Theme of the Week

Revisiting Private Equity

It’s said that markets don’t usually crash from equity bros doing really stupid things, but they usually crash from debt bros doing really stupid things.

With that in mind, we should probably talk a bit about PE, especially as the charts are starting to break. And the same can be said of large BDCs who lend to PE.

We first started noodling on this back in April 2025, and even had one of our favorite analysts, Erik Renander (also a Happy Hour guest), chime in with a guest post back in 2024. We think this is still early innings but a very big deal, hence us coming back to topic. Credit and illiquidity has a funny way of creating spillover effects that few can predict.

Essentially, if your BDC marks are below par, it implies the equity is worthless—which would be existential for many of the larger PE shops who to date have taken very few losses during the four-decade everything bubble. Remember it’s not a loss until you sell, right??? Market to model is great… until you reach for liquidity!

Maybe, we should go back in time. When PE started about 5 decades ago, smart scrappy guys would buy underperforming assets from larger companies, put a few turns of debt on it at very high rates, then work hard to turn these assets around. It was risky, but the rewards were massive. There is a reason that the early vintages of these funds had such great IRRs, especially as there were so few buyers for these dysfunctional assets.

Now, fast forward to today. Apparently there are more PE funds than McDonalds in USA (19,000 vs 14,000). There are no unique and unloved assets that need fixing. Instead, there are public auctions where every firm kicks the tires, then pays top dollar.

No longer is it about fixing a company, it’s about levering up and buying Beta in a bull market. As funds have gotten larger, the smaller quirky deals stopped even moving the needle. The big boys buy big assets, and usually well-run assets.

As with everything in finance, you can improve returns by adding leverage—so they have. Then they marked them to model, raised additional funds and put this thing on cruise control for a decade—or until they’re supposed to give the capital back.

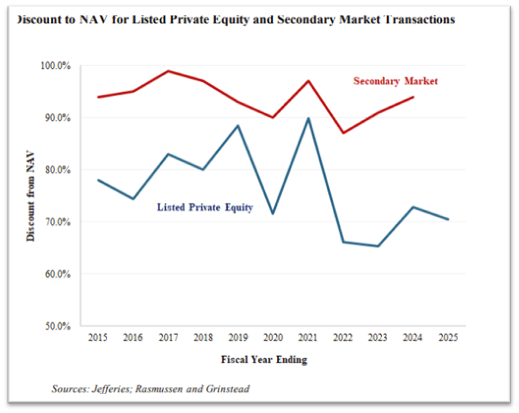

The issue is that the internal marks are above where they are in the actual market. Their PE peers no longer want to pay 15x EBITDA for an HVAC rollup with declining revenues, so they can’t sell it laterally to another PE fund.

They can’t sell it into the market, as larger public players trade at lower multiples. They can’t sell it to a strategic, because the value is also too high. It’s stuck. They’ll extend & pretend via continuation funds, but eventually there is a liquidity event, and that’s what we’ve all been waiting for. Where are the real marks for this stuff??

We’ve been amazed at how many of the schlocky companies we invest in, openly claim that they want to do M&A, but can’t buy from PE because the valuations make no sense and cannot buy privately owned assets because PE will outbid them.

Why would a larger and more diversified public business be worth 5 times EBITDA, when the smaller and more fragile PE name is 15 times?? We can think of one that just sold two separate divisions (both underperformers) for multiples that were almost three times the multiple of the mothership.

Look, when one party is acting irrational, you do what you have to do—even if you genuinely want to grow and gain synergies…

Subscribe For More Event-Driven Opportunities

Kuppy’s Tweet of the Week

Kliff Note of the Week

Inflection Monitor: If you’re looking for a way to ‘play’ potential changes in Venezuela that does not involve oil, check out Copa Airlines (CPA). This Panamanian airline connects the Americas through its hub and spoke model: all flights connect in Panama City.

The weaker BRL and loss of Venezuelan flights were a headwind in 2024, which might now both turn into a tailwind. At ~8x P/E, this was arguably undervalued before any pickup in flights to Venezuela. As a bonus, they don’t hedge their fuel costs, so they are effectively short oil.

Cluster Insider Buy Monitor: Just flagging that insiders continue to buy shares over at battered Lakeland (LAKE). This old fintwit darling has been posting a poor quarter after another, and the last one had even the last few bulls throwing in the towel.

Mix effects, tariffs, and acquisition accounting continue to pressure margins. But insiders seem to be signaling ‘thank you’ given the broad buying of shares on the open market.

Revenues are double what they were 5 years ago, but shares hit multi-year lows. This one has multi-bagger potential IF you can figure out here if margins can be recovered.

Announced Buyback Monitor: Simply Foods (SMPL) popped a $200m buyback, roughly 10% of its market cap. Simply, investors had an awful 2025, seeing their shares hammered almost 50%.

Part of this is due to slowing growth and margin pressures, but much of it stems from increased concerns about the impact of GLP‑1, volatile input costs (especially cocoa and dairy), and tougher competition in “better‑for‑you” snacks. Interestingly, looking at the financials, this one does not (yet) scream disaster.

Sure, growth slowed, but margins and leverage cash flow generation remain at healthy levels. In other words, there’s a major disconnect between earnings progression and stock price. One of the two is wrong… which one?

13D Monitor: Four Tree Island Advisory wrote a public letter to Willis Lease Finance Corporation (WLFC), pointing out the strong underperformance versus leasing peers FTAI and AER.

Their letter points to poor reporting with both buy- and sell-side, governance deficiencies, including excessive compensation and management’s indifference to the underperformance.

The Willis Family controls 58% of the shares but they are consistent sellers, so maybe they should care where their shares trade.

M&A Monitor: The John Wood Group PLC (WG/ LN) and Sidara deal is nearing completion – most major milestones have been satisfied, shareholders voted in favor of the merger, and Sidara released $250 mil in financing to John Wood to keep the company afloat.

John Wood is effectively an impaired company that is facing immediate liquidity shortfalls and covenant breaches without the deal. The merger spread is juicy at ~23%.

On the other hand, Sidara is effectively buying a global industrial company for a fraction of its replacement cost. The merger is expected to be consummated in the first half of 2026.

M&A Monitor: TS Shipping Invest is acquiring KNOT Offshore Partners (KNOP US) for $10 p/s, which is ballpark the current share price. Or more specifically, TS Shipping is trying: KNOT had to adjourn its annual meeting as it was not able to reach a sufficient quorum.

This is the THIRD time they’ve had to move the meeting. Clearly, people don’t like the deal. A solution is simple: raise the offer. We wouldn’t be surprised if this happened.

Strategic Alternatives Monitor: Bluefield Solar Income Fund (BSIF) trades at roughly a 40% discount to NAV despite a fully covered 13% dividend and a portfolio of 838MW of UK solar and wind assets.

The fund is currently on sale, with a good chance (according to what we gather) of selling assets above NAV. There’s also additional upside from a 25% JV stake and 180MW of consented development rights.

Indexation changes, possible subsidy cuts, and weaker power prices might hurt, but there’s quite some protection given by hedging and growing inflation-linked revenues. Might we be worth a look.

Other Interesting ED Action: This one should be added to a ‘Strong Discount to NAV’ monitor. It might be a good time to look at NL Industries (NL), a diversified holding company trading at a >40% discount to NAV.

Other than the usual Holdco discount, a large reason for the discount is the company’s (indirect) exposure to titanium dioxide, which has been in a brutal market. But at the current valuation, the titanium dioxide exposure is essentially ‘free’.

Core holdings include a ~$250m stake in CompX International (CIX), a ~$160m position in KRO, a leading global TiO2 producer, $13m in Valhi (VHI), and $55m in unrestricted cash.

We’ve had Chinese TiO2 oversupply pressures (off course), but more normal market dynamics and the current undervaluation might make a good trade.

KEDM Event Driven Monitor scans over 20 corporate events for market moving information and distills them into our propietary “Kliff Notes.” One profitable trade should more than cover an annual subscription and access to the Event Driven chatroom!