Some highlights from this weekend’s Event Driven Monitor

Have a friend with an ED (“Event-Driven”) problem? Forward this newsletter to them and they can sign up for their own ED fix right to their inbox:

NEW USERS RECEIVE A FREE 4-WEEK TRIAL

The Event of the Week

It’s said that markets don’t usually crash from equity bros doing really stupid things, but they usually crash from debt bros doing really stupid things. With that in mind, we should probably talk a bit about PE, especially as the charts are starting to break. And the same can be said of large BDCs who lend to PE.

We first started noodling on this back in April 2025, and even had one of our favorite nalysts, Erik Renander (also a Happy Hour guest), chime in with a guest post back in 2024 (we have already pinged Erik for an update, so stay tuned). We think this is still early innings but a very big deal, hence us coming back to topic. Credit and illiquidity has a funny way of creating spillover effects that few can predict.

Subscribe Now To Keep Reading…

Kuppy’s Tweet of the Week

Chart and Kliff Note of the Week

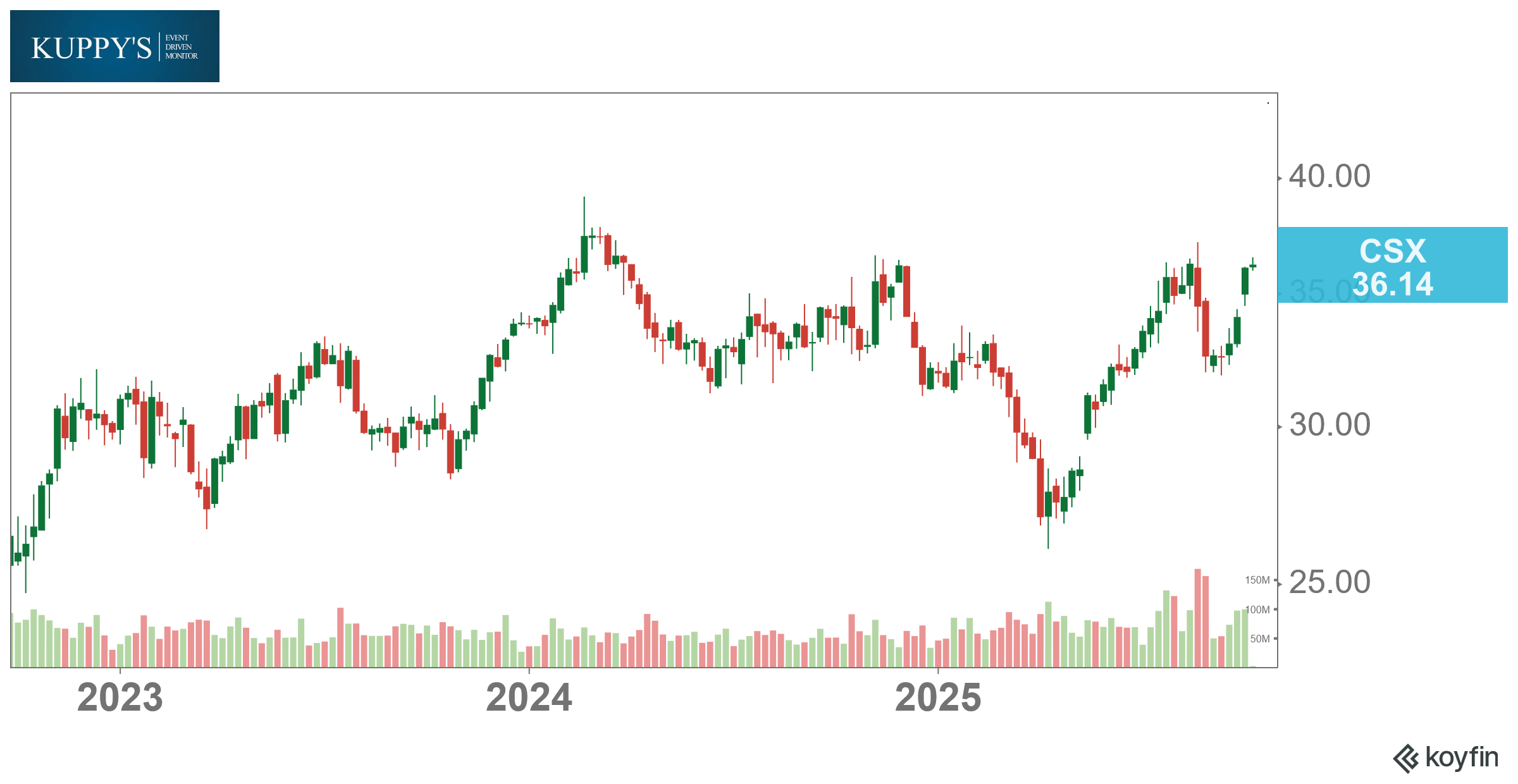

CEO Changes Monitor: CSX railroad bent to activist Ancora only two months after the fund went public and fired their CEO. He’ll be replaced by Steve Angel, a relative outsider to the industry besides some adjacent experience leading GE’s train building unit. Ancora had success turning around NSC so it’s likely that Angel is more than qualified to improve the Company’s operations. Worth keeping an eye on.

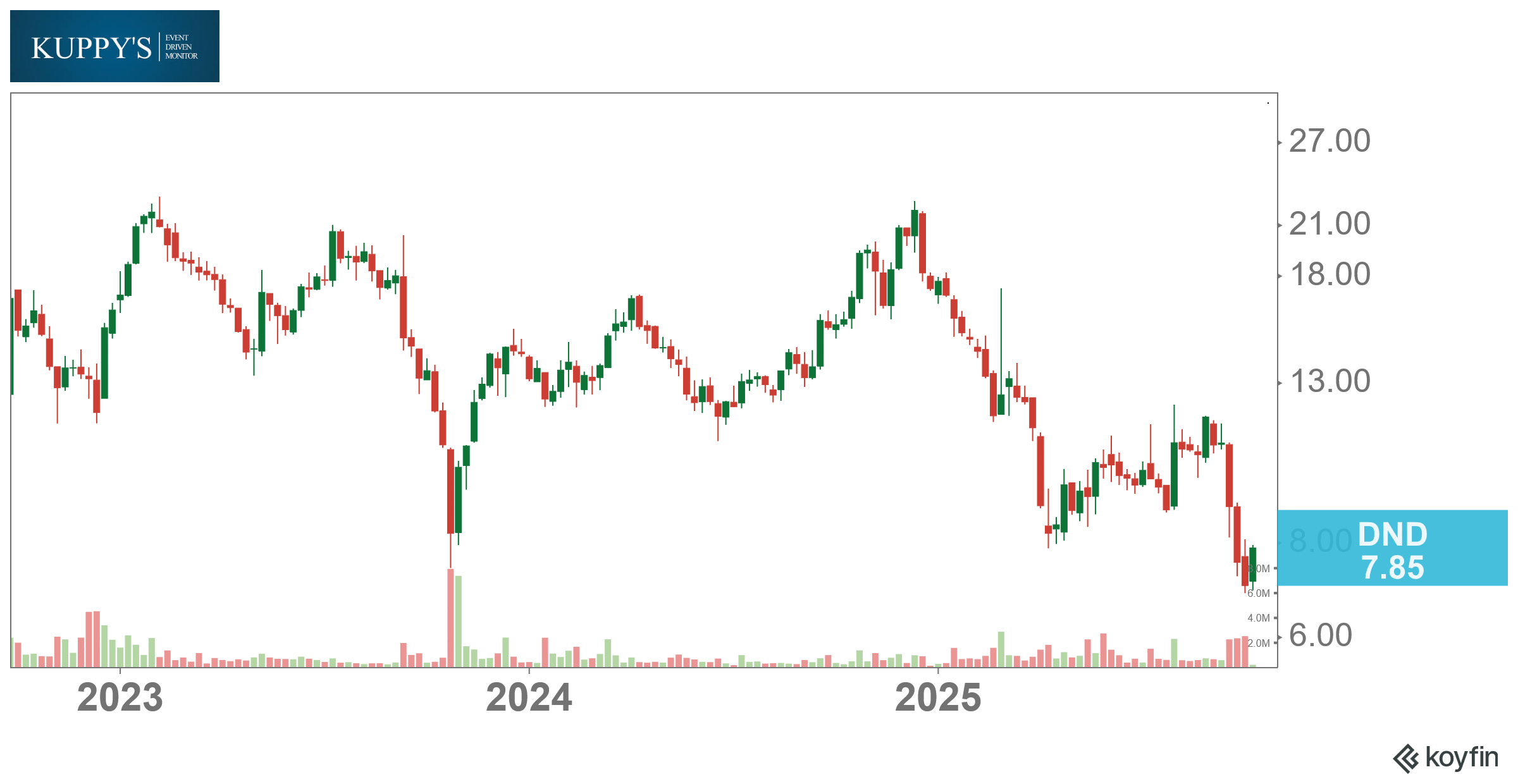

13D & Activist Monitor: Dye & Durham’s, DND CN, activist circus is back, with co-founder and ex-CFO Ronnie Wahi pushing to oust the board and force a sale after the stock cratered ~70%. He claims management is stonewalling acquirers while the “strategic review” drags on and financial filings go missing. The board says they’re stabilizing things; dissidents say the only thing left to stabilize is the “For Sale” sign. Remember Engine was active here last year, and ex-CEO, Matt Proun (Plantro) is currently engaged here as well. Worth watching

Subscribe Now for More Event-Driven Opportunities

Kuppy’s Event Driven Monitor scans over 20 corporate events for market moving information and distills them into our propietary “Kliff Notes.” One profitable trade should more than cover an annual subscription and access to the Event Driven chatroom!