Theme of the Week

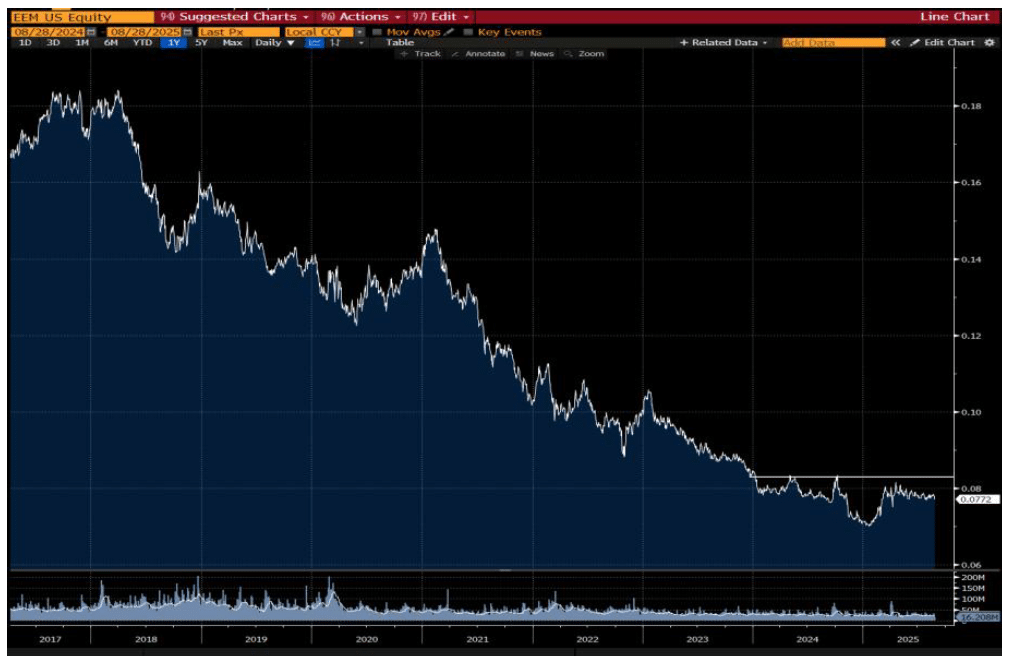

Emerging Markets

Its worth circling back on EM again. In particular, LatAm, which is waking up, is one of our main focuses given the upcoming election cycles. Back in Issues 200 and 210, we laid out our LatAM thoughts. Clearly, our thesis is beginning to play out and the elections are being priced in. The key questions now are: how do things stand on the ground? Is it all priced, or is there room for further upside?

As readers undoubtedly know, this is our favorite setup heading into 2026. It combines extremely high real rates, strong demographics, peaking inflation, and a poorly polling left-wing president, all of which we believe could come together to propel equities higher.

Even though we are incredibly bullish, we fully admit that there are plenty of risks. Lula’s government continues to prosecute former president Jair Bolsonaro and recently placed him under house arrest.

This prompted Trump to escalate tensions with Lula by imposing 50% tariffs on Brazil (though most goods ultimately ended up being exempt) and by sanctioning members of Brazil’s Supreme Court under the Magnitsky Act.

These developments knocked the Ibovespa Index roughly 6.5% over about three weeks and crushed many US-listed Brazilian stocks (and we did promise there would be volatility). Markets eventually rebounded, but there is nothing quite like emerging market antics to put some hair on your chest.

Kliff Note of the Week

Cluster Insider Buy Monitor: Just flagging that insiders continue to buy shares over at battered Lakeland (LAKE). This old fintwit darling has been posting a poor quarter after another, and the last one had even the last few bulls throwing in the towel.

Mix effects, tariffs, and acquisition accounting continue to pressure margins. But insiders seem to be signaling ‘thank you’ given the broad buying of shares on the open market. Revenues are double what they were 5 years ago, but shares hit multi-year lows.

This one has multi-bagger potential IF you can figure out here if margins can be recovered.

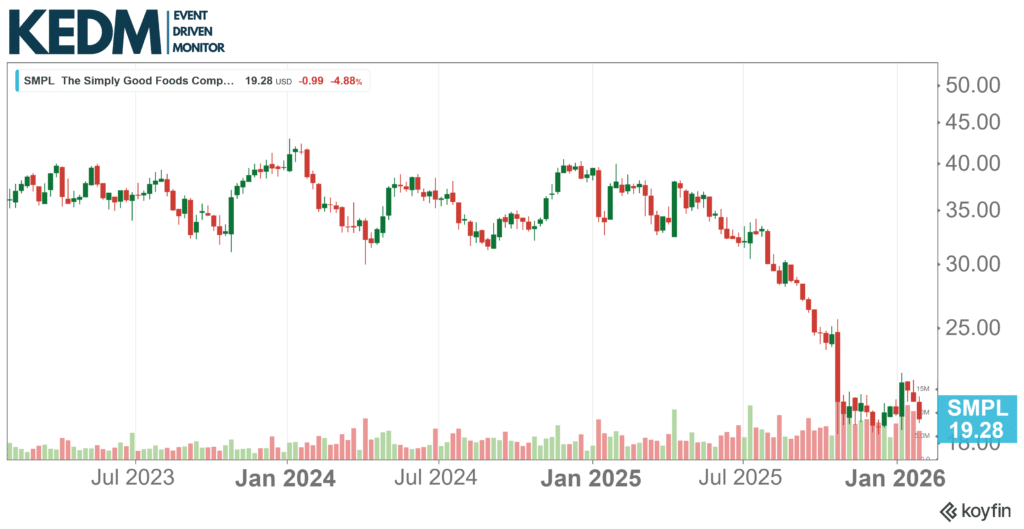

Announced Buyback Monitor: Simply Foods (SMPL) popped a $200m buyback, roughly 10% of its market cap. Simply, investors had an awful 2025, seeing their shares hammered almost 50%.

Part of this is due to slowing growth and margin pressures, but much of it stems from increased concerns about the impact of GLP‑1, volatile input costs (especially cocoa and dairy), and tougher competition in “better‑for‑you” snacks. Interestingly, looking at the financials, this one does not (yet) scream disaster.

Sure, growth slowed, but margins and leverage cash flow generation remain at healthy levels. In other words, there’s a major disconnect between earnings progression and stock price. One of the two is wrong… which one?

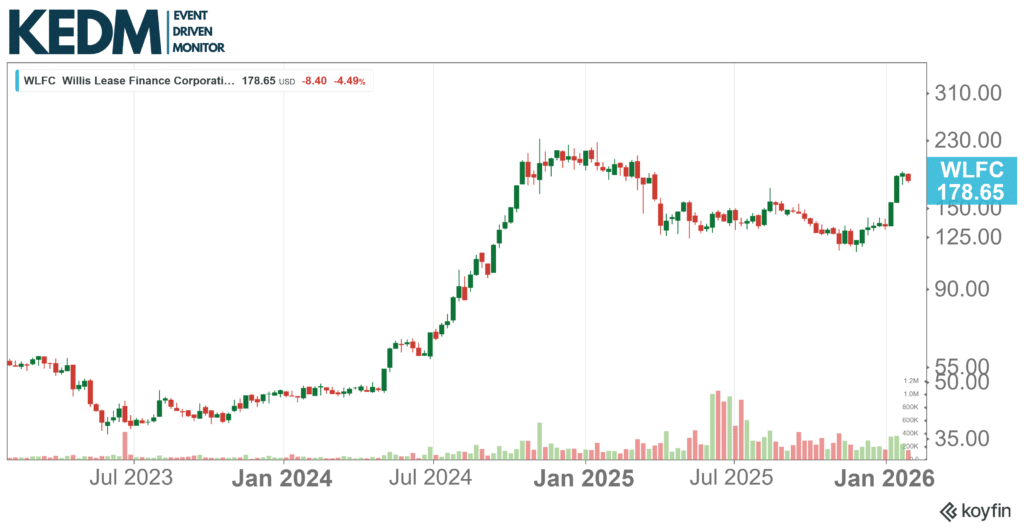

13D Monitor: Four Tree Island Advisory wrote a public letter to Willis Lease Finance Corporation (WLFC), pointing out the strong underperformance versus leasing peers FTAI and AER.

Their letter points to poor reporting with both buy- and sell-side, governance deficiencies, including excessive compensation and management’s indifference to the underperformance.

The Willis Family controls 58% of the shares but they are consistent sellers, so maybe they should care where their shares trade.

13D Monitor: A significant shareholder of TrueBlue (TBI), EHS Management, issued a letter to the company and proposed three new board members after a supposed failed “engagement” with the company.

If the company keeps performing poorly, there’s a good chance we’ll see a (new) deal come through. The upside would be immediate and substantial (remember the $12.30 offer from HQI, later reduced to $7.50).

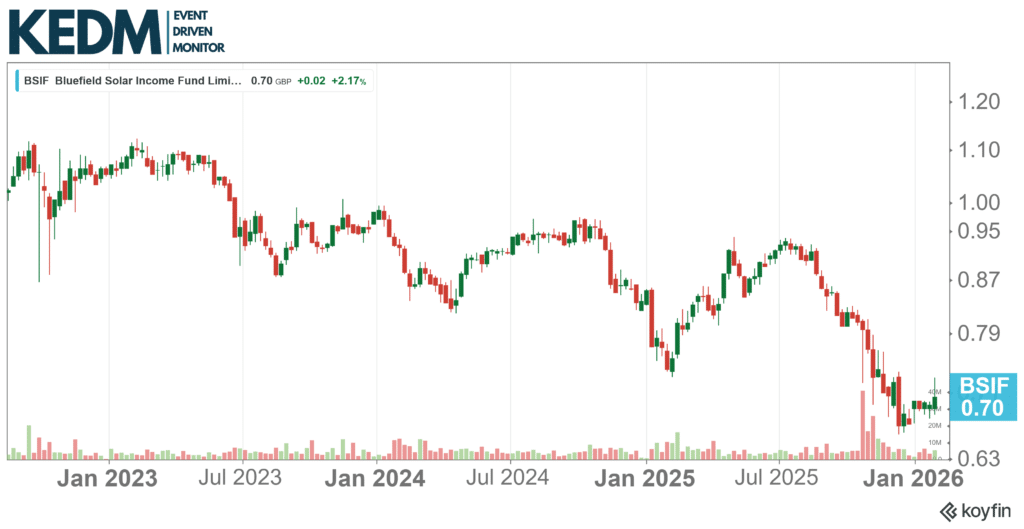

Strategic Alternatives Monitor: Bluefield Solar Income Fund (BSIF) trades at roughly a 40% discount to NAV despite a fully covered 13% dividend and a portfolio of 838MW of UK solar and wind assets.

The fund is currently on sale, with a good chance (according to what we gather) of selling assets above NAV. There’s also additional upside from a 25% JV stake and 180MW of consented development rights.

Indexation changes, possible subsidy cuts, and weaker power prices might hurt, but there’s quite some protection given by hedging and growing inflation-linked revenues. Might we be worth a look.

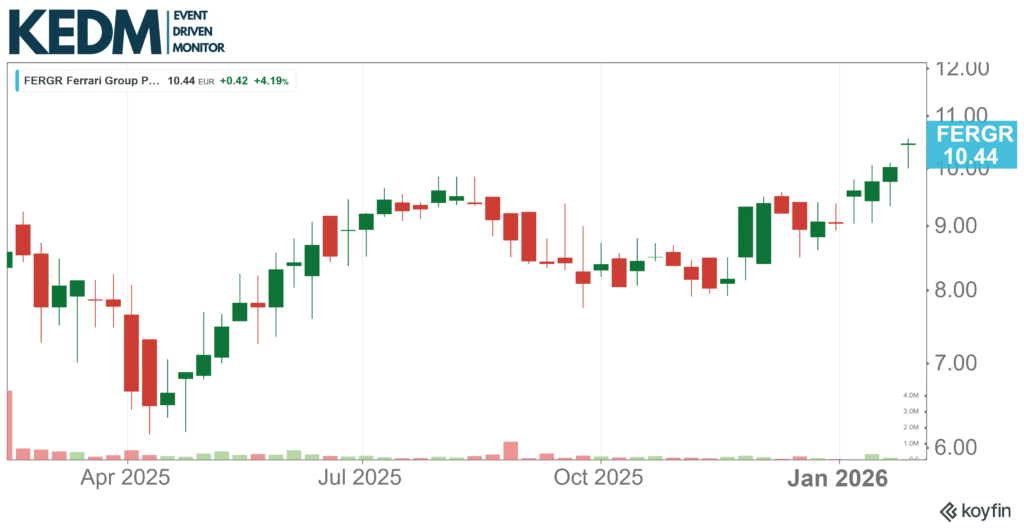

Other Interesting ED action: Other Interesting ED action: 2025 didn’t see many IPOs, particularly in Europe, but one of the few was Ferrari Group (FERGR – not RACE). Not much event-driven action is happening here, but it is interesting to keep an eye on nonetheless. The Italian Ferrari Group is listed in the Netherlands and is unrelated to the car brand, but is still rooted in luxury.

The company is a global logistics operator for high-value goods (jewelry, precious stones, high-end watches, etc.), primarily ensuring secure transport from warehouses to boutiques and between stores, as well as providing international freight forwarding, secure warehousing, vault services, and customs solutions.

KEDM Event Driven Monitor scans over 20 corporate events for market moving information and distills them into our propietary “Kliff Notes.” One profitable trade should more than cover an annual subscription and access to the Event Driven chatroom!