Some highlights from this weekend’s Event Driven Monitor

Have a friend with an ED (“Event-Driven”) problem? Forward this newsletter to them and they can sign up for their own ED fix right to their inbox:

NEW USERS RECEIVE A FREE 4-WEEK TRIAL

The Event of the Week

We’re in Zurich and then Geneva, after a week in Oslo at the Pareto Energy Conference. It was crowded, but we haven’t seen this much emotional pain outside of a funeral.

The theme of the week was resetting expectations for the timing of the inflection in offshore. Drillers saw 2024 as a busy contracting year, building off the contracting momentum of 2023 and setting up an inflection in pricing and term length of contracts starting in 2025. Instead, multiple factors stacked up and caused a sluggish 2024.

Subscribe Now To Keep Reading…

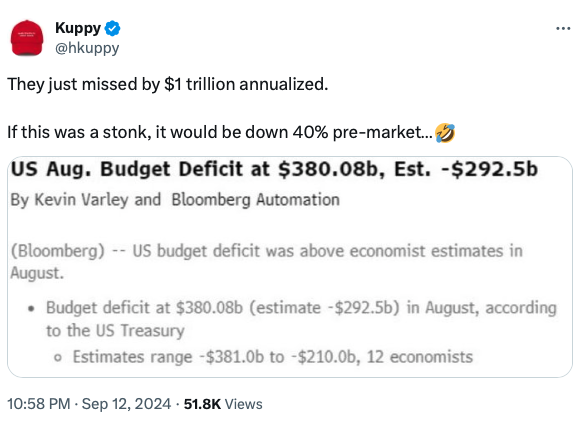

Kuppy’s Tweet of the Week

Chart and Kliff Note of the Week

IWG.L- (owns coworking brands like Regus, Spaces, HQ, Signature etc) shareholder Buckley Capital sent a letter to the board and wants the company to execute a share buyback, US Listing and consider a sale to a strategic buyer. We did a lot of work on IWG late last fall after WeWork turned into WeExploded, and IWG was the ‘last man standing’ in coworking. We like their capital light/ management contract model, and kicking ourself that we didn’t buy in the low 130s.

Subscribe Now for More Event-Driven Opportunities

Kuppy’s Event Driven Monitor scans over 20 corporate events for market moving information and distills them into our propietary “Kliff Notes.” One profitable trade should more than cover an annual subscription and access to the Event Driven chatroom!