Some highlights from this weekend’s Event Driven Monitor

Have a friend with an ED (“Event-Driven”) problem? Forward this newsletter to them and they can sign up for their own ED fix right to their inbox:

NEW USERS RECEIVE A FREE 4-WEEK TRIAL

The Event of the Week

Turning to the markets, since mid-to-late 2024 we have been banging the table on EMs, specifically Turkey, Colombia, Brazil and China. See issues 197 and 209 for China; 210 and 200 for LatAm. YTD, the latter 3 have been on a tear with China up 25%, Brazil up nearly 13%, and Colombia up 22% (using the ETFs as proxies).

Subscribe Now To Keep Reading…

Kuppy’s Tweet of the Week

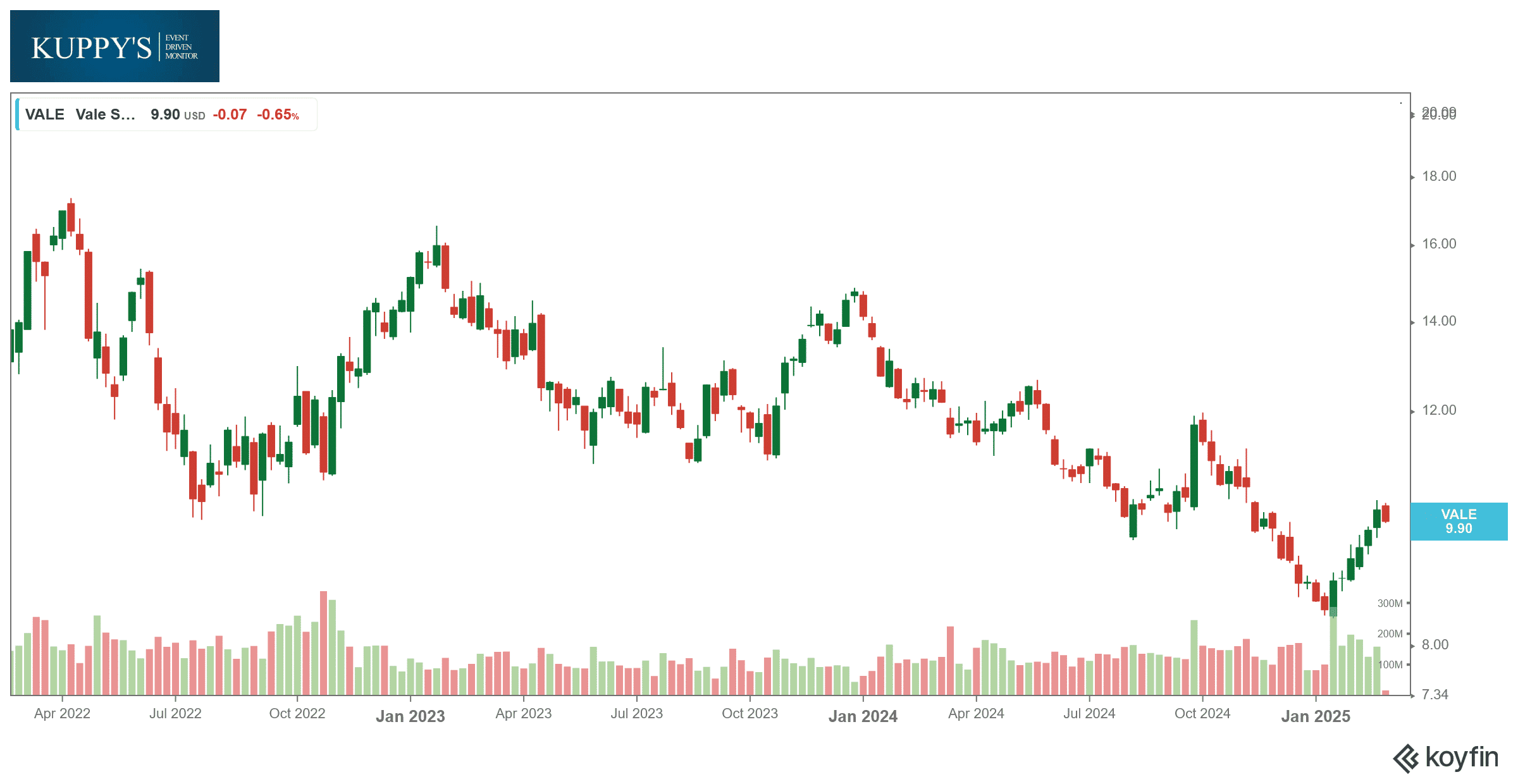

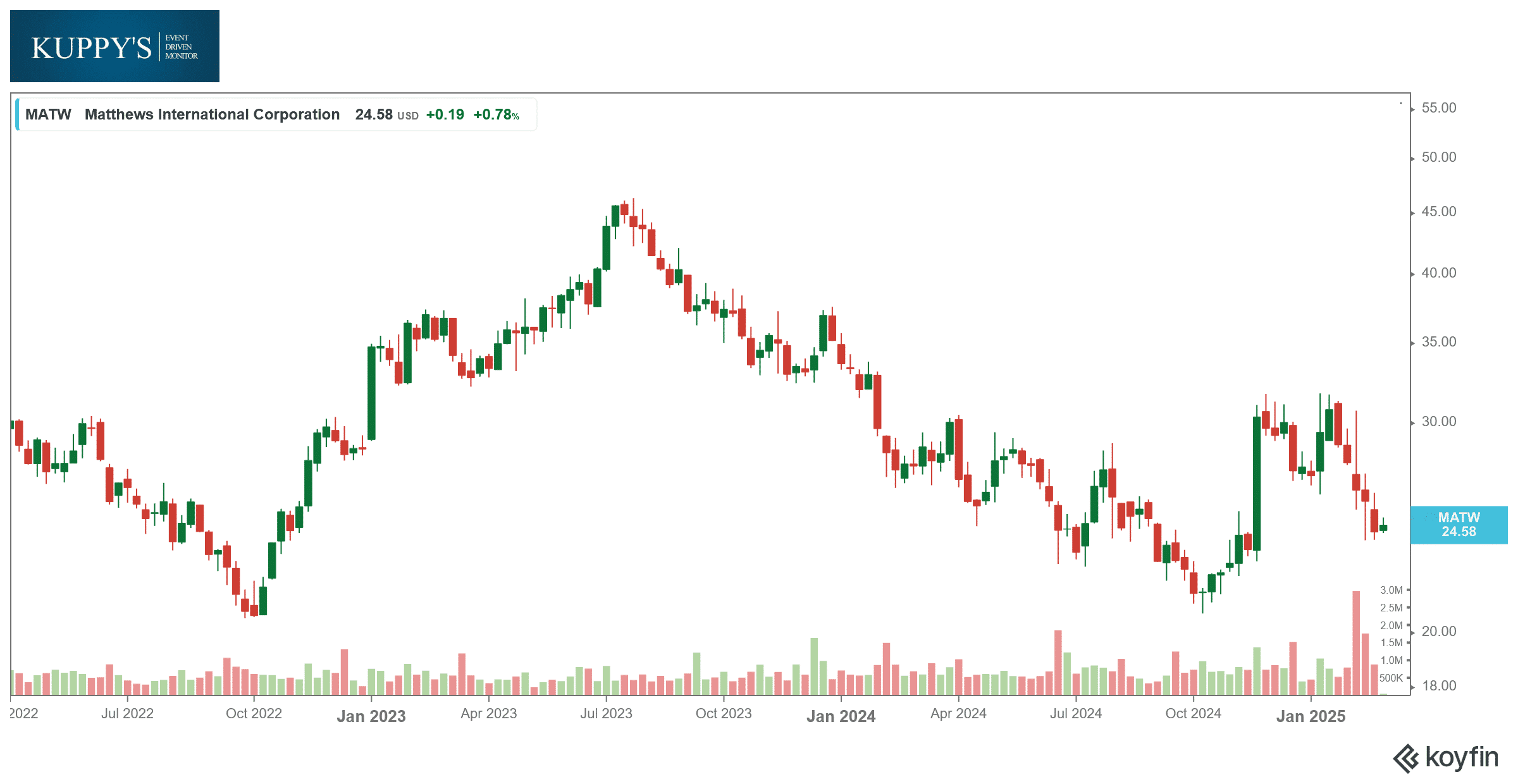

Chart and Kliff Note of the Week

Buyback Monitor: VALE re-upped with 120m share program (3% of SO) over the next 18 months. They’ve shrunk the share count by over 10% in the past few years. If China is perking up, whats that do to base metals?

Strategic Alternatives Monitor: MATW – Matthews popped up again as the company successfully fended off activist Barrington’s director nominees, and expects to announce several additional strategic initiatives in 2026.

Subscribe Now for More Event-Driven Opportunities

Kuppy’s Event Driven Monitor scans over 20 corporate events for market moving information and distills them into our propietary “Kliff Notes.” One profitable trade should more than cover an annual subscription and access to the Event Driven chatroom!