KEDM WEEKLY

A final reminder that this Friday, November 21st, 4:15pm ET, we are hosting Erik Renander from YWR on KEDM Happy Hour. Erik is one of our favorite independent thinkers.

He has lots to share from his recent visits to HK Property Developers, Macau Casinos and Shenzhen based tech companies. So get your questions ready and see you this Friday!

The No-Earnings Companies

Starting off this week’s theme, we were reminded of an old article by Erik that really challenged the way we think. In his piece titled “Stop caring about earnings” (paywall removed for KEDM subscribers), he explained how Warren Buffett pioneered the no-dividend company.

Prior to Berkshire, investors expected companies to return capital in the form of dividends. The idea that a company would retain all cash and reinvest it on behalf of investors was revolutionary. BRK could hypothetically pay out its cash any time it wanted. It just chose not to.

Kuppy’s Tweet of the Week

Kliff Note of the Week

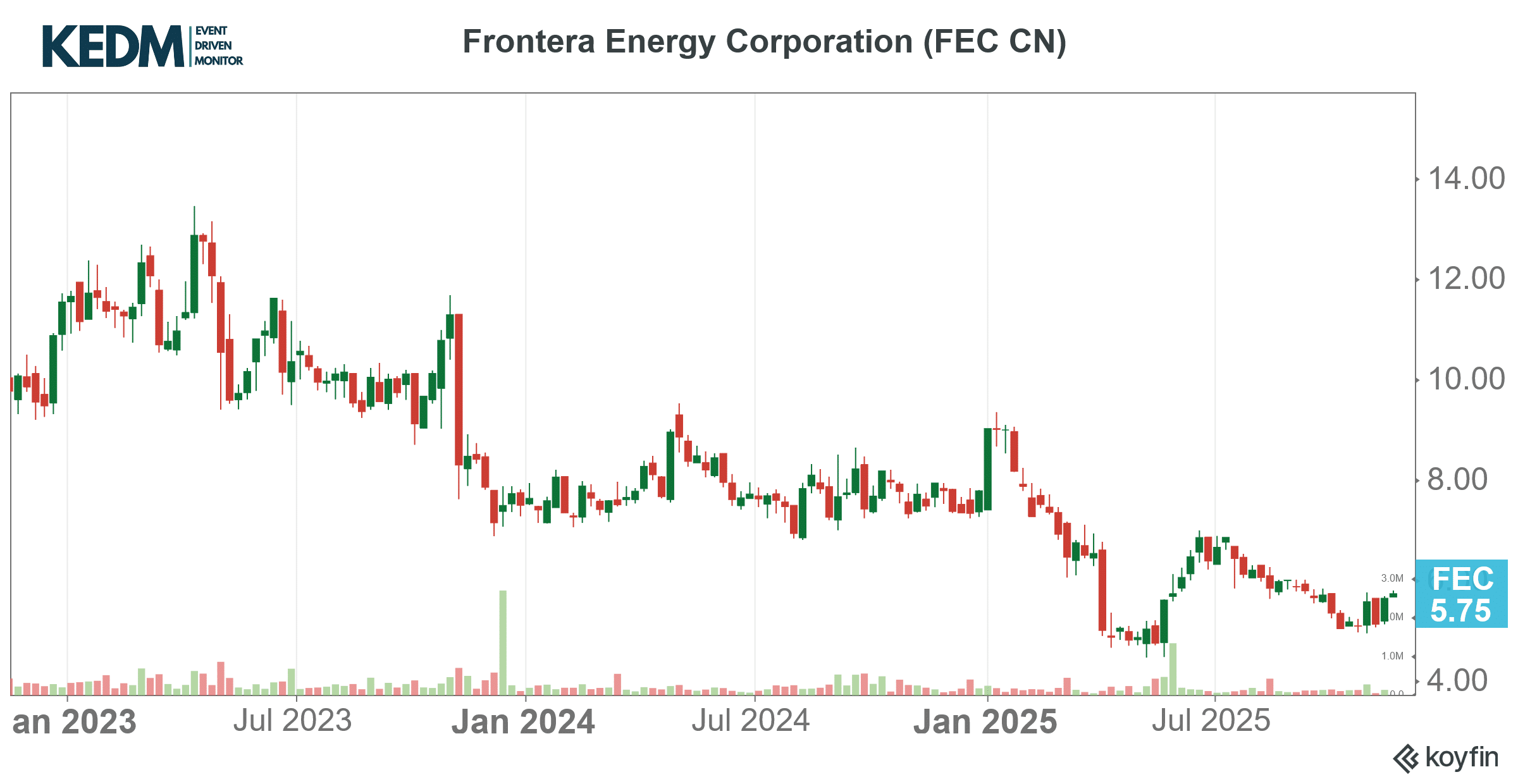

Spin-off Monitor: Frontera Energy, FEC CN, is planning to split its E&P and infrastructure businesses during 1H26. Both companies will be freed up to pursue future consolidations after the spin is complete.

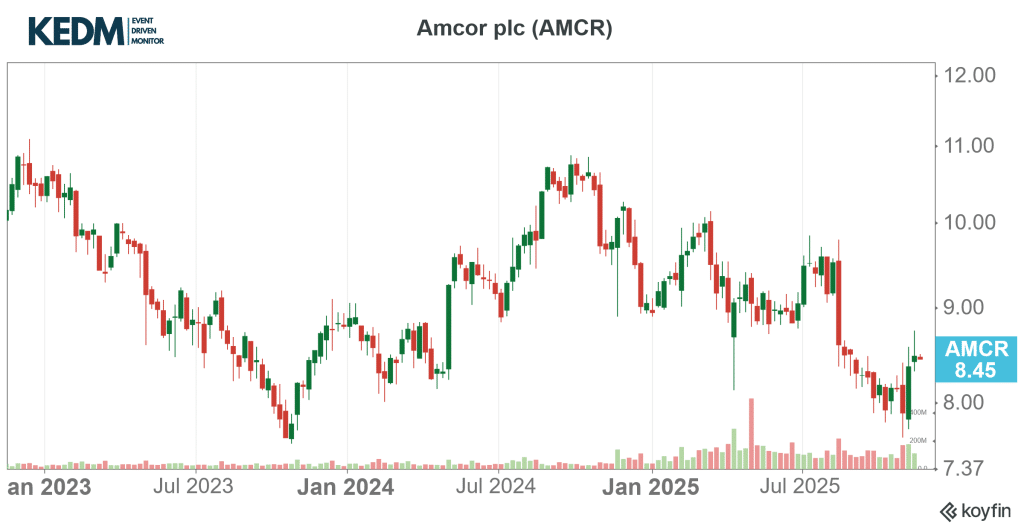

Cluster Insider Buy Monitor: Amcor (AMCR) is another interesting one to flag here. After years of sales, insiders became quite active purchasers of stock in 2025, with a very recent, relatively large purchase by the CEO.

A reminder that Amcor recently combined with Berry and has been reporting results despite still-soft end markets. Another one at a turning point? Quite the leverage though…

Investor Day Monitor: A heads up for Corbion’s (CBRN NA) upcoming CMD today.

We expect a lot of information, and perhaps some interesting capital returns; a refreshed growth plan through 2030, profitability boosting measures in the form of divestments, and a renewed capital allocation strategy including a fresh share buyback.

The shares have only gone south over the past years on a declining top line. Meanwhile, profitability is improving, and leverage has come down.

At roughly 7x EV/EBITDA and solid FCF generation, we would expect increasing buybacks.

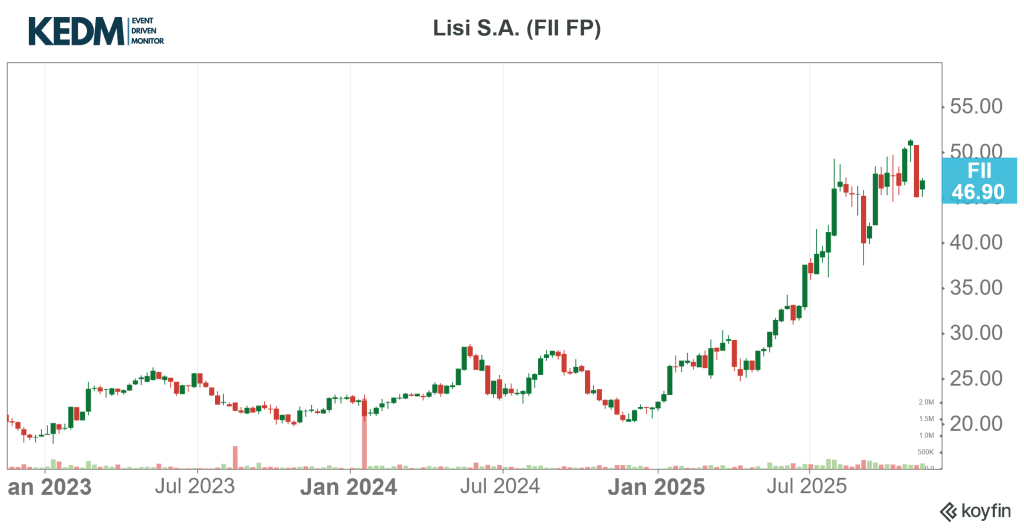

Strategic Alternatives Monitor: LISI (FII FP) is entering a new growth phase fueled by the aerospace production ramp at Airbus and Boeing, while simultaneously reshaping its portfolio with the sale of its Medical unit.

The divestment sharpens focus on core aerospace and automotive segments, where automation, contract renewals, and defense demand drive margin expansion.

So here we have a story of good order visibility, improving margin profile, strong deleveraging (we estimate €150-170m net debt pro-forma, c. 0.5-0.7x, vs €520m today) and a strong gearing to a sector trading at higher multiples. Worth keeping an eye out.

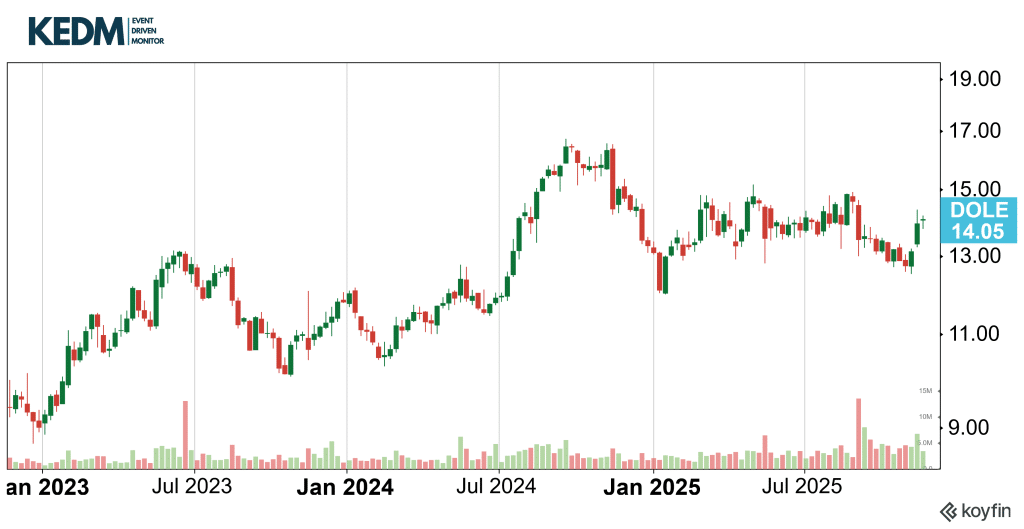

Buyback Monitor: After a few years of deleveraging, DOLE announced a $100m buyback, or 7.5% of the market cap.

The shares had been pressured when The Murdock Group sold 12.5% of the shares in a secondary, back in September. Meanwhile, DOLE disposed of its fresh vegetables division, which dropped leverage to 1.7x ND / EBITDA.

Look, selling bananas is not a sexy business, but 8x FCF does not scream expensive, especially compared to peer Fresh Del Monte Produce (FDP).

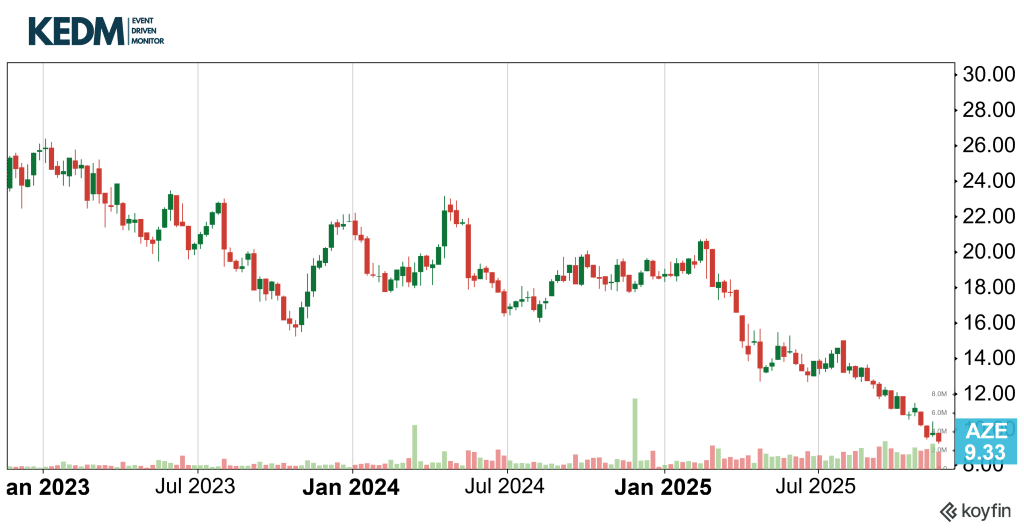

Priced Secondaries Monitor: Not really a Secondary, but certainly worth highlighting that Azelis’ (AZE BB) largest shareholder, EQT, has agreed to sell roughly 44m shares, reducing its stake to about 10% from ~28%.

The buyers include existing Azelis shareholders (e.g., Temasek, JNE Partners, and First Pacific Advisors). The large shareholder overhang has often been viewed as one of the main reasons for the company’s discount vs its main peer IMCD (IMCD NA).

These are very interesting and earnings resilient companies, currently suffering from poor end-markets, and, in the case of Azelis, still recovering from a few company-specific screw ups. If you’re one of the few people on earth still having faith in value investing (like us), it might be worth spending some time on this sector.

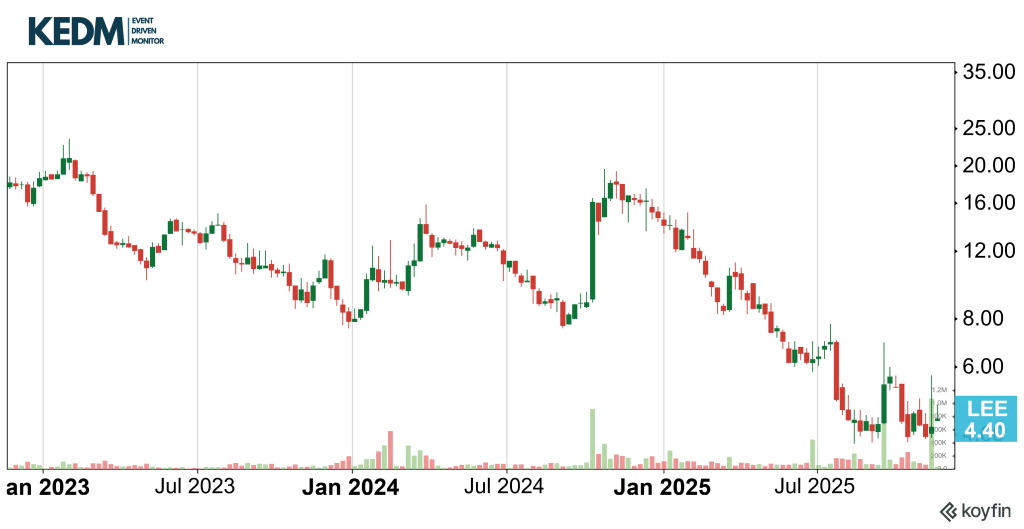

Rights Offering Monitor: Lee Enterprises (LEE) has been a real train wreck since it turned down the Alden Global Capital acquisition proposal in 2021.

After declining a recent recapitalization proposal from Hoffman, theyhave now announced they are considering a $50m rights issue (2x the market cap).

The proceeds would go straight to Uncle Warren (their sole creditor) in return for a drop in interest rate (from 8% to 5%) for 5 years. We can’t wait to hear what they will spend their savings on.

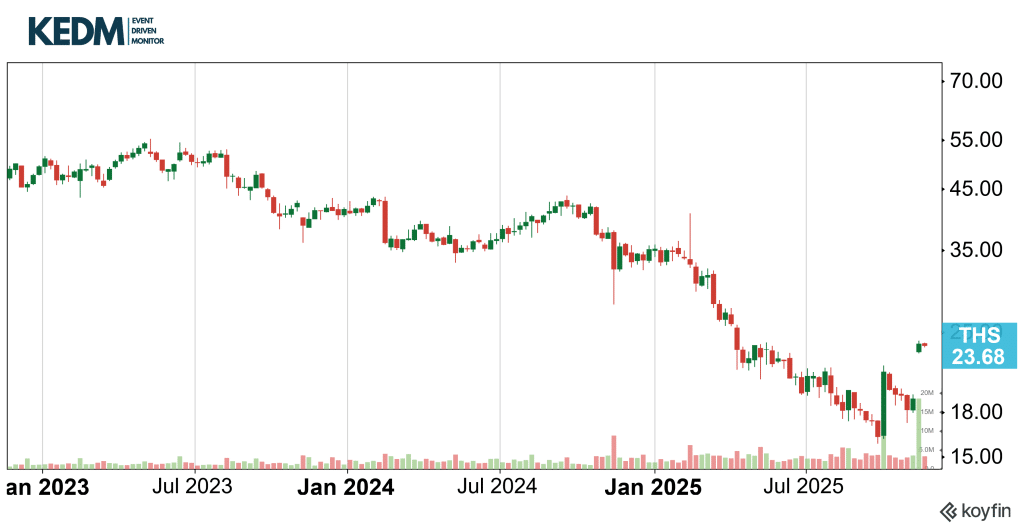

CVR Monitor: THS will be acquired by Industrial F&B for $22.50 per share plus a non-transferable CVR, which entitles the holder of 85% of the net proceeds from the ongoing TreeHouse v. Keurig Green Mountain litigation related to part of TreeHouse’s single-serve coffee business.

THS estimated the monetary damage at $0.7-$1.5 bil (or ~$11- $25 per share). THS closed at $23.86 per share, with an attractive risk/reward profile. Worth looking at for investors with litigation expertise.

KEDM Event Driven Monitor scans over 20 corporate events for market moving information and distills them into our propietary “Kliff Notes.” One profitable trade should more than cover an annual subscription and access to the Event Driven chatroom!