Some highlights from this weekend’s Event Driven Monitor

Have a friend with an ED (“Event-Driven”) problem? Forward this newsletter to them and they can sign up for their own ED fix right to their inbox:

NEW USERS RECEIVE A FREE 4-WEEK TRIAL

The Event of the Week

A smash, then consolidate, then leak lower until the real selling starts. What’s interesting is that the intermission between the crash and the real selling is about 6 months. Those are the hardest six months of a bear’s life. The economic data is still strong. All your friends are buying the dip like lunatics. You can’t short it because it’s very whippy and wild. You can’t buy it because you know what’s coming next. All you can do is stand aside—or at least you should.

Subscribe Now To Keep Reading…

Kuppy’s Tweet of the Week

Chart and Kliff Note of the Week

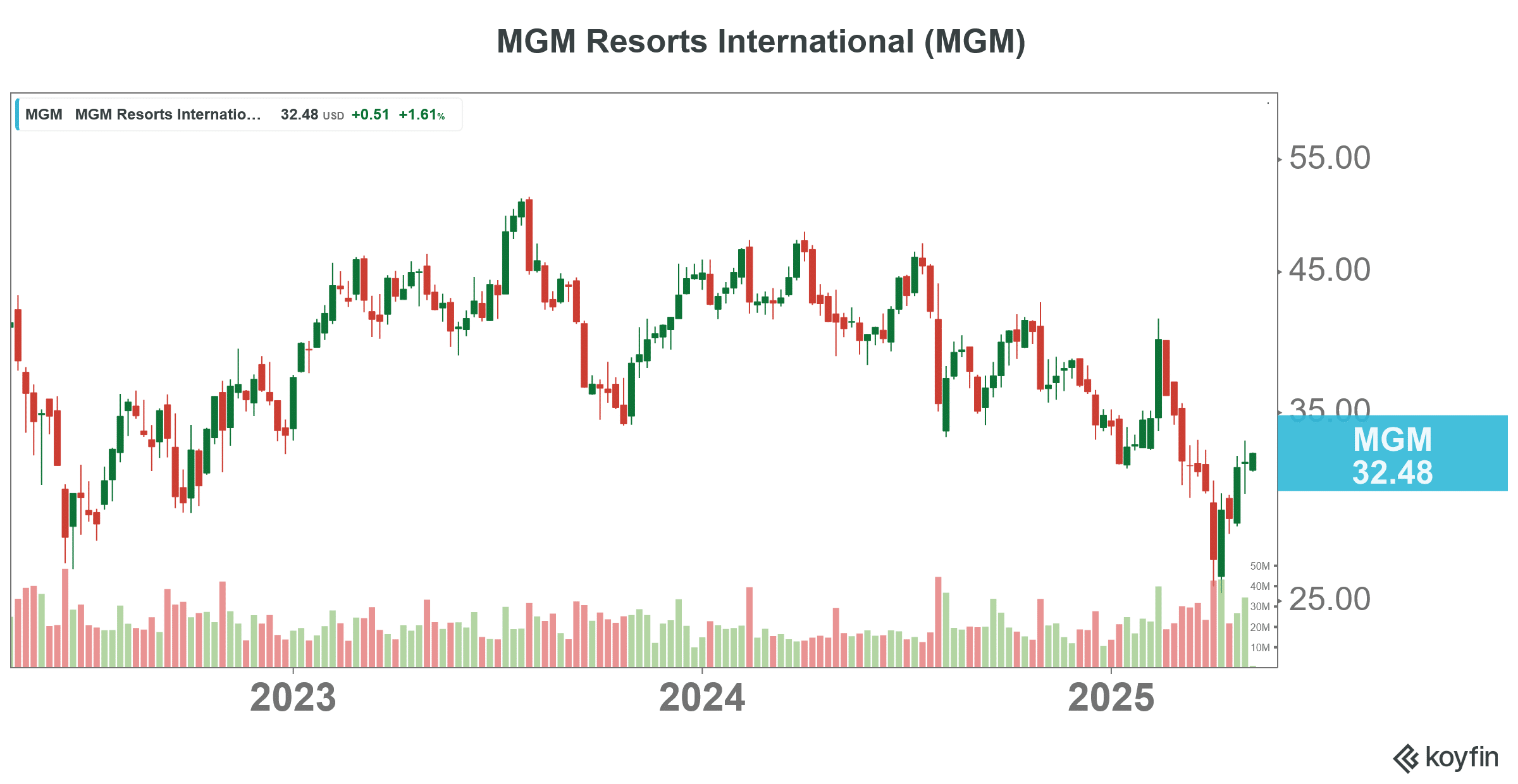

Announced Buyback Monitor: MGM continues to hammer the buy button with another $2B program (~20%). They purchased $489m in Q1 and $1.3B in the TTM and have shrunk the share count by 43% since 2021. Worth noting they are #23 on the buyback leaderboard….

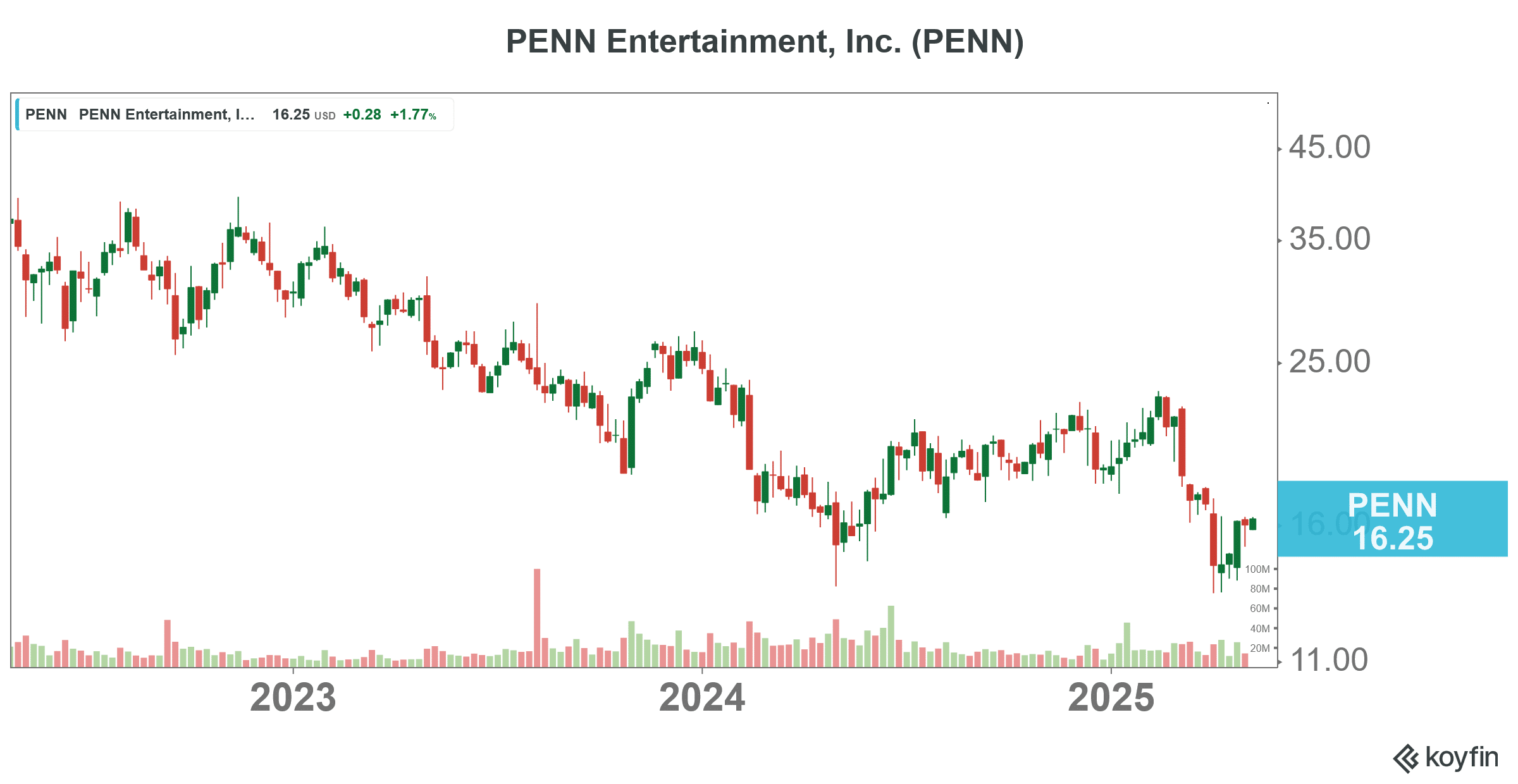

13D and Activist Monitor: Penn Entertainment, the casino and racetrack operator, announced board refreshment, company will nominate two board choices proposed by activist HG Vora Capital Management. Remember, activists have been criticizing the company’s foray into online betting.

Subscribe Now for More Event-Driven Opportunities

Kuppy’s Event Driven Monitor scans over 20 corporate events for market moving information and distills them into our propietary “Kliff Notes.” One profitable trade should more than cover an annual subscription and access to the Event Driven chatroom!