Theme of the Week

December is a month when many investor days are organized. We have been diligently tracking those investor days in our Investor Day Monitor, and we believe such events can be a rich source of alpha, though they always require additional research.

From attending many of those events, we have learned over the years that there are roughly two reasons why a company organizes an investor day. On the one hand, you have companies that host such an event annually and invite their analysts to 1 or more days of presentations, followed by a factory tour and a fancy dinner. The fact that those events are organized annually makes them less exciting: no company has something completely new to share each year.

Multi-day events in fancy tourist destinations where they will serve you ample amounts of foie gras are not uncommon. Attending such an event makes it difficult for a sell-side analyst to assign anything other than a ‘strong buy’ rating to the stock, but at the same time, it tells the company’s shareholders how they spend their dollars. These are not the companies we are after.

On the other hand, some companies organize an investor event only when they have something exciting to share. They might not have hosted such an event in 5 years, or, in some cases, it’s their first-ever investor event.

No company goes through the trouble of inviting 50+ shareholders to an in-person event to present bad news. Those events take months of planning. When they organize such an event, they have a message to tell. And when they do, we’d better listen. We love companies that seem stagnant for years, with their stock going nowhere. And then suddenly, change is happening, and they feel the need to tell us about it.

Case Studies

Let’s look at some investor days that worked well.

Western Digital Corp (WDC) hosted an investor day in February 2025, while its competitor, Seagate (STX), hosted one in May. The companies operate in a near-monopoly (Toshiba is a distant 3rd player) in Hard Disk Drives (HDD). Let’s focus on WDC, because the ED angle is more obvious (continue reading on our website).

Subscribe Now For More Event Drive Oportunities

Kuppy’s Tweet of the Week

Kliff Note of the Week

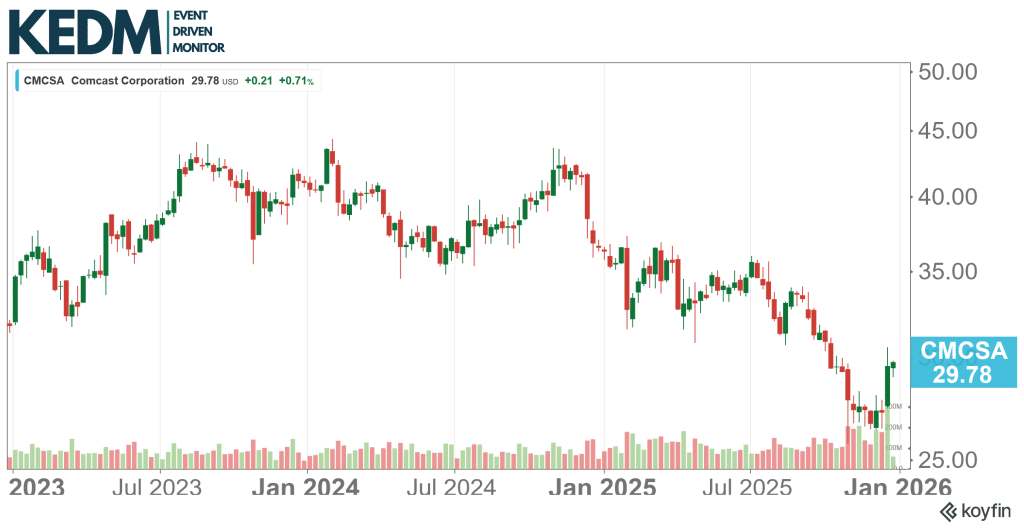

Announced Spin-off Monitor: Comcast’s (CMCSA), spin-off Versant (VSNT), starting when-issued trading this week, closing at $47/share (albeit on low volume). This translates to a ~$6.8bn market cap and ~$9bn enterprise value for VSNT.

The SpinCo forecasts FY26 EBITDA to be between $1.85bn and $2bn, meaning VSNT currently sits around 4.5-5x EV/EBITDA. This will be interesting to watch as the Paramount-Netflix-Warner Bros saga plays out, since Netflix’s current bid hinges on WBD’s valuation of its linear network.

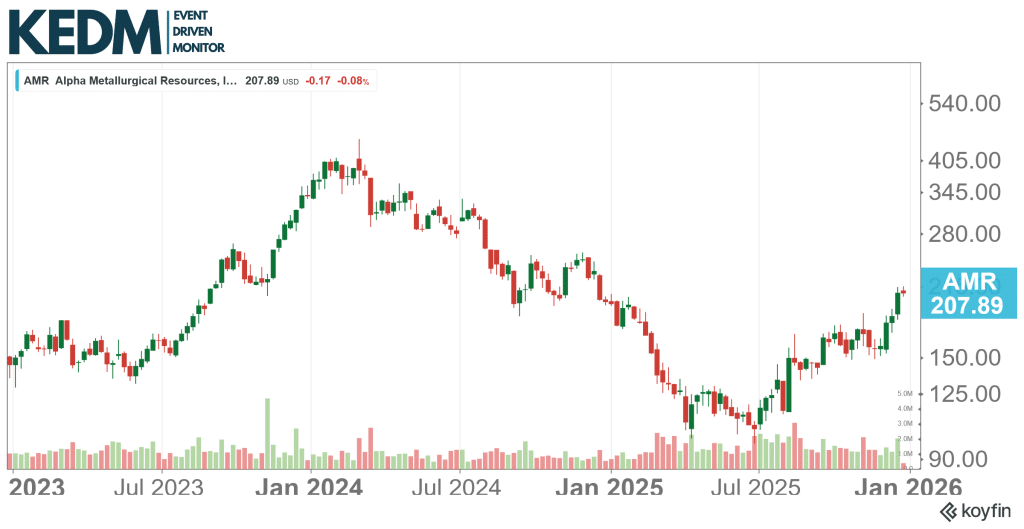

Cluster Insider Buy Monitor: A few directors have been aggressively buying shares on the open market at Alpha Metallurgical Resource (AMR). Just over $9m a few days ago, for a total of roughly $18m this month alone.

The shares bottomed in June and are close to hitting 52-week highs. This comes after a big run in 2023 on massive tailwinds. Earnings seem to be normalizing, and the company did a good job improving its balance sheet and buying back shares.

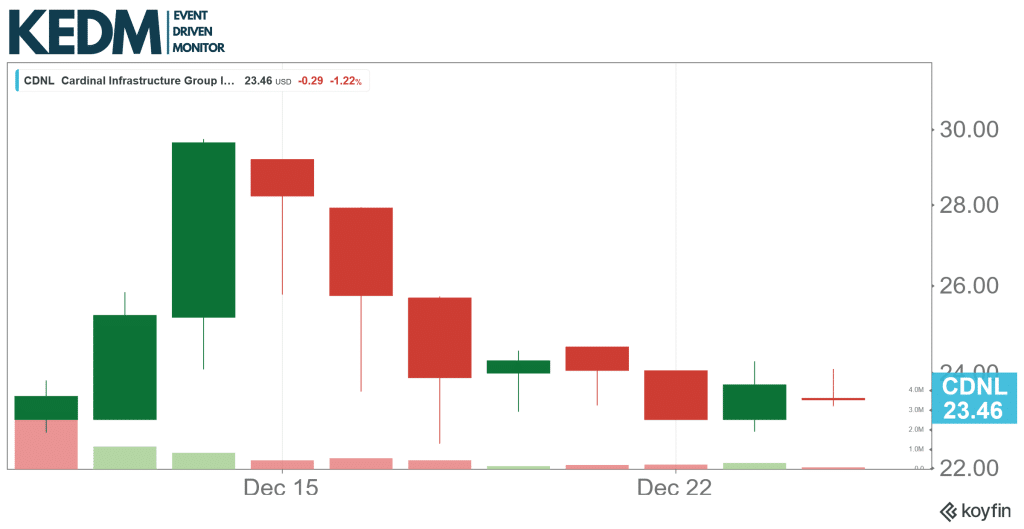

Cluster Insider Buy Monitor: Cardinal Infrastructure (CDNL) just listed, and insiders are already out buying. You don’t see that often. Good business with secular tailwinds. Also, large market fragmentation; Cardinal has been actively consolidating the market, though conservatively.

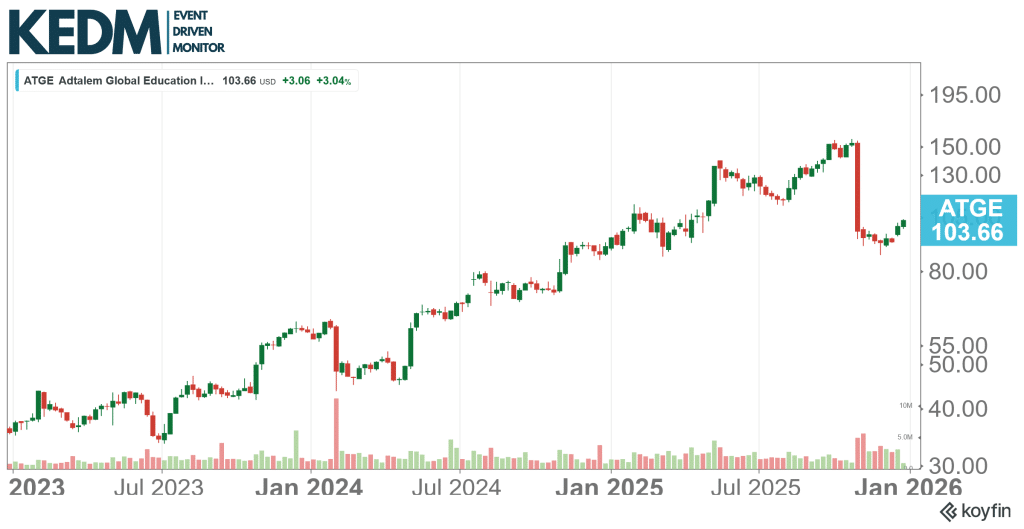

Announced Buyback Monitor: Adtalem (ATGE) announced a $750m buyback, roughly 20% of the current market cap.

Very strong performance over the past few years, but the stock recently experienced a major correction, mainly due to lower-than-expected enrollment growth in Chamberlain’s post-licensure programs (which should impact the next few quarters as well).

But growth, profitability and cash flow generation continue to move in the right direction. The balance sheet is improving each quarter, while the share count continues to decline. Is a LDD P/E fair here?

CEO Turnover Monitor: Not a CEO change, but Brad Jacobs is stepping down as Chairman of both XPO and GXO Logistics to focus on building materials distributor QXO.

QXO today isn’t much more than the former Beacon Roofing, just with Brad at the Whelm which apparently justifies a huge premium. It is clear they’re going after some large acquisitions. We wonder if BLDR is a realistic target.

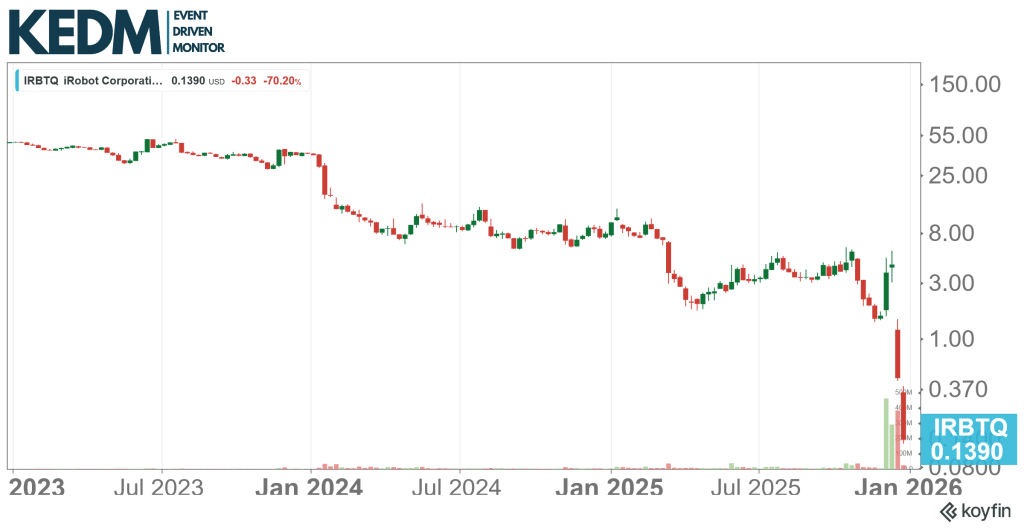

Bankruptcy Monitor: iRobot (IRBT) filed a prepackaged Chapter 11, with its Chinese manufacturer, Shenzhen Picea Robotics, set to take control of the company.

This is the last act in the series of blows for iRobot, from the failed Amazon deal to the increased competition and tariffs.

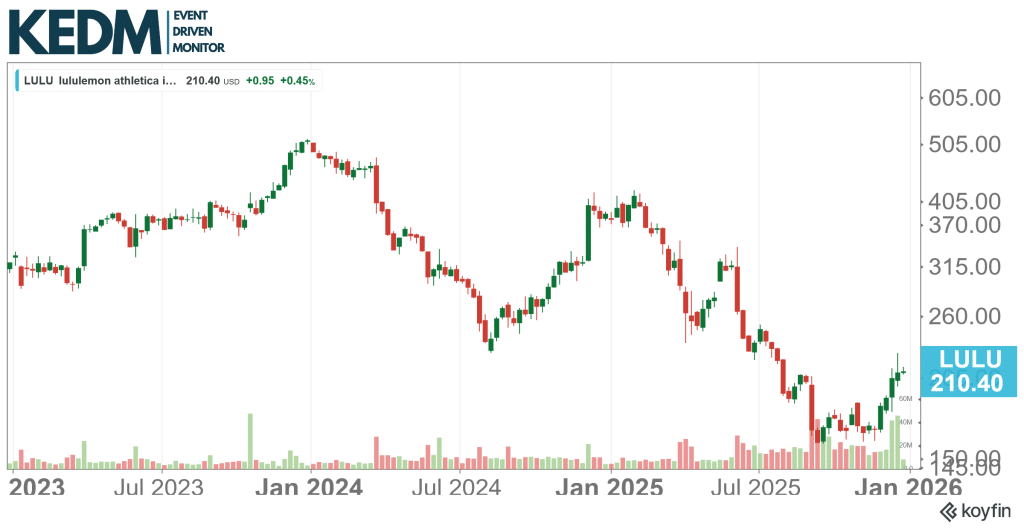

13D Monitor: Elliott has disclosed over $1 bil in exposure to Lululemon (LULU) and is pushing to influence the company’s CEO transition and appoint an ex-Ralph Lauren exec. The company was once trading at x30, but has lost its ‘hype’ and is now doing a CEO transition.

Interestingly, a number of funds had a write-up on the company in Q3 with mostly bullish tone (Vision Capital, Eagle Point Capital, Middle Coast Investing, and JB Global Capital), and it is in our Buyback Monitor and entered into 13D this week. Worth looking at the company.

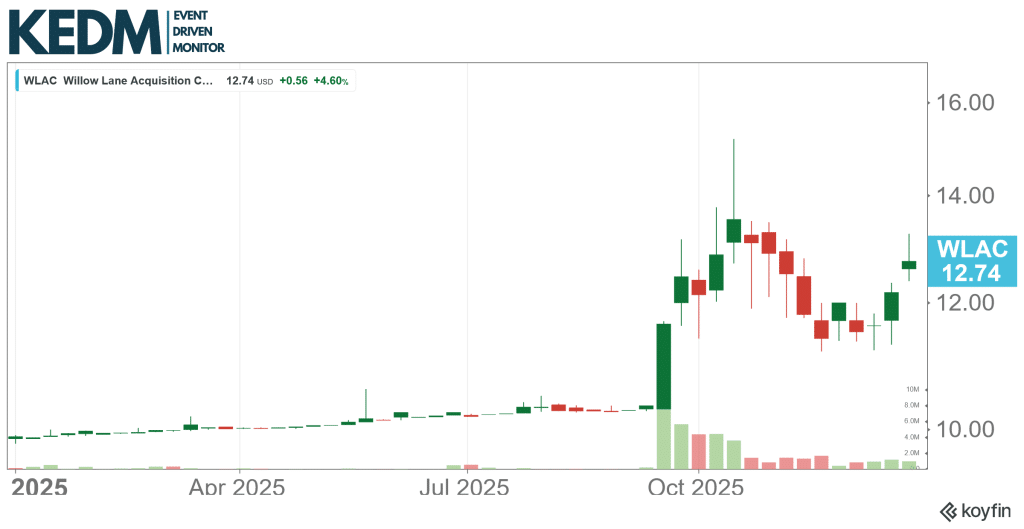

Completed SPACs Monitor: Willow Lane Acquisition (WLAC) is merging with Boost Run, a profitable AI-infrastructure “neocloud” operator growing rapidly with ~80% EBITDA margins.

Boost Run is projecting roughly 500% revenue over 2026 (from a low base) and c. $140m EBITDA. There’s a 2-year, $127m Fluidstack contract that secures a big chunk of revenue over the next few years, with more in the pipeline.

WLAC trades at ~4.5x 2026E EBITDA (it’s a SPAC), quite below peers like CoreWeave and Nebius. SPAC NAV floor of ~$10.60 (pre-merger). Could be very interesting (if you believe that the entire AI infrastructure space won’t collapse next year).

13 Activist Monitor: Be Brave continues to hammer the Buy button at Univance (7254), now at ~5%.

Operations are relatively cyclical (transmission units for motor vehicles) and there hasn’t been much (read, any) growth over the past years, but Univance did a good job protecting margins and cash flow generation.

Even more, despite the shares doubling since Oasis began buying, the company remains a net-net, with the market cap reflecting only current assets and investments, net of total liabilities. 1.5x TTM EV/EBITDA.

M&A Monitor: If you haven’t followed the action at Humm Group (HUM), you should take a look. Humm is under heavy shareholder pressure after mishandling recent takeover interest.

The company previously engaged with Abercrombie’s 58ct p/s (low-ball) bid without performing a broader market check, and recently disclosed that it basically just sat on a new, better offer (77ct p/s from Credit Corp) for nearly a month! We have seen director disputes over accounting, delayed financials, executive departures (including the CFO’s recent departure), and criticism of inconsistent disclosures.

As a reminder, KEDM friend Jeremy Raper has recently increased his stake in the company and is pushing strongly to oust current management. Still ~4.5x earnings (ex-cash) with peers trading at 10-13x. Expect more from activists.

KEDM Event Driven Monitor scans over 20 corporate events for market moving information and distills them into our propietary “Kliff Notes.” One profitable trade should more than cover an annual subscription and access to the Event Driven chatroom!