Theme of the Week

Crypto Treasury Stocks

The financial alchemy of MSTR and the other crypto treasury companies is impressive. Michael Saylor is a master financial engineer and he is even better at painting a narrative. Selling billions of dollars of stock at a multiple of its stated worth is always impressive, and these companies are on one of the greatest sustained streaks of alchemy we have ever seen. Calling the exact moment this streak ends is a fool’s errand, but we are starting to wonder whether some of the tailwinds powering this trend are finally shifting into headwinds.

Timing, as always, remains the trickiest part. MSTR has been able to keep the machine running by opportunistically issuing equity and convertible bonds at essentially zero percent, which has provided a long runway to build its BTC holdings and its mNAV. However, MSTR may have finally crossed the Rubicon by levering up its cash flow statement rather than relying primarily on its balance sheet. The roughly $580 million in preferred-share dividends means the company has traded a long runway for short-term liquidity. It is now on the clock to fund these payments with quarterly equity raises, instead of raising capital only when conditions are advantageous.

At the same time, MSTR may be forced to raise capital in a market with increasing competition for the same pool of capital, which could push its cost of capital higher. Those circumstances were deadly for investment trusts a century ago, and they may prove to be Saylor’s kryptonite.

If MSTR’s days are numbered, what comes next. What happens if the capital markets close for MSTR and the company is forced to sell BTC to cover its obligations. These structures are some of the most reflexive mechanisms we have seen in a very long time. If MSTR, SBET, and similar vehicles stop using shareholder capital to buy more BTC or ETH and grow NAV, they could instead be forced to sell BTC, shrink NAV, and pay out other claimholders. That dynamic could pressure the underlying asset, which could then force additional selling. The loop could repeat, over and over.

Kliff Note of the Week

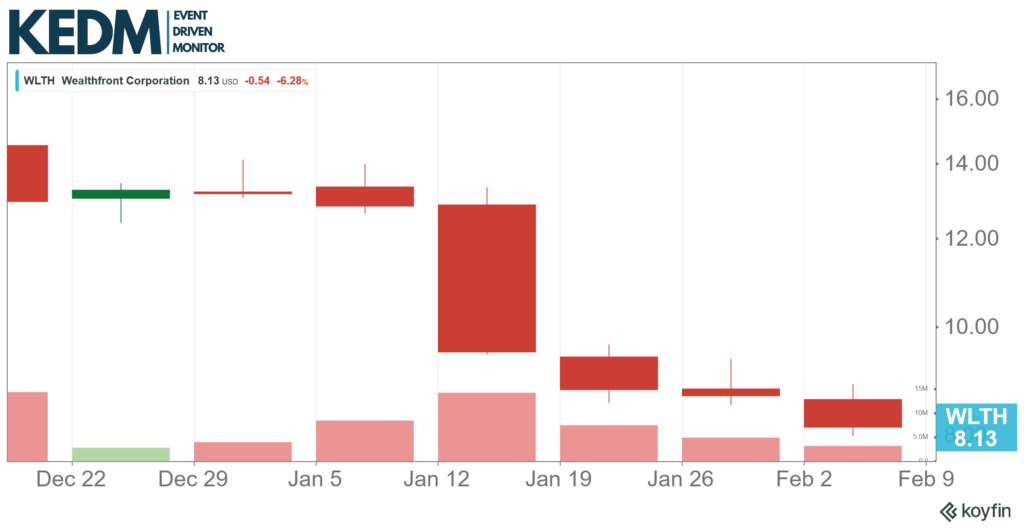

IPO Monitor: Wealthfront (WLTH) is a recent IPO to watch. WLTH is listed at $14, but shares are drifting lower, recently breaking $10. We should see continued strong growth and profitability going forward, given the digital platform’s potential. High growth, asset light, strong cash flow generation; if shares keep drifting lower, this will certainly be one we’ll be doing more work on.

CEO Turnover Monitor: GungHo Online Entertainment (3765.JP) has spent more than a decade living off Puzzle & Dragons, drifting into irrelevance. This could be over, and we might finally see some value unlock. Strategic Capital mounted a year-long activist campaign, forcing the company’s long-time boss out.

So now we have a new CEO (with a big pay cut compared to the previous chief) and a TSR-linked incentive plan. But this is not the most interesting part. GungHo holds a stake in Gravity (GRVY) (~59%). worth more than GungHo’s entire enterprise value. Gravity itself is interesting, btw: profitable and with a net cash position equal to its market cap. Now let’s see if Strategic can get this thing over the finish line.

13D Monitor: Wherever Saba pops up, we take a look. And this time they popped up at Workspace Group (WKP), pushing the company to initiate a managed wind-down, arguing that the UK REIT won’t be able to close its massive 45% discount to NAV.

Saba is holding 13.5%, and is proposing a 12-month, three-phase plan: sell easily marketable assets, use proceeds to pay down debt, then return capital via buybacks and special dividends while disposing of remaining properties. Saba believes most realisation can be done at close to NAV. The board has until Feb. 20 to adopt the proposal, or face escalation. Nice.

Strategic Alternatives Monitor: Poor battered Ontex (ONTEX) is accelerating the transition to a new CEO. Originally planned for May, the new CEO already started this week. And Ontex immediately announced a strategic review, covering ‘all levers available to enhance the company’s performance, including business portfolio, operational footprint and route to market, with a clear goal to improve cash generation and return on investment.’

Ontex’s suffering stems from years of debt-fueled acquisitions, and when the market turned, and interest rates rose, well, shit hit the fan. A classic. So the focus over the past years has been on profitability, cash flow generation, and debt reduction. We’re not there yet, but debt is down from insane levels. IF this continues, the shares are a coiled spring.

Strategic Alternatives Monitor: Picton Property Income (PCTN) is the next REIT to put itself up for sale. The company launched a strategic review to explore either a merger with another UK REIT or an outright sale of its industrial‑heavy portfolio.

The message was clear: Picton, on its own, cannot close its discount. Interesting to look at, given a NAV of 102p (still 20%+ upside despite the recent move), and recent asset sales at close to book value.

Strategic Alternatives Monitor: Another company that has been cut in half in a few years despite fundamentals remaining pretty resilient is Diageo (DGE). It took the company some time to find the right strategic moves, but they seem to have found it: shed (non-core) assets and focus on the parts that grow (shocker).

After selling most of its stake in East African Breweries (~$5bn EV), the company is said to be reviewing options for its Chinese assets. These disposals might not (yet) be huge compared to Diageo’s size, but it’s the direction that matters. It might be good to wait for the momentum to improve. But we’re approaching single-digit EBITDA multiples for a company with massive brands and 30%+ margins.

KEDM Event Driven Monitor scans over 20 corporate events for market moving information and distills them into our propietary “Kliff Notes.” One profitable trade should more than cover an annual subscription and access to the Event Driven chatroom!