial Crisis, SARS, and the Global Financial Crisis were all buying opportunities. And it made sense. Hong Kong’s favorite national pastime wasn’t horse racing; it was buying property with maximum conviction.

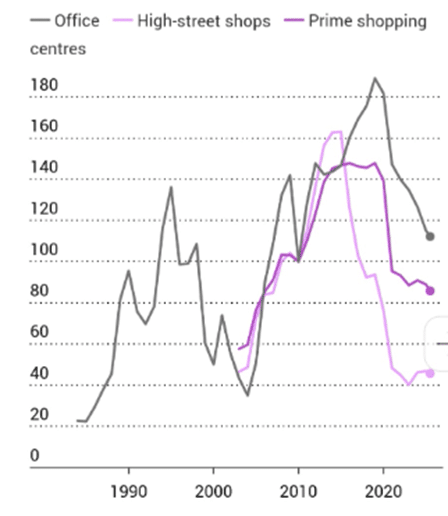

The current downturn, however, has been different. You can practically timestamp the top of the last commercial real estate cycle. In 2018, Li Ka-Shing’s CK Asset sold The Center, a literal skyscraper in Central, for HKD 40 billion.

The first shoe to drop was the 2019 umbrella protests, which prompted foreign firms to relocate their Asia headquarters elsewhere, such as Singapore. Then came Covid, further destroying the idea that you need big towers with small cubicles to write emails.

Finally, HK followed America’s lead in the rate increases between March 2022 and July 2023, which put the final nail in the coffin. The protests pushed companies out, COVID eliminated the need for offices, and higher rates crushed the economy. Three consecutive blows, each worse than the last.

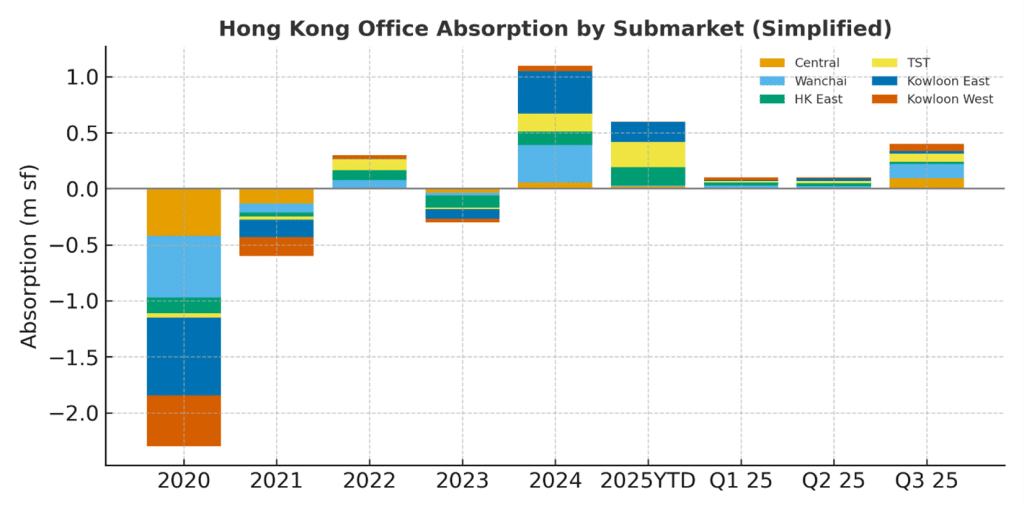

Unsurprisingly, the result looks like a slow-motion margin call. Prime offices are down about 50% from the 2018 peak, rents are down 23%, and vacancy is north of 13%. Net absorption has been negative for years at roughly -2.9 million square feet since 2020.

But cycles don’t stay frozen forever. So why are we bullish on HK real estate?

For starters, let’s look at the supply situation. Newspaper headlines will tell you there is still an ample supply coming online between now and 2028. But if we zoom in, we see that 2026 is the last year with significant supply (1.4m sq ft), followed by a sharp drop starting in 2027. There are some 2027 completions in Kowloon, which shouldn’t really impact property prices in Central.

Absorption of this new supply has been slowly recovering. Q3 actually came in at +0.4m sq ft, helped by a recovering HK IPO market and financial industry. Will HK be able to absorb 1.5m sq ft of new supply annually? (read the full note at http://www.kedm.com)

Kuppy’s Tweet of the Week

Kliff Note of the Week

Spin-off Monitor: Barrick Mining’s Board, B, is allowing management to explore an IPO for its North American Assets.

This includes JV interests in Nevada Gold Mines and Pueblo Viejo, as well as the wholly-owned Fourmile Gold Discovery in Nevada. The IPO would be of a small minority interest, with B holding the large majority interest and control.

Cluster Insider Buy Monitor: Insiders (mainly the CEO) continue to buy shares over at SmartRent (SMRT). The shares are staging a clear rebound, and much more could come if the company continues its track towards profitability.

2024 and 2025 were tough years, and the promise is that 2026 will be better. IF that pans out, and operating losses are reduced, this one could move much more.

Downside risk seems pretty mitigated with c. 30% of the market cap in net cash. Also, as a reminder, Shareholder Land & Buildings Investment Management has been pushing SMRT to explore a sale of the company. L&B believes SMRT could fetch a premium of up to 100%. Relatively new CEO.

Another one with interesting insider action is Alight (ALIT). The stock has been an absolute disaster, dropping from $8 to $2 in roughly a year.

At the same time, open-market sales stopped and were replaced by purchases, which recently accelerated. Alight sold its Professional Services segment in 2024 and strongly delevered the balance sheet, now a 3x vs 6x a few years ago.

There should also be strong margin improvements on the back of a big cloud migration and efficiency movements. Momentum is still poor, but certainly worth keeping an eye on.

CEO Turnover Monitor: Daktronics (DAKT) has a new CEO! This is big news. The first non-family leader in the company’s history, and by all accounts, a major upgrade.

He brings deep manufacturing and operational experience and is reportedly eager to bring discipline to a business that has long been under-organized and inefficient (and that’s putting it nicely). Now we might see a new CFO next, and hopefully increased engagement with investors ahead of the first-ever 2026 investor day.

We also note the strong order book growth over the past few quarters, indicating another nice jump in growth and earnings ahead. Healthy net cash balance sheet, ~7x forward EV/EBITDA, new management, some buybacks… this one could soon start moving in the right direction again.

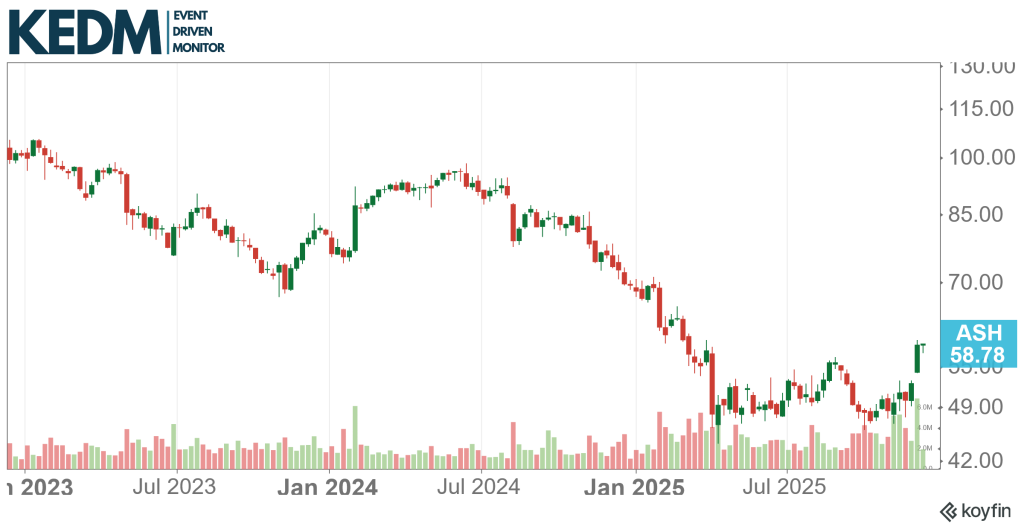

13D Monitor: Standard Investments reported a 9.9% stake in ‘specialty’ chemicals company Ashland (ASH).

While they are now only ‘in discussion’ with the company, we bet something more will happen here. Still at ~$100 a year ago, the share price collapsed as a deteriorating macro-economic environment had a nasty impact on earnings and sentiment.

But margins remain healthy, and so should cash flow generation. And unless you believe that Industrial chems are dead (so never again construction, coatings, etc.), the cycle will turn at some point. If that takes time, we’ll probably see divestments. In the meantime, Ashland will continue to buy back shares.

M&A Monitor: Mattress firm Somnigroup (SGI) makes a non-binding offer for Leggett & Platt (LEG) in an all-stock transaction with the exact ratio to be agreed (according to LEG), or $12 / share (according to SGI).

LEG’s activities are a step down the supply chain for furniture and mattresses, with a near-monopoly in adjustable bed frames. Look, mattress manufacturing is a low-value-added business that shouldn’t really happen in the USA if it weren’t for tariffs. But mattress sales have been in a downturn since 2022, and current sales seem to be worse than in 2009.

Existing housing transactions are hovering around 4 million per year, well below the historic average of 5 million, as people are locked into their current residences because of mortgage rates. At $11, LEG is only trading at ~11x 2025 (trough?) P/E.

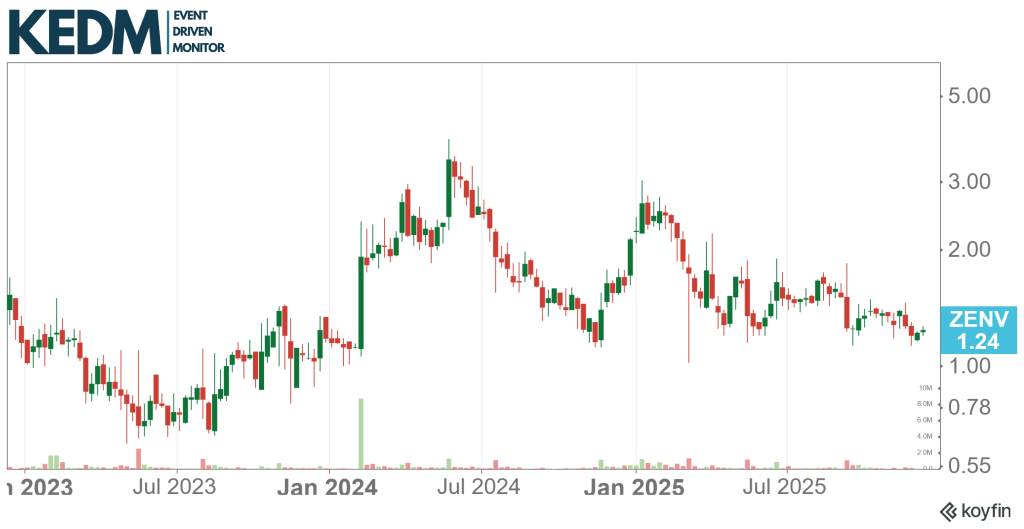

Strategic Alternatives Monitor: Interesting developments at Zenvia (ZENV). Early this year, Zenvia pivoted its focus to SaaS and AI and has been assessing potential asset divestments.

It recently announced that it will internally separate its CPaaS business, which will have its own tax ID and governance structure. This screens as preparing the business for a sale; quite a big change, as this unit accounts for over 70% of revenues (but just over 40% of GP).

This would also mean the company will start reporting more KPIs for its SaaS business, showing the market’s attractiveness of its SaaS proposition.

Rights Offering Monitor: Theon International (THEON) is launching a €150m rights offering, issuing new shares at €17.40 (vs ~€28.25 today).

The proceeds will be used to strengthen the balance sheet and fund growth initiatives. The defense company is seeing continued strong demand, signaling years of topline growth above 20% ahead. The company benefits from structurally rising European defense spending, as NATO rearmament and long-term procurement cycles provide multi-year visibility.

The company operates in high-spec, mission-critical optronics and night-vision systems, niches with high barriers to entry, sticky customer relationships, and long replacement/upgrade cycles. The rights will be traded under “THERI” between Dec 2 and 11.

M&A Monitor: As we mentioned previously (specifically in Vol. 251), AXTA’s transcript from the 2025 Basic Materials Conference further strengthens our view that AXTA is selling its upside too cheaply.

The deal spread is over 42% and two of the institutional investors in AXTA oppose the merger and specifically stated that they are “very interested” in talking to other potential buyers. Worth tracking the deal.

Other Interesting ED Action: French apparel company SMCP (SMCP) finally confirmed that its 51% controlling stake is officially for sale, ending years of uncertainty and opening the door to a likely change in ownership.

The shares involved (the GLAS-held block plus those recently repatriated from Asia) form a clean control package that would trigger a mandatory bid, giving minority holders a (long-awaited) liquidity path. The company enters this process in decent shape: Sandro and Maje brands remain strong, margins are recovering, costs are tighter, and the shareholder structure is no longer a mess.

At roughly €6 per share, the market isn’t pricing in much beyond the status quo, so any competitive bidding could introduce real upside. Worth keeping an eye on.

KEDM Event Driven Monitor scans over 20 corporate events for market moving information and distills them into our propietary “Kliff Notes.” One profitable trade should more than cover an annual subscription and access to the Event Driven chatroom!