Theme of the Week

Thinking back to the summer of 2025, we hit a period where every company with a failed business model had a chance at a second life if they transitioned to a bitcoin treasury strategy.

We have been outspoken in our views on crypto. If you look at crypto trying to find intrinsic value, you won’t find any. Despite tens of billions of dollars in VC investment to find bitcoin use cases, no real use case has emerged. Yes, there are some stores where you can trade in your bitcoin for a pizza, but we don’t know anyone who’s been buying bitcoin with the intention of using it.

We don’t even know people who can honestly claim to own bitcoin for capital preservation. People own it because its price goes up. If crypto ever stops going up, there would be no reason to own it.

We’re not here to dunk on crypto bulls. Instead, our interest is whether Western consumer demand for crypto could pivot to gold. If you want to call gold another Ponzi that has existed for several thousand years, we wouldn’t argue with you.

Apart from some industrial use cases and jewelry-related demand, the price of gold is primarily set by flows. The only difference is that industrial and jewelry demand do provide a more normal demand curve (one that shows more demand when prices go down rather than the other way around), and that investment demand is much more stable: gold investors actually look for capital preservation.

What’s been surprising about the bull run is the absence of US retail investors. Inflows in the GLD ETF have been muted, and mining ETFs (GDX, GDXJ) are even seeing outflows. Instead, Chinese and Japanese funds have seen a steady increase in shares outstanding, clearly showing us where the demand has been coming from.

Other than a few die-hard gold investors, Western interest in gold has largely disappeared since the 2022 peak. Now and then, a brave soul stands up and predicts the next commodity supercycle, but until 2022, none of those predictions has come true.

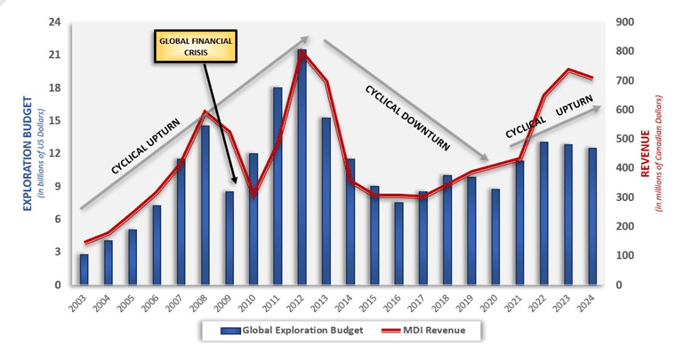

Which brings us to hard rock mineral drillers. In March (KEDM Volume 217), we wrote about Trump’s EO to accelerate the permitting process for strategic mineral deposits.

One of the few good things about mining services is that upcycles can keep going for a long time. The average mine takes over 10 years from discovery to production (ignoring the fact that most don’t make it to production at all). So once the cycle gets going, there is no risk of fresh supply spoiling the party…

Kuppy’s Tweet of the Week

Kliff Note of the Week

Spin-off Monitor: Green Dot, GDOT, announced a sale and merger with Smith Ventures and CommerceOne that will split up its non-bank fintech business from its bank. Smith Ventures will acquire GDOT’s non-bank fintech assets and operations for $690m, with $470m going to shareholders, $155m going to GDOT’s bank, and $65m going to pay off debt.

CommerceOne will then merge with Green Dot Bank, creating a new publicly traded Bank Holding Co. BankCo will be the exclusive issuing bank for the fintech business. GDOT shareholders will receive $8.11 in cash as well as 0.2215 BankCo shares for every GDOT share, and GDOT shareholders will hold 72% of BankCo. The investment deck is here.

Cluster Insider Buy Monitor: The CEO of HCAV company Carrier Global (CARR) bought roughly $1m shares. This was the first open-market purchase in quite some time at a company where selling is more the norm.

While Carrier is not having a good year with revenues under pressure, margins, and cash flow generation remain healthy. They’ve also continued to buy back shares at an elevated pace this year, with substantial capacity (>10% of s/o) remaining.

Another interesting highlight is Sonos’ (SONO) CEO buying ~$1m worth of shares. Revenue growth remains anemic, but margin expansion is expected to be strong.

Given the massive seasonality here, it’s always curious to see insiders buying (in this case, before the largest quarter of the year).

Announced Buyback Monitor: Researchco Gartner (IT) popped up on our Buyback Leaderboard monitor after strongly accelerating its buyback program in Q3. They’ve now reduced s/o by roughly 6% ytd and have still over $1bn in buyback capacity left.

Given where the shares are, we won’t be surprised if this is fully utilised by the end of the year. End markets are not that great, and we don’t like the massive share-based comp, but is this supposed to trade at these levels? Fwiw, there’s the largest EPS-to-P/E disconnect over the past decade; one of the two will correct sooner or later.

CEO Turnover Monitor: Six Flags (FUN) appointed J. Reilly as new CEO effective Dec 8. Difficult turnarounds in consumer recessions are hard to pull off. At their investor day in May of this year, the plan was to reinvest in F&B and get the legacy Six Flags parks to perform in line with legacy Cedar parks.

Bad weather (it’s always the weather) and low-season pass sales early in the year meant they had to cut their Capex budgets, upsetting their plan just 2 months after presenting it to the capital markets. We’re looking forward to hearing how Reilly plans to turn this overleveraged company around.

Bankruptcy Monitor: Clearside Biomedical, CLSD, is a clinical-stage biopharma company focusing on therapies for severe eye disease and filed for Chapter 11.

The most significant liability for CLSD is a $61.2m balance related to the sale of future royalties held by HealthCare Royalties, making them the ultimate gatekeeper to any sale of the core royalty platform.

Newsletter Short Monitor: ACHR, a zero-revenue electric takeoff-and-landing aircraft company with a $5.7b market cap, continues to be shot by short sellers. This week, Hunterbrook reported that ACHR’s planned public flight was scheduled to take place in Dubai, but the aircraft didn’t take off during the show.

Culper Research and Grizzly Research, which called ACHR “Nicola of the Skies”, both raised multiple concerns over the company’s financials and aircraft.

13D Monitor: The action is back at uniform maker UniFirst (UNF). Engine Capital has launched a proxy fight, seeking two board seats to pressure the Croatti family (which controls the company through Class B shares) to explore a sale.

Engine argues UniFirst has “lost its way” since former CEO Ron Croatti’s death and cannot achieve the valuation a strategic buyer like Cintas would pay.

A reminder that Cintas previously offered $275 per share before walking away when talks stalled. The shares are now at ~$170. To note that River Road recently disclosed a position as well (6.1%).

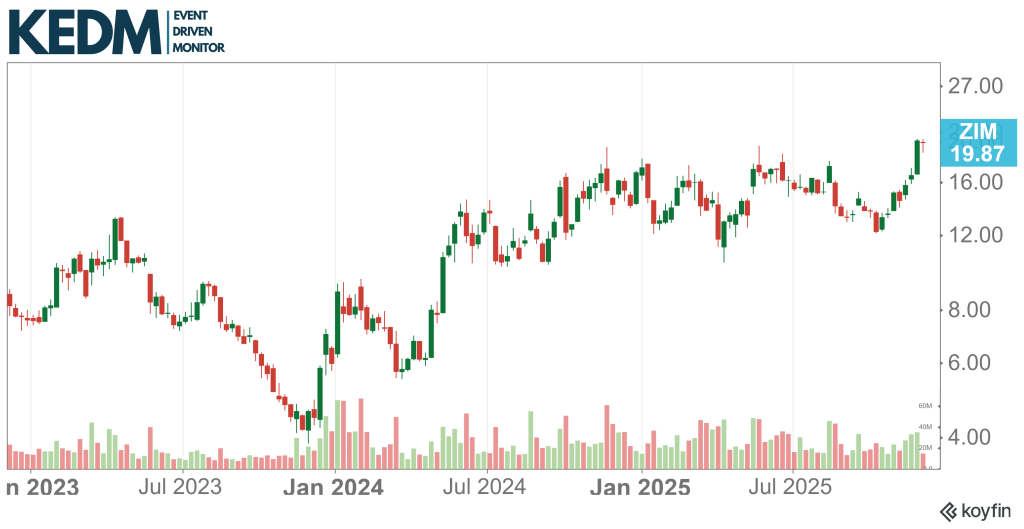

M&A Monitor: ZIM Integrated Shipping Services (ZIM), an Israeli-backed shipping company, has been on and off our radar since our Happy Hour with Charles Bonner (watch it here).

Remember the Red Sea crisis with Houthis? It was intended to hurt Israelis, but because of the longer voyage and higher container rates, ZIM benefited (ironically) the most, as 87% of its containers were priced on the spot market.

Last August, we read rumors that the CEO was considering taking the company private at $20 per share, and that the company was considering strategic alternatives. And then again this week, the company reported receiving a non-binding proposal at $25 per share and is actively exploring strategic options.

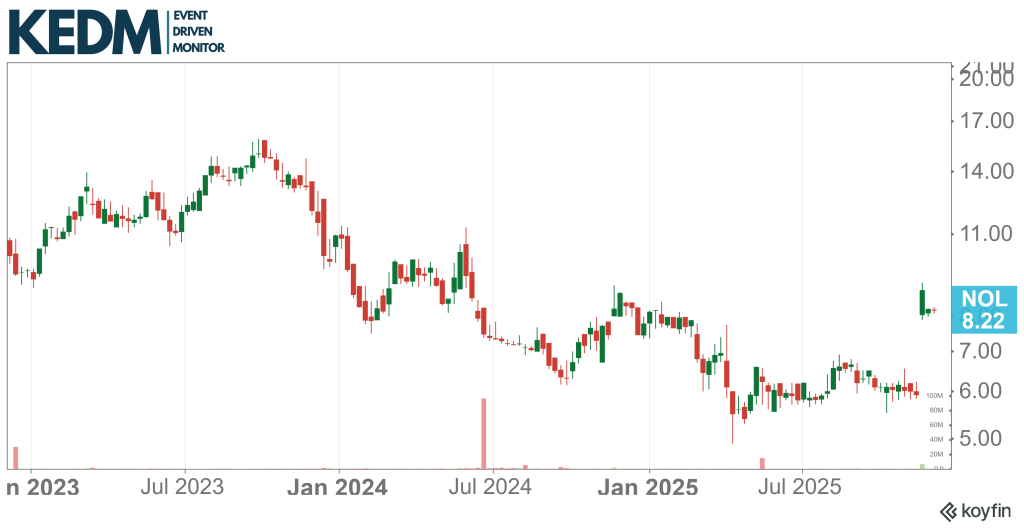

Other Interesting ED Action: A few weeks ago, offshore drillco Northern Ocean (NOL NO) announced the sale of its Deepsea Bollsta for $480m in cash to Odfjell Drilling. While the shares shot up to NOK 8 from NOK 6, the risk/reward might be even better now.

The sale allows NOL to “refinance its balance sheet and materially improve capital efficiency, thereby enabling the company to commence the return of capital to shareholders.” While this is good, there could be more, as NOL still has one similar rig left on the books (the Deepsea Mira), which the market doesn’t seem to be valuing properly.

So, basically no debt, a roughly $280m EV, and what could be another big asset sale + shareholder returns on the horizon.

KEDM Event Driven Monitor scans over 20 corporate events for market moving information and distills them into our propietary “Kliff Notes.” One profitable trade should more than cover an annual subscription and access to the Event Driven chatroom!