Theme of the Week

Year-End Review

Reflecting on our own year, it’s been a good year for the home team, and hopefully for our KEDM subscribers. We’ve covered a long list of new themes in 2025 (none of which were recommendations, so no victory laps if it worked and no walk of shame if it didn’t).

Some themes show early signs of working: Hong Kong real estate is rerating as rental prices stabilize, and Hibor is hitting new lows. Macau Casinos have seen growth re-accelerate since last summer. Refiners are benefitting from elevated crack spreads, as Russia finds out how drone-resistant its refining capacity really is.

The US Critical Mineral Security Act, together with higher gold and silver prices, is indicating a renaissance in US mining activity. And finally, US Automotive is slowly receiving recognition as a tariff winner, even though Ford saw its largest aluminium supplier burn down, impacting their production. Uggh, car manufacturing remains a terrible business…

Some themes hit early roadblocks, and we have since changed our thinking: iGaming is clearly noticing the competitive impact of prediction markets. DKNG and FLUT might launch their own prediction markets to compete, but that won’t stop hold rates from coming down. We are not sticking around to find out how this will end.

We discussed Elder Care in 2023, and next year will mark the first baby boomers’ 80th birthdays. Our preferred way to play this: the senior living facilities (WELL, VTR, BKD, SNDA) did very well in 2025, and we believe this sector is due for its own deep dive, which we’ve got planned for next year.

Rather than discuss every theme in detail here, we have uploaded the full video of our year-end Happy Hour with Kuppy (CIO Praetorian Capital) and Roderick (CIO Night Watch Investment Management) to the website.

Regardless of how well we all did in our portfolios, we almost certainly did better than Main Street, which enjoyed a short 6-day winning streak in April before realizing again how much they’ve lost in spending power over the last few years.

Whether it’s the sale of houses, sports boats, sneakers, or furniture, the US consumer seems tapped out, and every year, when we think it can’t get any worse, consumer spending continues to surprise to the downside.

Fortunately, the Ministry of Truth has declared an end to inflation. Drug prices are down by 1500%. Egg prices are down, beef prices can be hedonically adjusted using CPI, and there has been no bad private-sector employment data since the head of the BLS got fired.

The US has clearly moved into a new paradigm, and we recently re-read the book 1984 to better prepare us for what is about to come. As every candidate for Federal Reserve President seems eager to show by how much they can cut interest rates, US Monetary policy will almost certainly switch more dovishly in 2026. Will Trump finally get to ‘run it hot’ in 2026? (continue reading kedm.com).

Subscribe For More Event-Driven Opportunities

Kuppy’s Tweet of the Week

Kliff Note of the Week

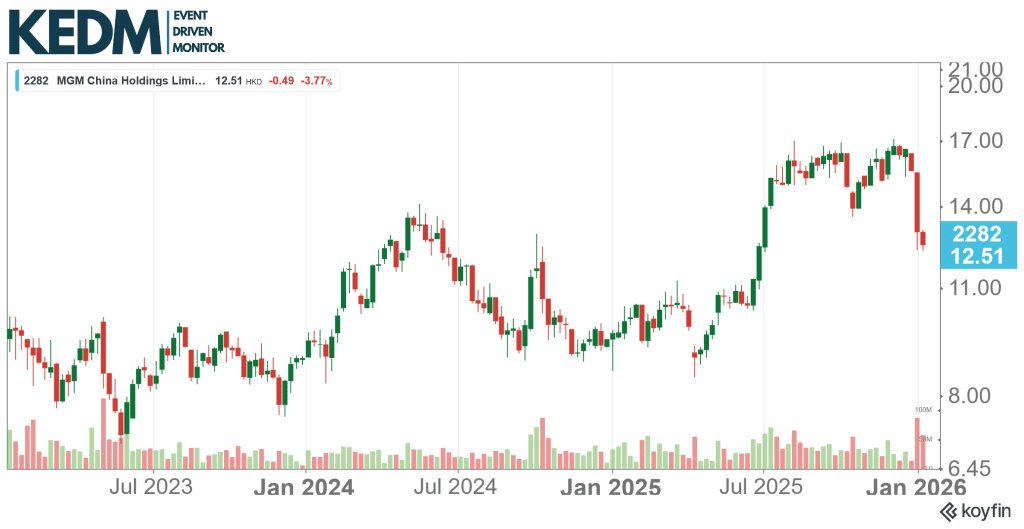

Inflection Monitor: MGM China (2282.HK) reported on Christmas Eve that it will increase the License fees it pays to MGM Resorts from 1.75% to 3.50%. MGM is a 56% shareholder. License fees will now make up 14% of EBITDA.

By comparison, Sands China and Wynn pay license fees of 1.5% and 3% respectively. As always, the real challenge in China is finding a company that doesn’t abuse its minority shareholders, and having a company controlled by a US entity is clearly no guarantee that your money won’t disappear into someone else’s pocket.

Cluster Insider Buy Monitor: Hirequest (HQI) keeps popping up in different monitors. After announcing a buyback program equal to ~40% of the free float, CEO Richard Hermanns has been scooping up shares around $9-10.

There have also been rumors of HQI wanting to acquire competitor TrueBlue, but maybe their buyback will now be prioritized? HQI is highly exposed to labor demand in the light industry, such as construction, and claims that the influx of immigrant labor has hurt its business over the last few years. Is this about to reverse?

Announced Buyback Monitor: Insiders have been buying on the open market over at the old KEDM flag, Butler National (BUKS). Always good to see insiders buying after strong price moves, and even better when the shares are at multi-decade highs. A relatively small purchase but interesting nonetheless.

Butler services casinos and the aerospace market (why not). And it’s mainly the latter that is performing quite well. Plenty of aircraft need (military) modification. ~6x annualized EV/EBITDA (though EBITDA can be lumpy), at very strong margins.

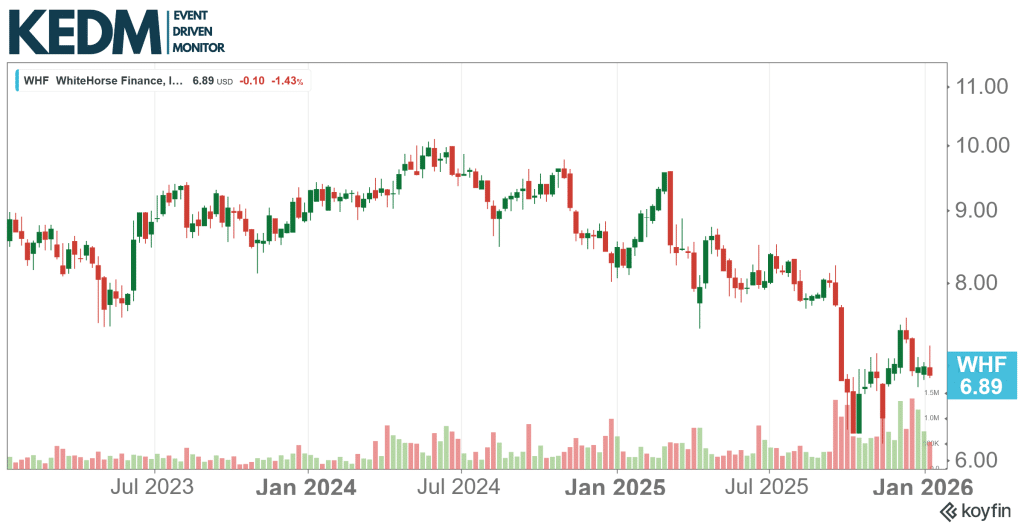

Announced Buyback Monitor: In the category ‘rummaging through the trash’, WhiteHorse Finance (WHF) has seen insiders buying, and quite in size.

WHF is a lower-middle-market lender that sold off sharply due to increasing concerns about portfolio quality and earnings durability. Add downgrades and growing skepticism about the sustainability of WHF’s dividend, and you get a strong discount to NAV, now at roughly 70% (on the latest reported NAV).

This used to be a decent company; perhaps (probably) too early, but this one could move strongly should the situation even stabilise.

CEO Turnover Monitor: Lee Enterprises (LEE) closed a $50m private placement at $3.25 per share, with David Hoffman assuming the role of Chairman.

LEE was earlier exploring a rights issue. Proceeds will be used to pay down debt and lower the interest paid to Uncle Warren from 9% to 5% for 5 years. Existing shareholders get diluted by roughly 70%. CEO Kevin Mowbray is set to retire and will be replaced by COO Nathan Bekke on an interim basis.

CEO Turnover Monitor: Following the announcement of strategic alts for its consumer beauty business, COTY replaced its CEO with P&G veteran Markus Strobel. COTY has been deleveraging its balance sheet (still 3x ND / EBITDA) and will focus on its Prestige Beauty business. They expect to return to growth in H2 of FY2026.

13D Monitor: Syuppin (3179.JP) shareholder VIS Advisors has called an EGM for January 22nd to propose three new outside directors, aiming to force management to exit or downsize the capital-intensive, underperforming luxury watch segment and refocus resources on the highly profitable used camera business.

Management has countered with its own capital markets-focused nominee. Either way, shareholders win.

13D Monitor: We’re continuing to follow the action at Humm Group (HUM.AX). Activists Jeremy Raper and Collins have set an EGM for February 19th, where they will seek to remove 3 of the current 4 directors and elect Jeremy Raper and Garry Sladden. Both insiders and activists are continuing to scoop up shares in order to secure more votes.

Other Interesting ED Action: This is another one for our Liquidations Monitors (we’re still working on it). Apartment Investment and Management Company (AIV), or just Aimco, closed the $520m sale of the Brickell property just before Christmas.

A reminder that Aimco is liquidating with the intention to return capital to shareholders. They also announced the sale of another two properties at $155m, expected to close in Q1.

And this comes after the Chicago asset deal for $455m announced on Dec. 12. Very strong sales momentum. Worth keeping an eye on.

Other Interesting ED Action: Norma Group (NOEJ) appears mispriced following the recent sale of its Water Management arm for €840m, roughly equal to the company’s enterprise value. And there’s still the Mobility and Industry divisions, which should be worth quite a bit themselves.

The disposal gives Norma significant funds for debt reduction and sizable buybacks. And there’s also activist Teleios (at roughly 21%) pressing to extract value. Execution risks on reinvestment and cyclical exposure, but the sale and valuation provide an interesting base

KEDM Event Driven Monitor scans over 20 corporate events for market moving information and distills them into our propietary “Kliff Notes.” One profitable trade should more than cover an annual subscription and access to the Event Driven chatroom!