Some highlights from this weekend’s Event Driven Monitor

Have a friend with an ED (“Event-Driven”) problem? Forward this newsletter to them and they can sign up for their own ED fix right to their inbox:

NEW USERS RECEIVE A FREE 4-WEEK TRIAL

The Event of the Week

While you all know we aren’t technical guys at KEDM, we can’t dismiss the nasty weekly bar on the broad indices this week. Bust out your crayons and call them voodoo lines, but there are ugly failing rallies all over the place.

There are times to press and times to sit back and await the next layup. Having gone “full harvest” back on May 26, we are degrossed and comfortable biding our time in a few core themes.

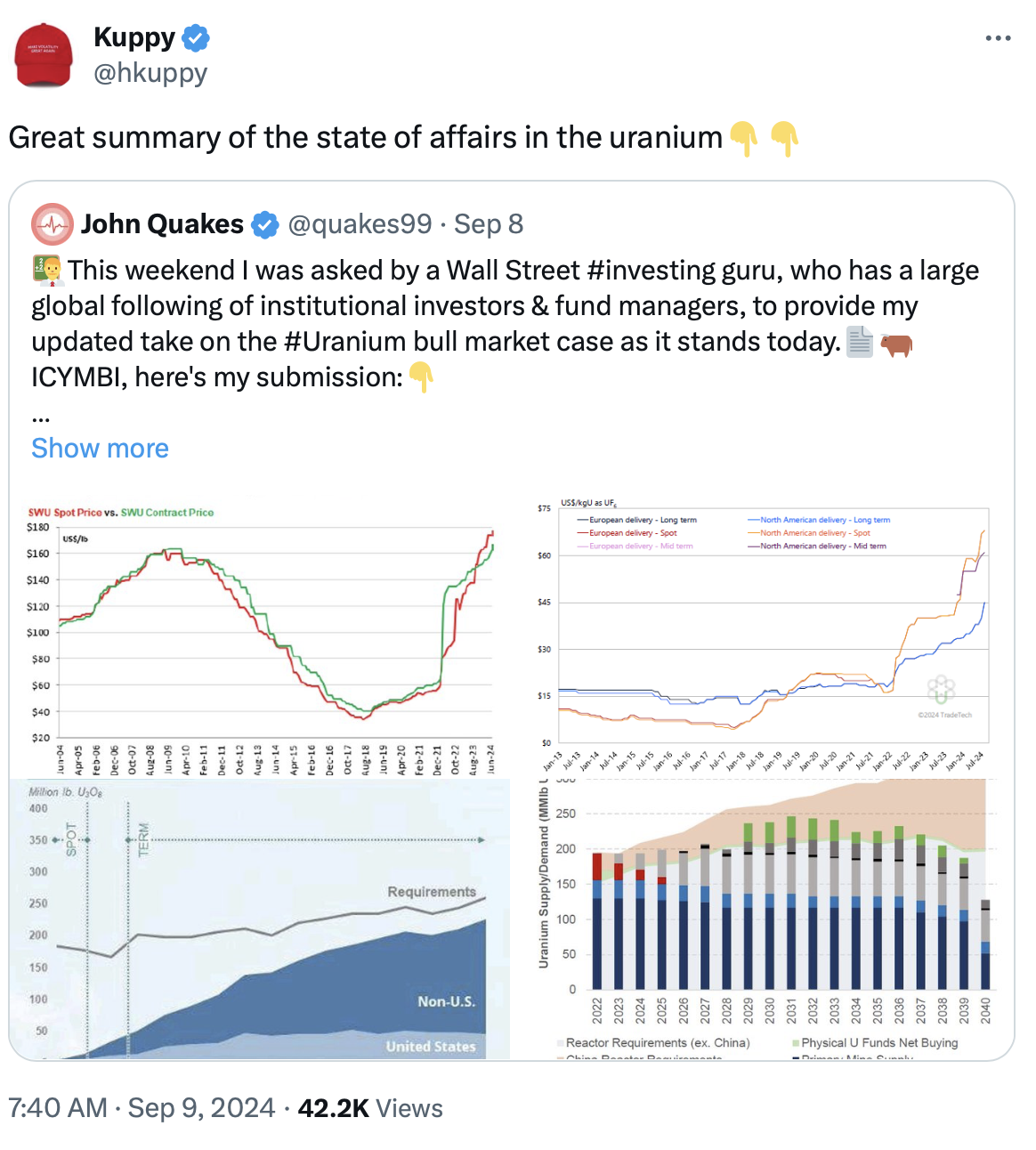

Meanwhile, we had a busy week at the annual Uranium conference – WNA London – tons of meetings with traders, miners, fuel suppliers, technical specialists, rector suppliers, IAEA executives. We met practically every part of the supply chain. Overall, the mood was upbeat as the fundamentals of the thesis are playing out even better than most imagined, combined with confusion around the price and fundamentals divergence, finished off with investor fatigue from bleeding lower the last 7 months…

Subscribe Now To Keep Reading…

Kuppy’s Tweet of the Week

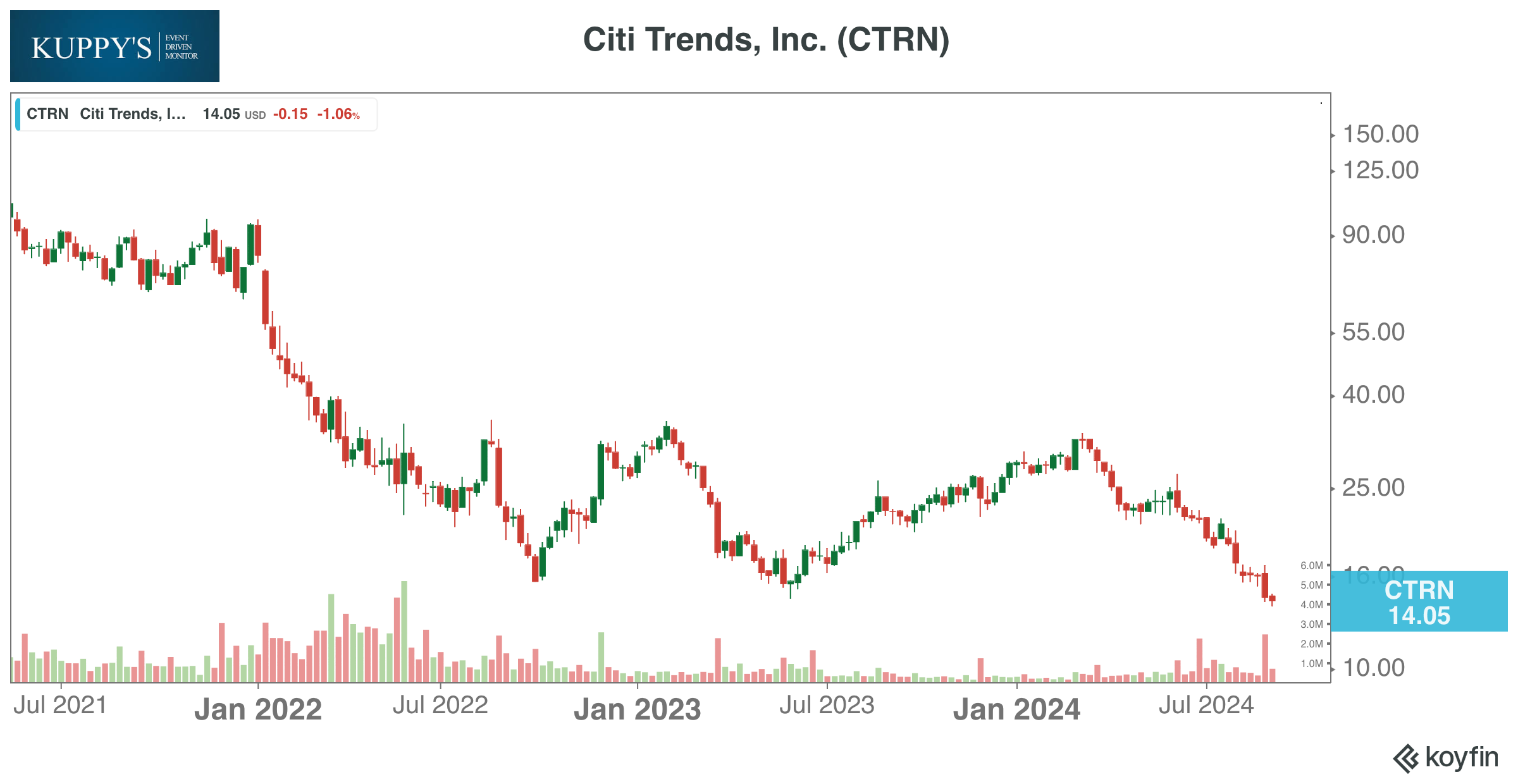

Chart and Kliff Note of the Week

The Interim CEO and Director at Citi Trends Inc. (CTRN) bought again. In total, he has bought ~$5.7 million worth since July. The CFO bought ~$50K worth on 9/4/24. Worth noting Fund 1 Investments has been accumulating the stock (flagged in the past on our 13D Monitor) and now owns about 30% as they agitate change. Short Interest ~23%.

Subscribe Now for More Event-Driven Opportunities

Friends of KEDM

- Our friends at Crossroads Capital published a quality write-up on Google’s antitrust case and identified the biggest beneficiary from the reduced sell-side advertising market. It is worth reading as the implications of the DOJ decision on the internet search market are huge. Check out the special commentary here.

- Our Happy Hour Guest Kevin Muir interviewed Dario Perkins on his podcast – The Market Huddle – “A Credit Cycle That Hasn’t Cycled”.

Kuppy’s Event Driven Monitor scans over 20 corporate events for market moving information and distills them into our propietary “Kliff Notes.” One profitable trade should more than cover an annual subscription and access to the Event Driven chatroom!