We’re planning another Happy Hour this Friday. Grab a 6-pack as Kuppy sits down with Roderick (aka Roojoo) for our annual KEDM “Year-End Review” and AMA.

Kuppy and Roderick will dive into what worked and what didn’t, and share their outlook for 2026. Then, we will pivot into an open AMA session, so come prepared with your questions!!

Theme of the Week

Private Equity

A couple weeks ago we touched on PE/PC as a ticking time bomb. And as noted, we wanted to get an update on the theme from one of the better analysts we know – Erik Renander over at YWR. Eventually these PE flows will flip to the “next big thing” and Erik zeroes in on the recipient of those flows towards the end.

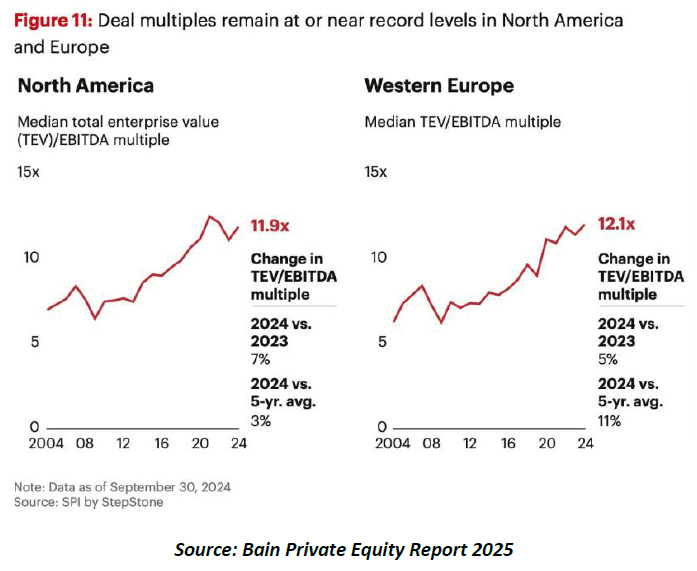

Last year in Anatomy of a Private Equity Train Smash we made a bold call – that private equity would be the worst asset class of the next 10 years. Today we build on that view with the 2024 year-end data plus new insights on the state pension fund industry from Equable.

But it’s not all bad as the Harvard Management Company tips us off to the best performing asset class for the next 10 years. But we get to that at the end.

The Set-Up

Subscribe Now For More Event Drive Oportunities

Kuppy’s Tweet of the Week

Kliff Note of the Week

Cluster Insider Buyback Monitor: If you want to see the meaning of ‘buying aggressively’ by a CEO, look at Charles Cohn’s action over at Nerdy (NRDY). Mr. Cohn is now up to 46.6%. We suspect we’ll see some action here.

Nerdy’s share price won’t see much of a relief from fundamentals anytime soon ioo, as sustainable cash flow generation is still far away, and the threat of AI won’t disappear until the company is actually able to show that AI isn’t a threat (by growing).

But this all makes the aggressive purchases more interesting food for thought.

Announced Buyback Monitor: German WashTec (WSU) has been hitting the buyback button non-stop since early November. WashTec is worth a look: a carwash equipment and services company undergoing a full turnaround under new management.

After a decade of flawed bets on Asia and an overextended US push, a new leadership team, backed by activist shareholders who now effectively own half the register, has reset the strategy. The focus is now on restoring margins in Europe, fixing (or selling) the subscale US operations, and deploying capital more intelligently.

A long-delayed replacement cycle is finally boosting orders, and management thinks EBIT margins can climb into the low-teens by 2027. In short: growth and margin recovery, rerating potential, and (eventually) a good chance of a bid.

CEO Turnover Monitor: Camping World (CWH) announced that Marcus Lemonis will step aside as CEO and Chair, to be replaced by Matt Wagner and Brent Moody.

Under Lemonis, CWH has changed strategic direction roughly once a quarter. They also earned themselves a place on the Wall Street wall of shame for buying back shares during the boom years in the $20s, only to issue new equity a few years later at around $20.

We expect little to change under Wagner – it’s been clear he’s been in charge for a while, as Lemonis seems more focused on BBBY, or on his role as ‘The Fixer’ on Fox, telling business owners how to turn their business around. The current strategy is to cut costs while the consumer continues to weaken. If people ever start buying RVs again, this has a lot of upside.

13D Monitor: Standard Investments reported a 9.9% stake in ‘specialty’ chemicals company Ashland (ASH).

While they are now only ‘in discussion’ with the company, we bet something more will happen here. Still at ~$100 a year ago, the share price collapsed as a deteriorating macro-economic environment had a nasty impact on earnings and sentiment.

But margins remain healthy, and so should cash flow generation. And unless you believe that Industrial chems are dead (so never again construction, coatings, etc.), the cycle will turn at some point. If that takes time, we’ll probably see divestments. In the meantime, Ashland will continue to buy back shares.

13D Monitor: Jana Partners is pushing Alkami Technology (ALKT) to pursue a sale, arguing the fintech platform is materially undervalued after a sharp share price drop.

At first sight, Alkami looks like your typical not-yet-profitable / disgusting share-based comp / a ton of open market sales company. That said, this thing actually has an interesting offering, which makes continued ~20% organic growth and high customer retention very probable over the next years. Also, we’ve seen funds getting more active in the market and taking significant stakes (ao, General Atlantic). We would not be surprised to see some action here.

M&A Monitor: Worth flagging that Tiptree (TIPT) shareholders recently approved the sale of Fortegra to DB Insurance. This remains an interesting sit.

In short, Tiptree is selling its core operating asset, insurance co Fortegra, for roughly $1.8bn in gross proceeds. This will result in the Tiptree almost entirely consisting of cash and treasuries with a pro forma NAV >$24 per share versus ~$18 today.

The CEO owns roughly 27% and other insiders another 13% or so. There isn’t much opex in the business after the sale, so we could see some movement as the deal reaches closing.

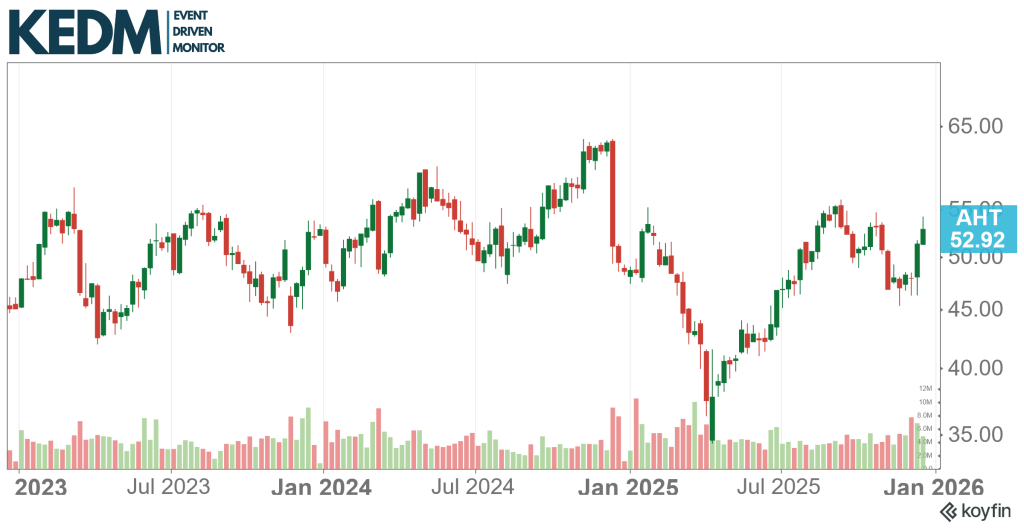

Listing Changes Monitor: Ashtead (AHT) recently confirmed that the NYSE relisting from London remains on track for March. They also announced a $1.5bn buyback and even started hitting the buy button the day before they sent out the press release.

The shares have traded sideways for a few years as end markets soured, but returns and profitability remained healthy.

Strategic Alternatives Monitor: More of a liquidation, NET Lease office Properties (NLOP) remains interesting. NLOP has now eliminated all non-mortgage debt and paid out $7.20 per share in special dividends, with the remaining portfolio generating roughly $60-65 million of annualized NOI.

The estimated remaining value is about $445 million. With debt gone and significant price discovery, downside risk has fallen meaningfully (despite missing out on earlier dividends).

The current liquidation value is estimated at roughly $33.5 per share, versus a ~$25.5 stock price, with $214 million in sales in process that could return $10-14 per share near term.

Other Interesting ED Action: Zedcor (ZDC) is an interesting company to look at. Zedcor is scaling quickly as a vertically integrated mobile security operator whose surveillance towers are steadily displacing far pricier, less reliable on-site guards.

Churn is essentially nonexistent, margins are strong, and U.S. expansion is gathering momentum with major customers already on board.

With fast tower paybacks, attractive unit economics, and a still-nascent North American market, revenue can compound at a very high rate while gross margins above 60% create meaningful operating leverage. Shares sit around ~10x FY27 EV/EBITDA. Very decent.

Other Interesting ED Action: For the segment ‘we need to bring back the Fallen Angels monitor’, Wolters Kluwer (WKL). 15 years of steady and low-risk compounding, followed by -45% in 2025, basically fully driven by AI fears. The best part is that it’s not even visible in the numbers! And the question is, will it ever?

Wolters recently organized an ‘AI teach-in’ to highlight that it is not just catching up to AI but already scaling it across core franchises. The company is embedding AI everywhere and is seeing clients not only stick around but also upgrade.

With retention around 95% and 80% of revenue coming from enterprise contracts, management argues its moat is actually widening as proprietary datasets, compliance requirements, and long-term customer relationships make generic GenAI tools poor substitutes. It is probably too soon, given the negative momentum, but a good one to keep on the watchlist. LDD forward EV/EBITDA is just too low for a company of this quality.

KEDM Event Driven Monitor scans over 20 corporate events for market moving information and distills them into our propietary “Kliff Notes.” One profitable trade should more than cover an annual subscription and access to the Event Driven chatroom!