Some highlights from this weekend’s Event Driven Monitor

Have a friend with an ED (“Event-Driven”) problem? Forward this newsletter to them and they can sign up for their own ED fix right to their inbox:

NEW USERS RECEIVE A FREE 4-WEEK TRIAL

The Event of the Week

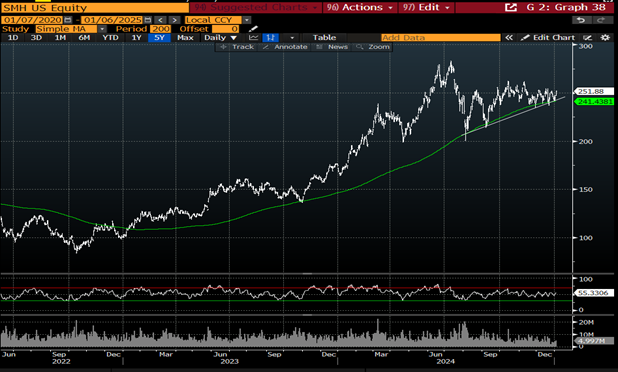

If there’s 1 chart to rule them all, then SMH is our Sauron. It’s the chart to track. To our eyes, it looks like a massive failing rally. After leading the market higher in H1 2024, key component NVDA stopped making highs, other components like MU, ASML and AMD have clearly rolled over. Only AVGO is making highs today. So you have divergence of the sector from the market, after being a leader, and now you have intra-sector divergence. For those of you who’ve followed us for some time, you know we fixate on divergences…

Subscribe Now To Keep Reading…

Kuppy’s Tweet of the Week

Chart and Kliff Note of the Week

Buyback Monitor: BABA continues to scoop up shares with another $1.3B bought in Q4. They have taken in over $25b in the past 24 months.

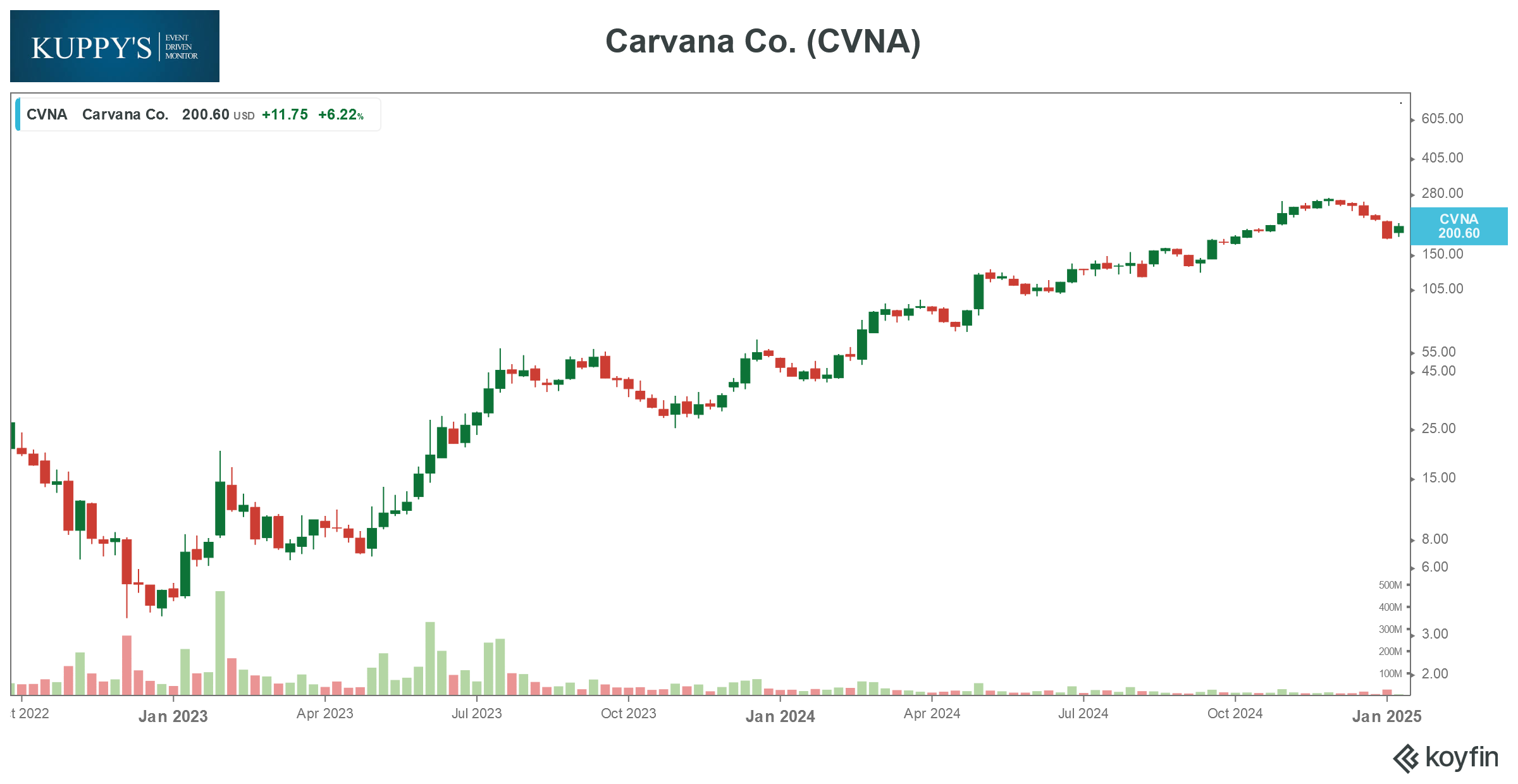

Newsletter Short Monitor: Hindenburg wrote a short piece on Carvana, CVNA, a $37b market cap, used car trading platform. The short seller claimed that the company has risky sub-prime loans with potential insolvency risk, and its main purchasing party has been scaling back its cooperation with Carvana since January.

Subscribe Now for More Event-Driven Opportunities

Kuppy’s Event Driven Monitor scans over 20 corporate events for market moving information and distills them into our propietary “Kliff Notes.” One profitable trade should more than cover an annual subscription and access to the Event Driven chatroom!